What is a Collection Agency?

A collection agency is a business that specializes in recovering overdue debts on behalf of creditors. When individuals or businesses fail to pay their debts, the creditor may hire a collection agency to help recover the money owed.

Collection agencies can work with various types of debts, including credit card bills, medical bills, student loans, and more. They act as intermediaries between the creditor and the debtor, using various methods to collect the outstanding balance.

These methods may include sending letters or making phone calls to remind debtors of their obligations, negotiating repayment plans, or even taking legal action if necessary. Collection agencies are skilled in navigating the complex world of debt collection and are trained to handle difficult situations professionally and ethically.

By hiring a collection agency, creditors can focus on their core business while leaving the task of debt recovery to the experts. Collection agencies have the resources and expertise to locate debtors, communicate with them effectively, and pursue legal action if needed.

| Benefits of using a collection agency: |

| – Increased chances of debt recovery |

| – Saves time and effort for the creditor |

| – Expertise in debt collection laws and regulations |

| – Professional and ethical handling of debtors |

Overall, collection agencies play a crucial role in the financial ecosystem by helping creditors recover their outstanding debts and maintaining a healthy credit system.

How Does a Collection Agency Work?

A collection agency is a business that specializes in collecting overdue debts on behalf of creditors. When a person or business fails to pay their debts, the creditor may hire a collection agency to recover the money owed.

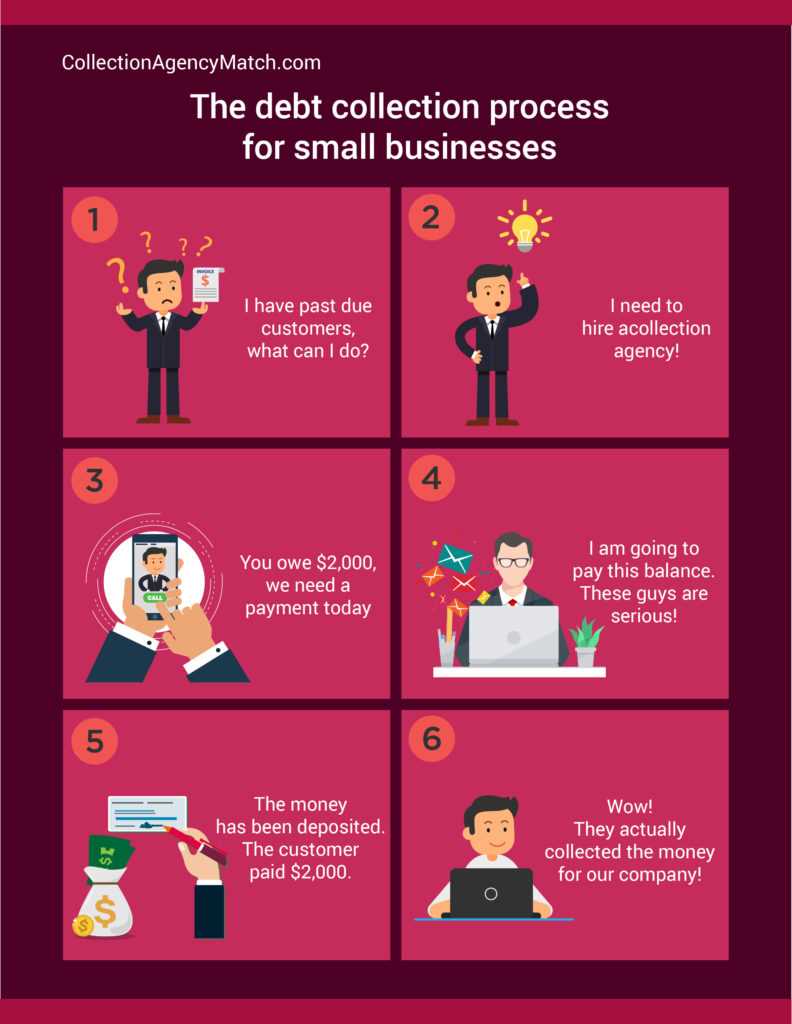

Here is a step-by-step breakdown of how a collection agency typically works:

1. Assignment of Debt

2. Contacting the Debtor

Once the debt is assigned, the collection agency will start contacting the debtor. They may do this through phone calls, letters, or emails. The purpose of these contacts is to inform the debtor about the debt and to request payment.

3. Verification of Debt

Before proceeding with collection efforts, the agency will verify the debt to ensure its accuracy. This involves reviewing the original contract or agreement, checking payment records, and confirming the amount owed. If there are any disputes regarding the debt, the agency will investigate and resolve them.

4. Negotiating Payment

If the debtor acknowledges the debt and is willing to pay, the collection agency will negotiate a payment plan. They may offer options such as lump-sum settlements, installment payments, or reduced interest rates. The goal is to reach an agreement that is acceptable to both parties.

5. Collection Actions

If the debtor refuses to pay or fails to respond, the collection agency may take further action to recover the debt. This can include reporting the debt to credit bureaus, initiating legal proceedings, or hiring skip tracers to locate the debtor’s whereabouts. The agency will use various tactics within the boundaries of the law to encourage the debtor to fulfill their obligation.

