What is Chattel Mortgage?

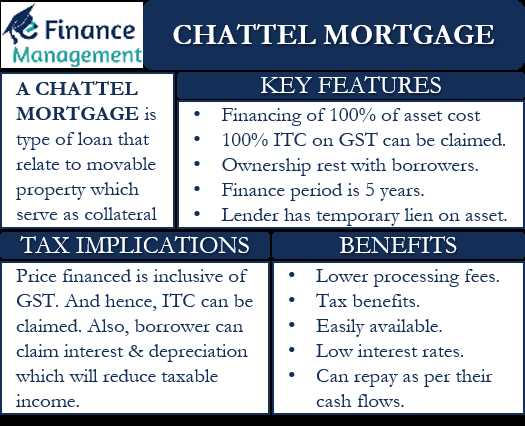

Chattel Mortgage is a type of loan agreement where movable personal property, such as vehicles, equipment, or inventory, is used as collateral for the loan. Unlike traditional mortgages that are secured by real estate, chattel mortgages are secured by movable assets.

Definition of Chattel Mortgage

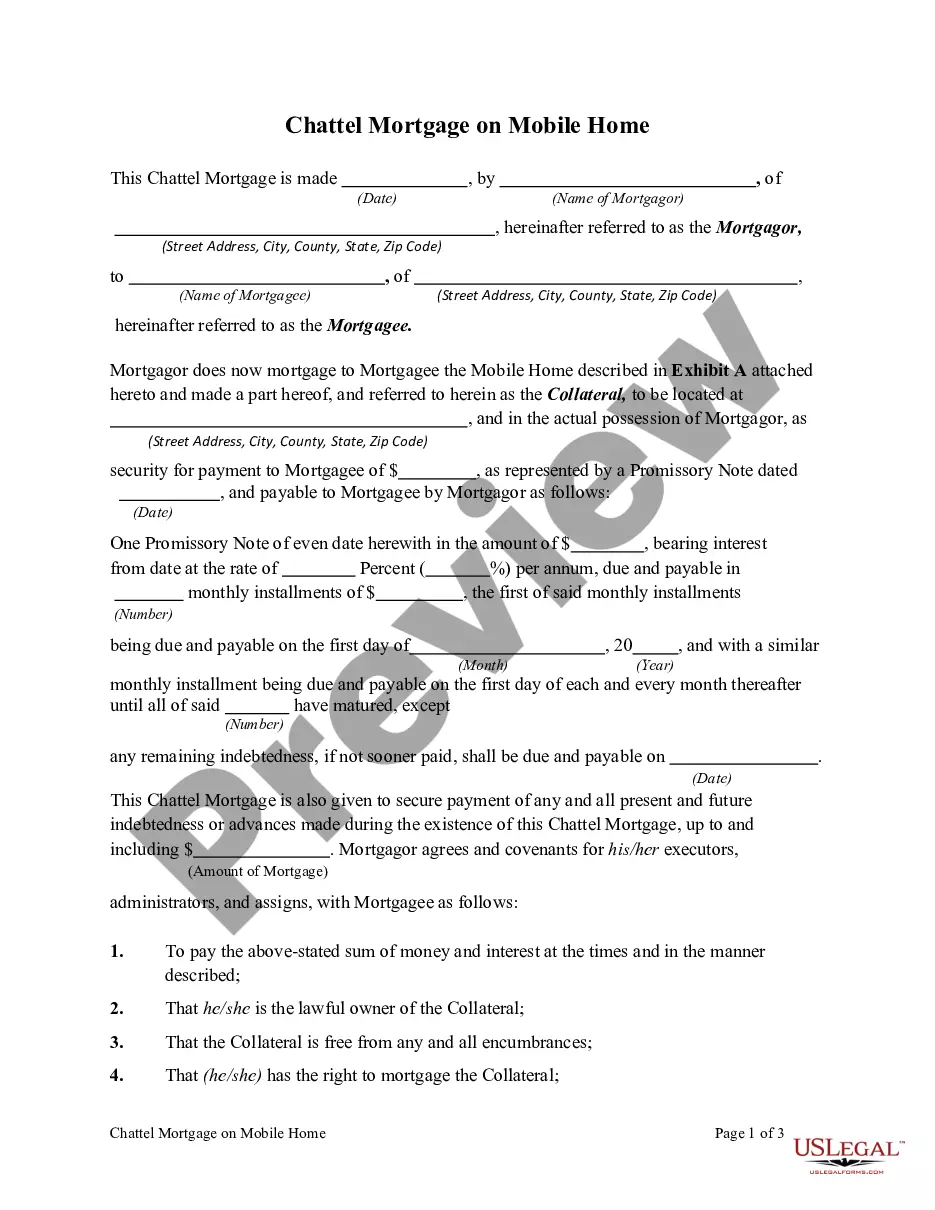

A chattel mortgage is a legal contract between a borrower (mortgagor) and a lender (mortgagee) where the borrower pledges movable personal property as security for a loan. The lender holds a security interest in the chattel until the loan is fully repaid.

