What is Combined Ratio?

Combined ratio is a key financial metric used in the insurance industry to assess the profitability and underwriting performance of an insurance company. It is a ratio that measures the relationship between the company’s incurred losses and expenses to its earned premiums.

The combined ratio is calculated by dividing the sum of incurred losses and expenses by the earned premiums and multiplying the result by 100 to express it as a percentage. A combined ratio below 100% indicates that the company is generating an underwriting profit, while a ratio above 100% indicates an underwriting loss.

The combined ratio takes into account both the losses incurred by the company and the expenses associated with running the business, such as administrative costs, commissions, and claims handling expenses. It provides a comprehensive view of the company’s overall financial performance and its ability to manage risk.

A low combined ratio is desirable for insurance companies as it indicates that they are effectively managing their underwriting risks and generating profits from their operations. On the other hand, a high combined ratio suggests that the company is experiencing significant losses and may need to make adjustments to its underwriting practices or pricing strategies.

Insurance companies closely monitor their combined ratios to evaluate their underwriting performance and make informed decisions about pricing, risk selection, and overall business strategy. A consistently high combined ratio can be a warning sign of financial instability and may lead to rating downgrades or loss of market share.

| Pros | Cons |

|---|---|

| Provides a comprehensive view of an insurance company’s financial performance | A high combined ratio indicates underwriting losses |

| Helps insurers make informed decisions about pricing and risk management | A low combined ratio may suggest inadequate pricing |

| Can be used to compare the performance of different insurance companies | Does not consider investment income |

Definition and Explanation

The combined ratio is a financial metric used in the insurance industry to assess the profitability of an insurance company’s underwriting activities. It is calculated by dividing the sum of the company’s incurred losses and expenses by its earned premiums. The result is expressed as a percentage, with a ratio below 100% indicating that the company is making an underwriting profit, while a ratio above 100% indicates an underwriting loss.

The combined ratio takes into account both the claims paid out by the insurance company and the expenses incurred in running its operations. This includes costs such as salaries, administrative expenses, and commissions paid to agents. By analyzing the combined ratio, insurers can evaluate the effectiveness of their underwriting and pricing strategies.

A combined ratio below 100% suggests that the insurance company is generating more in premiums than it is paying out in claims and expenses, indicating a profitable underwriting operation. On the other hand, a combined ratio above 100% indicates that the company is paying out more in claims and expenses than it is collecting in premiums, resulting in an underwriting loss.

Components of the Combined Ratio

The combined ratio consists of two main components: the loss ratio and the expense ratio. The loss ratio is calculated by dividing the incurred losses by the earned premiums. It represents the percentage of premiums that an insurer pays out in claims. A lower loss ratio indicates that the insurer is effectively managing and pricing its risks.

The expense ratio, on the other hand, is calculated by dividing the company’s underwriting expenses by its earned premiums. It represents the percentage of premiums that an insurer spends on administrative and operational costs. A lower expense ratio suggests that the insurer is operating efficiently and keeping its costs under control.

By analyzing the combined ratio, insurance companies can identify areas for improvement in their underwriting and expense management. They can adjust their pricing strategies, reduce expenses, or reevaluate their risk selection and underwriting guidelines to improve profitability.

What Does Combined Ratio Measure?

The combined ratio is a financial metric used in the insurance industry to measure the profitability and efficiency of an insurance company’s underwriting operations. It is a key indicator of the company’s ability to generate profits from its core business of writing insurance policies.

The combined ratio takes into account both the company’s losses and expenses relative to its premiums. It is calculated by dividing the sum of the company’s incurred losses and expenses by its earned premiums. The result is expressed as a percentage, with a ratio below 100% indicating that the company is generating an underwriting profit, while a ratio above 100% indicates an underwriting loss.

The combined ratio provides insight into the overall health of an insurance company’s underwriting operations. A ratio below 100% suggests that the company is effectively managing its risks and generating profits from its insurance policies. On the other hand, a ratio above 100% indicates that the company is paying out more in claims and expenses than it is earning in premiums, which can be a sign of poor underwriting or pricing practices.

Insurance companies strive to achieve a combined ratio below 100% in order to generate profits from their underwriting activities. However, it is important to note that a combined ratio below 100% does not necessarily guarantee profitability, as other factors such as investment income and reinsurance can also impact an insurance company’s overall financial performance.

In addition to measuring profitability, the combined ratio also serves as a benchmark for comparing the performance of different insurance companies within the industry. It allows investors, analysts, and regulators to assess the financial strength and efficiency of insurance companies and make informed decisions about their investments or regulatory oversight.

Overall, the combined ratio is a critical metric for insurance companies as it provides valuable insights into their underwriting profitability and efficiency. By analyzing this ratio, insurance companies can identify areas for improvement and make strategic decisions to enhance their financial performance.

