What is a Buy Limit Order?

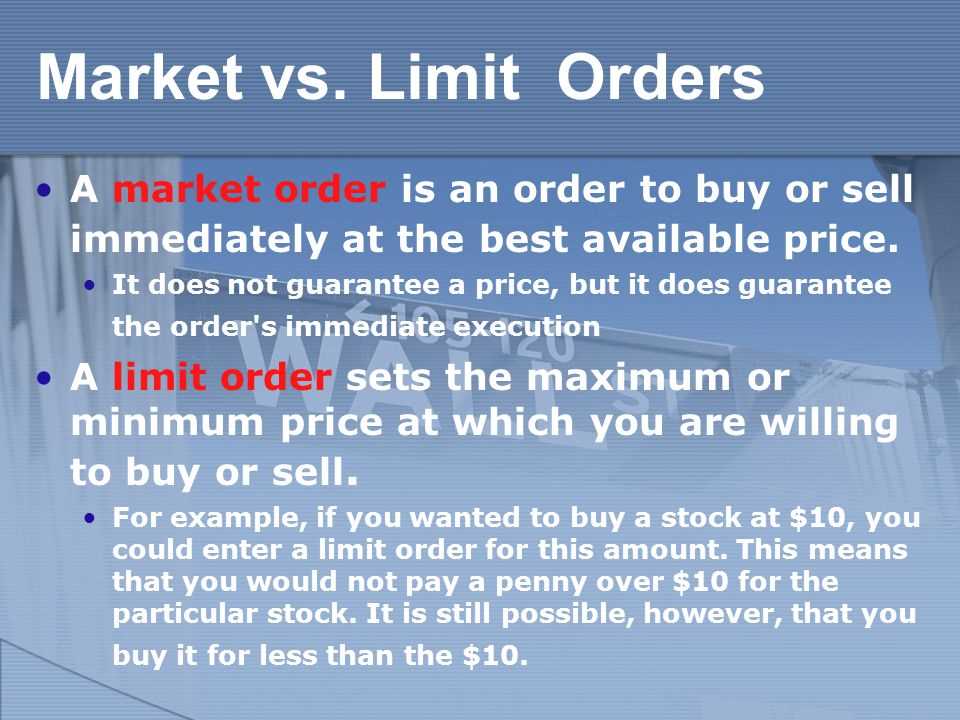

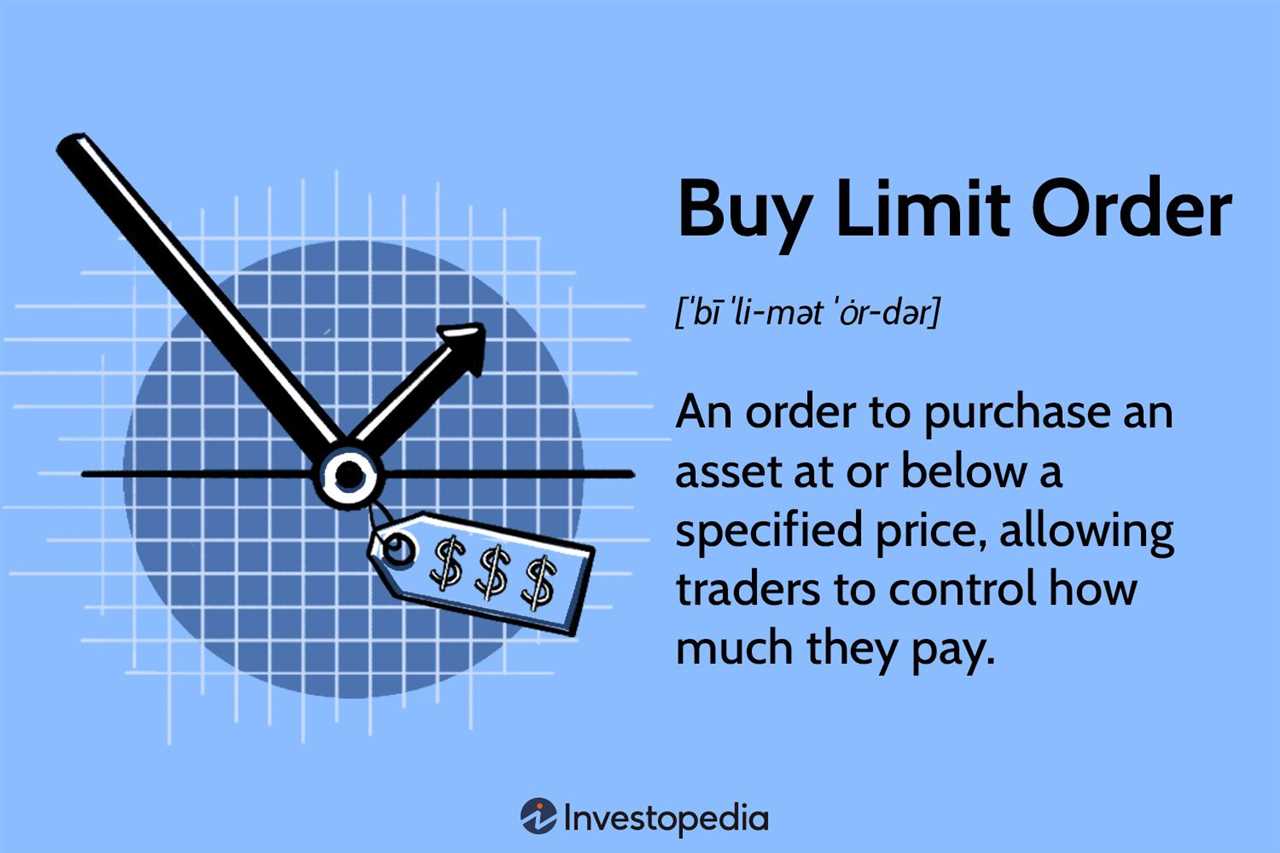

A buy limit order is a type of trading order that allows investors to set a specific price at which they are willing to buy a security. This order is placed with a brokerage firm or online trading platform and is only executed if the market price of the security falls to or below the specified limit price.