Types of Chattel Mortgage

There are two main types of chattel mortgages:

| 1. Traditional Chattel Mortgage | This type of chattel mortgage is commonly used for financing vehicles, such as cars, trucks, and motorcycles. |

|---|---|

| 2. Equipment Chattel Mortgage | This type of chattel mortgage is used for financing equipment and machinery, such as construction equipment, agricultural machinery, or office equipment. |

Examples of Chattel Mortgage

Here are a few examples of chattel mortgages:

- A business owner financing a delivery van for their company

- A farmer using a chattel mortgage to finance a tractor

- A restaurant owner obtaining a loan to purchase kitchen equipment

These examples illustrate how chattel mortgages can be used to finance various movable assets for personal or business purposes.

Benefits of Chattel Mortgage

Chattel mortgages offer several benefits to borrowers:

- Flexible repayment terms

- Lower interest rates compared to unsecured loans

- Ability to finance a wide range of movable assets

- Potential tax advantages for business borrowers

- Quick and streamlined loan approval process

Overall, chattel mortgages provide borrowers with a convenient and accessible financing option for acquiring movable assets while using them as collateral to secure the loan.

Definition of Chattel Mortgage

Chattel mortgages are commonly used by businesses to finance the purchase of assets that are essential to their operations. This type of loan allows the borrower to use the asset while making regular payments to the lender. Once the loan is fully repaid, the borrower becomes the outright owner of the chattel.

Types of Chattel Mortgage

A chattel mortgage is a type of loan that is secured by movable personal property, such as vehicles, equipment, or inventory. There are several different types of chattel mortgages that borrowers can choose from, depending on their specific needs and circumstances. Here are some of the most common types:

1. Traditional Chattel Mortgage

2. Fleet Chattel Mortgage

A fleet chattel mortgage is specifically designed for businesses that need to finance multiple vehicles or equipment. This type of chattel mortgage allows the borrower to finance a fleet of assets under a single loan agreement, making it more convenient and cost-effective.

3. Equipment Chattel Mortgage

4. Inventory Chattel Mortgage

An inventory chattel mortgage is used to finance the purchase of inventory or stock for businesses. This type of chattel mortgage allows the borrower to secure the loan with the inventory itself, providing working capital to purchase and maintain stock levels.

5. Agricultural Chattel Mortgage

Agricultural chattel mortgages are specifically designed for farmers and agricultural businesses. This type of chattel mortgage allows the borrower to finance agricultural assets, such as livestock, crops, or farm equipment, and use them as collateral for the loan.

Examples of Chattel Mortgage

Chattel mortgage is a versatile financing option that can be used for various types of movable assets. Here are some examples of chattel mortgage in different industries:

1. Automotive Industry

In the automotive industry, chattel mortgage is commonly used to finance the purchase of vehicles such as cars, trucks, and motorcycles. For example, a business owner can use chattel mortgage to acquire a fleet of delivery vans for their logistics company.

2. Agriculture Sector

In the agriculture sector, chattel mortgage can be used to finance farming equipment and machinery. Farmers can use this financing option to purchase tractors, harvesters, irrigation systems, and other necessary equipment. This allows them to upgrade their equipment and increase productivity.

3. Construction and Manufacturing

Chattel mortgage is also popular in the construction and manufacturing industries. It can be used to finance the purchase of heavy machinery, such as excavators, cranes, bulldozers, and forklifts. This enables construction companies and manufacturers to acquire the equipment they need to complete projects efficiently.

4. Medical and Healthcare

In the medical and healthcare field, chattel mortgage can be used to finance the purchase of medical equipment and technology. Hospitals, clinics, and private practices can use this financing option to acquire equipment such as MRI machines, ultrasound devices, and surgical instruments.

5. Hospitality and Tourism

These are just a few examples of how chattel mortgage can be used in different industries. It provides businesses with the flexibility to acquire necessary assets while spreading the cost over a period of time. By using chattel mortgage, businesses can preserve their working capital and maintain cash flow, which is crucial for their operations and growth.

Benefits of Chattel Mortgage

Chattel mortgage offers several benefits to individuals and businesses looking to finance the purchase of movable assets. Here are some of the key advantages:

1. Quick and Easy Approval: Unlike traditional loans, chattel mortgages typically have a faster approval process. This means that you can secure the funds you need to acquire the asset quickly, allowing you to take advantage of time-sensitive opportunities.

2. Flexible Repayment Options: Chattel mortgages offer flexible repayment options, allowing you to tailor the loan to your specific financial situation. You can choose the loan term, repayment frequency, and payment amount that works best for you, ensuring that the loan is manageable and fits within your budget.

3. Lower Interest Rates: Chattel mortgages often come with lower interest rates compared to other forms of financing. This can result in significant savings over the life of the loan, making it a cost-effective option for acquiring movable assets.

4. Tax Deductible: In many jurisdictions, the interest paid on a chattel mortgage is tax deductible. This can provide additional financial benefits, reducing your overall tax liability and increasing your cash flow.

5. Asset Ownership: With a chattel mortgage, you retain ownership of the asset from the start. This means that you can use the asset for your business or personal needs while making repayments, allowing you to generate income or enjoy the benefits of ownership immediately.

6. Asset Protection: Chattel mortgages provide a level of security for the lender, which can result in more favorable loan terms. Additionally, the asset itself serves as collateral, reducing the risk for the lender and potentially allowing you to secure a larger loan amount or better interest rate.

Overall, chattel mortgages offer a convenient and flexible financing option for acquiring movable assets. Whether you are looking to purchase a vehicle, equipment, or other movable property, a chattel mortgage can provide the funds you need with favorable terms and benefits.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.