Formula and Calculation

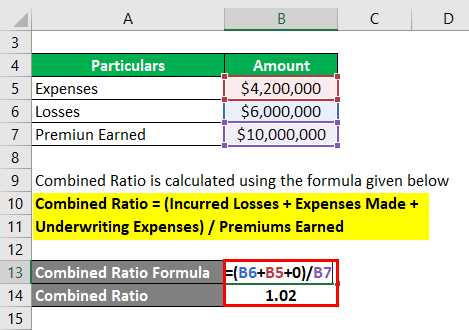

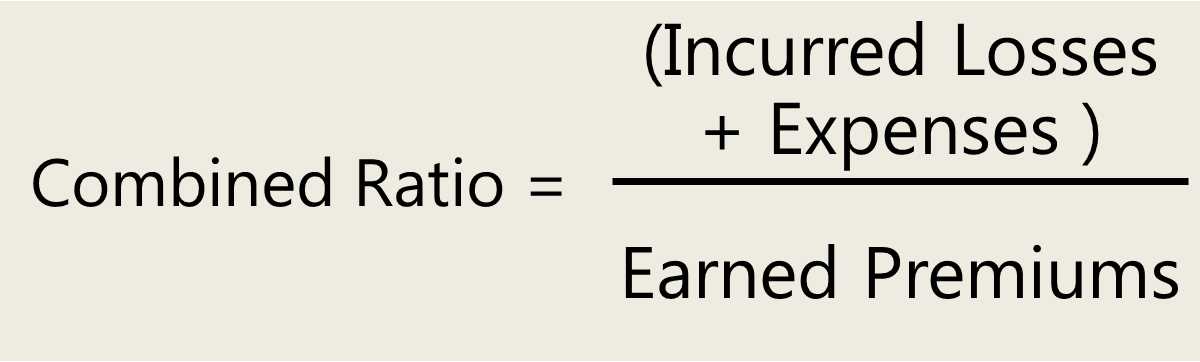

The combined ratio is calculated by dividing the sum of an insurer’s incurred losses and expenses by its earned premium. The formula for calculating the combined ratio is as follows:

Combined Ratio = (Incurred Losses + Expenses) / Earned Premium

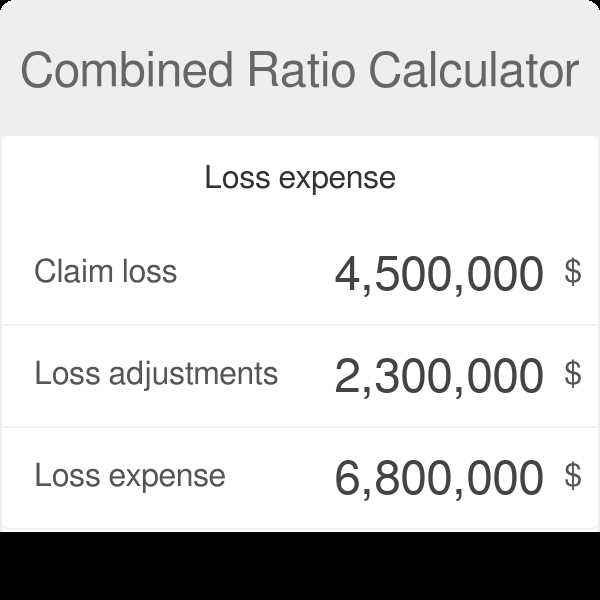

The incurred losses represent the total amount of claims that an insurer has paid out during a specific period, including both reported and estimated losses. Expenses include all the costs associated with running the insurance business, such as administrative expenses, underwriting expenses, and commissions.

The earned premium is the total amount of premiums that an insurer has earned from policyholders during the same period. It represents the revenue generated by the insurance company.

By dividing the sum of incurred losses and expenses by the earned premium, the combined ratio provides a measure of the insurer’s overall underwriting profitability. A combined ratio below 100% indicates that the insurer is making an underwriting profit, while a ratio above 100% indicates an underwriting loss.

Insurance companies aim to achieve a combined ratio below 100% to ensure profitability in their underwriting operations. However, it is important to note that a combined ratio above 100% does not necessarily mean that the insurer is unprofitable. It may still generate profits from investment income, which is not included in the calculation of the combined ratio.

Example:

Let’s consider an insurance company that has incurred losses of $10 million, expenses of $5 million, and earned premiums of $15 million during a specific period.

Using the formula mentioned above, we can calculate the combined ratio as follows:

Combined Ratio = ($10 million + $5 million) / $15 million = 1.00 or 100%

The combined ratio is a crucial metric for insurance companies as it helps them assess the profitability of their underwriting activities and make informed decisions to improve their financial performance.

| Ratio | Interpretation |

|---|---|

| Less than 100% | Profitable underwriting operations |

| Equal to 100% | Break-even underwriting operations |

| Greater than 100% | Underwriting loss |

Examples and Application

To better understand how the combined ratio is calculated and its significance in the insurance industry, let’s consider a few examples.

Example 1: Insurance Company XYZ

Insurance Company XYZ provides various types of insurance coverage, including auto, home, and health insurance. In a given year, the company collects $10 million in premiums from policyholders.

During the same year, the company incurs $6 million in claims and claim adjustment expenses. Additionally, the company spends $2 million on operating expenses, such as salaries, rent, and administrative costs.

To calculate the combined ratio for Insurance Company XYZ, we add the claims and claim adjustment expenses to the operating expenses and divide the sum by the premium collected:

Combined Ratio = (Claims + Claim Adjustment Expenses + Operating Expenses) / Premiums

= ($6 million + $2 million) / $10 million

= 0.8 or 80%

Example 2: Comparison of Insurance Companies

Let’s compare the combined ratios of Insurance Company XYZ with two other insurance companies, Company ABC and Company DEF.

Company ABC has a combined ratio of 90%, while Company DEF has a combined ratio of 110%. This means that Company ABC is more efficient in managing its expenses compared to Company XYZ, as it spends a lower percentage of its premium income on claims and operating expenses.

Insurance companies regularly monitor their combined ratios to assess their financial performance and make necessary adjustments. A consistently high combined ratio may indicate the need for premium rate increases, cost-cutting measures, or changes in underwriting practices.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.