Conditional Value at Risk (CVaR): Definition, Uses, Formula

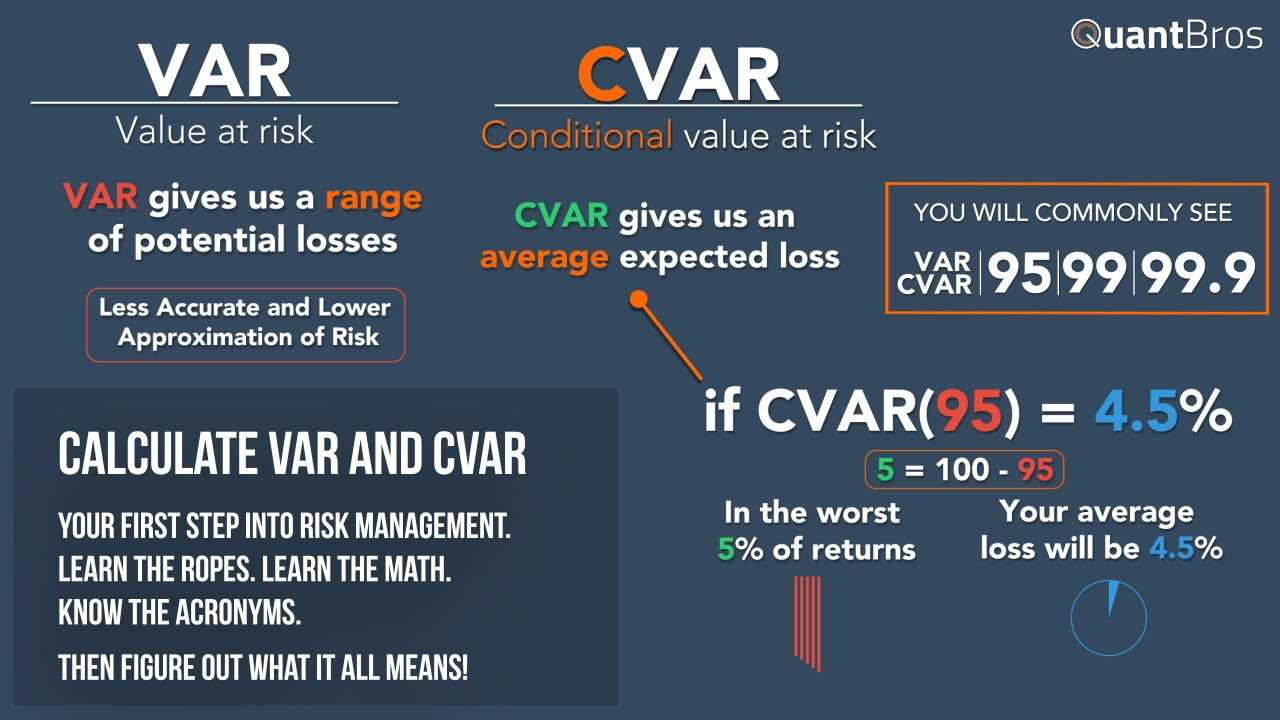

Conditional Value at Risk (CVaR) is a risk measurement technique that provides a more comprehensive assessment of the potential losses in an investment or portfolio. It goes beyond traditional risk measures such as standard deviation and Value at Risk (VaR) by considering the tail end of the distribution of possible outcomes.

Definition

CVaR is calculated by taking the average of all the losses that exceed the VaR threshold. It provides a more realistic measure of risk as it takes into account the severity of losses rather than just their probability.

Uses

CVaR is widely used in the financial industry for risk management and portfolio optimization. It helps investors and fund managers to assess the downside risk of their investments and make informed decisions. By considering the tail end of the distribution, CVaR captures the potential losses that are often overlooked by other risk measures.

CVaR can be used to set risk limits, evaluate investment strategies, and compare the risk-reward trade-offs of different portfolios. It provides a more robust measure of risk that aligns with investors’ preferences and risk tolerance.

Formula

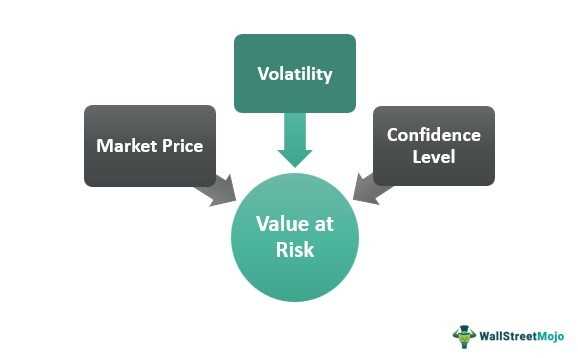

The formula for calculating CVaR is as follows:

Where:

- CVaR is the Conditional Value at Risk

- α is the confidence level (typically between 0 and 1)

- VaR(x) is the Value at Risk at a given threshold x

- ∫α0 represents the integral from α to 0

The formula calculates the average of the VaR at different thresholds, weighted by the probability of each threshold. It provides a more accurate measure of the potential losses beyond the VaR threshold.

One of the key advantages of CVaR is its ability to capture the asymmetry of risk. Unlike standard deviation, which treats gains and losses equally, CVaR assigns higher weights to losses. This is particularly useful in financial markets where losses tend to have a greater impact on investors than gains.

CVaR can be calculated using various mathematical formulas, including historical simulation, Monte Carlo simulation, and analytical methods. These methods use historical data, probability distributions, and statistical techniques to estimate the CVaR of a portfolio or investment.

Applications and Benefits of CVaR

1. Portfolio Risk Management

CVaR is widely used in portfolio risk management to assess the risk of a portfolio and make informed investment decisions. By incorporating CVaR into the risk analysis, investors can better understand the potential downside risk and take appropriate actions to mitigate it.

For example, a portfolio manager can use CVaR to determine the optimal allocation of assets in a portfolio. By considering the CVaR of different asset classes, the manager can construct a portfolio that balances risk and return, aiming to achieve the desired level of risk while maximizing the potential for returns.

2. Risk Measurement and Reporting

CVaR is also used in risk measurement and reporting to provide a more accurate representation of the potential losses in a portfolio. Unlike VaR, which only provides a single number representing the maximum potential loss at a certain confidence level, CVaR provides a more comprehensive measure by considering the severity of potential losses beyond the VaR threshold.

3. Risk Assessment in Insurance

CVaR is also applicable in the insurance industry for risk assessment and pricing. Insurance companies can use CVaR to estimate the potential losses associated with different insurance policies and set appropriate premiums to cover these risks.

By considering the CVaR of potential claims, insurance companies can ensure that they have sufficient reserves to cover the expected losses and maintain solvency. This helps them to accurately price their policies and avoid underpricing, which can lead to financial instability.

In addition, CVaR can also be used in the assessment of catastrophic risks, such as natural disasters. By incorporating CVaR into risk models, insurers can better estimate the potential losses from these events and develop appropriate risk management strategies.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.