6. Remittance to Creditor

Once the debt is collected, the collection agency will remit the payment to the creditor, minus their fees or commission. The agency’s fees are typically a percentage of the amount collected, and they vary depending on the specific agreement between the agency and the creditor.

Overall, collection agencies play a crucial role in the debt recovery process. They help creditors collect money that is owed to them, while also providing debtors with opportunities to resolve their financial obligations.

| Benefits of Using a Collection Agency | Drawbacks of Using a Collection Agency |

|---|---|

|

|

Regulations for Collection Agencies

Collection agencies are subject to various regulations to ensure fair and ethical practices in their debt collection activities. These regulations are in place to protect consumers from harassment and unfair treatment. Here are some of the key regulations that collection agencies must adhere to:

Fair Debt Collection Practices Act (FDCPA)

The Fair Debt Collection Practices Act is a federal law that sets guidelines for how collection agencies can communicate with debtors. It prohibits abusive, deceptive, and unfair practices and outlines the rights of consumers. Under the FDCPA, collection agencies are not allowed to use threats, harassment, or false statements to collect debts.

Fair Credit Reporting Act (FCRA)

The Fair Credit Reporting Act regulates the collection, dissemination, and use of consumer credit information. It requires collection agencies to provide accurate and complete information to credit reporting agencies. The FCRA also gives consumers the right to dispute inaccurate information and have it corrected or removed from their credit reports.

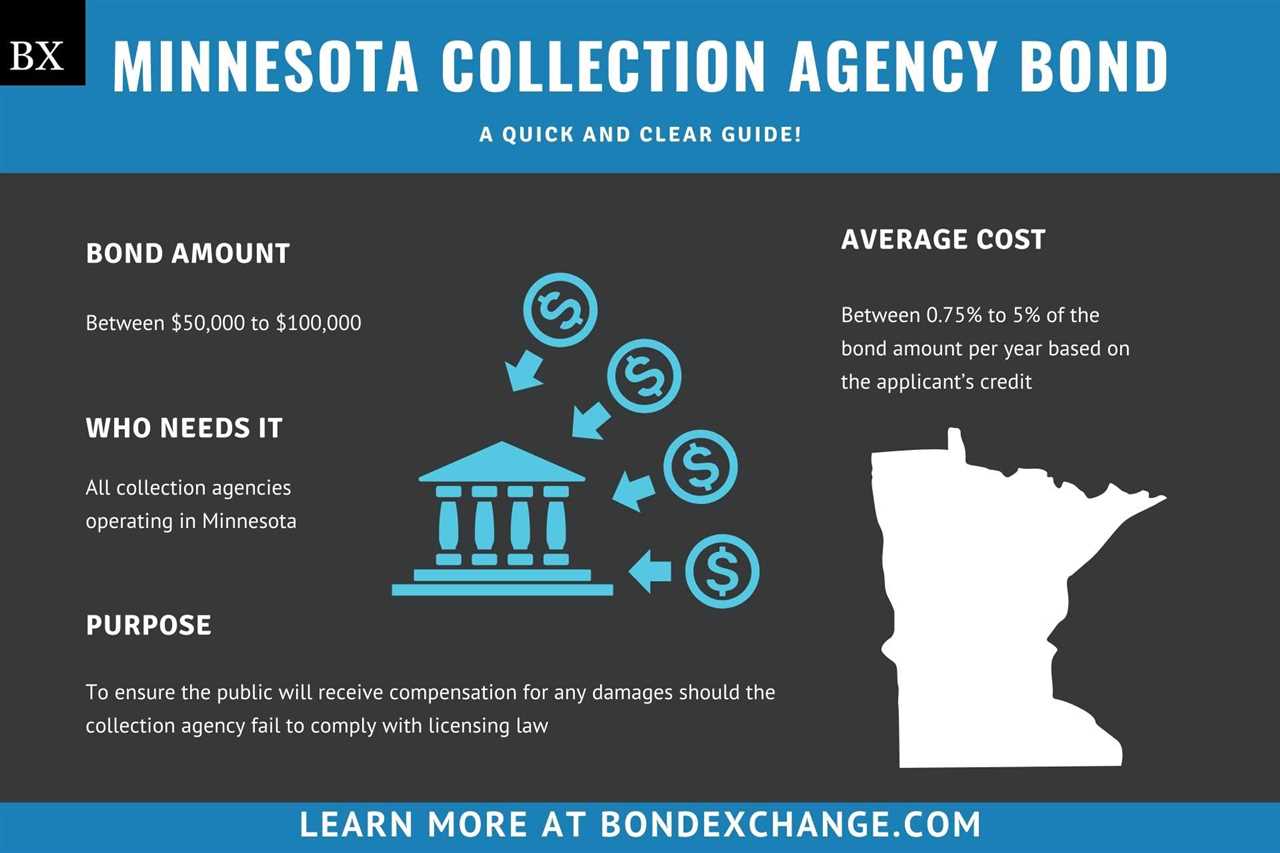

State-Specific Regulations

In addition to federal regulations, collection agencies must also comply with state-specific laws. These laws vary from state to state and may include additional requirements and restrictions on debt collection practices. It is important for collection agencies to be familiar with the laws in each state where they operate to ensure compliance.

Consumer Financial Protection Bureau (CFPB)

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.