When placing a buy limit order, investors are essentially saying, “I want to buy this security, but only if the price is at or below a certain level.” This allows investors to potentially purchase a security at a lower price than the current market price.

How does a Buy Limit Order work?

When a buy limit order is placed, it is added to the order book of the exchange or trading platform. The order book is a list of all the buy and sell orders for a particular security, organized by price and time. When the market price of the security reaches or falls below the specified limit price, the buy limit order is triggered and executed.

For example, let’s say an investor wants to buy shares of a company at a price of $50 or lower. They would place a buy limit order with a limit price of $50. If the market price of the shares falls to $50 or below, the buy limit order would be executed and the investor would purchase the shares at or below the specified price.

Advantages of Buy Limit Orders

- Allows investors to set a specific price at which they are willing to buy a security

- Potentially allows investors to purchase a security at a lower price than the current market price

- Provides control and flexibility in trading

- Can be used to take advantage of short-term price fluctuations

Overall, buy limit orders can be a useful tool for investors who want to buy a security at a specific price or take advantage of potential price dips. By setting a limit price, investors can have more control over their trading decisions and potentially save money on their investments.

Definition and Explanation

A buy limit order is a type of trading order that allows investors to set a specific price at which they are willing to buy a security. This order is executed only if the market price of the security reaches or falls below the specified limit price.

When placing a buy limit order, investors must specify the limit price, which is the maximum price they are willing to pay for the security. If the market price of the security falls below the limit price, the order is triggered and executed at the specified price or better.

Buy limit orders are commonly used by investors who want to buy a security at a lower price than the current market price. By setting a limit price, investors can take advantage of potential price declines and buy the security at a more favorable price.

How Does a Buy Limit Order Work?

When a buy limit order is placed, it is added to the order book of the exchange or trading platform. The order book is a list of all buy and sell orders for a particular security, organized by price and time.

If the market price of the security reaches or falls below the specified limit price, the buy limit order is matched with a sell order at the same or lower price. The trade is then executed, and the investor becomes the owner of the security at the specified price.

It is important to note that a buy limit order does not guarantee execution. If the market price of the security does not reach or fall below the specified limit price, the order remains open and unfilled until it is either canceled by the investor or the market price reaches the limit price.

Benefits of Buy Limit Orders

- Allows investors to buy securities at a lower price than the current market price

- Provides control over the purchase price

- Can be used to take advantage of potential price declines

- Helps avoid buying securities at inflated prices

Overall, buy limit orders are a useful tool for investors who want to buy securities at specific prices and take advantage of potential price declines. By setting a limit price, investors can control their purchase price and potentially save money on their investments.

Advantages of Buy Limit Orders

Buy limit orders offer several advantages for traders and investors:

| Advantage | Description |

| Control over the purchase price | With a buy limit order, traders can specify the maximum price they are willing to pay for a security. This allows them to have more control over their purchase price and potentially get a better deal. |

| Protection against overpaying | By setting a limit on the purchase price, traders can avoid overpaying for a security. This can help them avoid potential losses and ensure they are getting the best value for their investment. |

| Opportunity to catch a dip in price | |

| Flexibility in timing | With buy limit orders, traders have the flexibility to set their desired purchase price and wait for the market to reach that price. This allows them to choose the timing that is most favorable for their investment strategy. |

| Reduced emotional decision-making | Setting a buy limit order can help traders avoid making impulsive decisions based on emotions. By predefining their purchase price, traders can stick to their strategy and avoid getting caught up in market fluctuations. |

Overall, buy limit orders provide traders and investors with greater control, protection, and flexibility in their buying decisions. By using this type of order, traders can potentially optimize their investment outcomes and reduce the risks associated with buying securities.

Pros and Benefits of Buy Limit Orders

Buy limit orders offer several advantages and benefits for traders looking to enter the market at a specific price:

1. Price Control

One of the main benefits of using a buy limit order is that it allows traders to have control over the price at which they enter a trade. By setting a specific price, traders can ensure that they only buy an asset when it reaches their desired level, preventing them from overpaying or entering a trade at an unfavorable price.

2. Potential for Better Execution

Buy limit orders can also increase the chances of getting a better execution price. When the market reaches the specified price, the order is triggered, and the trade is executed at that price or better. This means that traders may be able to buy an asset at a lower price than the current market price, potentially increasing their profits.

3. Automation and Convenience

Using buy limit orders allows traders to automate their trading strategy and take advantage of market movements without constantly monitoring the market. Once the order is set, traders can focus on other tasks or strategies, knowing that their buy order will be executed when the market reaches their desired price.

4. Risk Management

Buy limit orders can also be used as part of a risk management strategy. By setting a specific price at which to enter a trade, traders can define their risk-reward ratio and determine their maximum potential loss. This can help traders manage their risk and avoid entering trades at unfavorable prices.

Disadvantages of Buy Limit Orders

While buy limit orders offer several advantages, there are also some disadvantages to consider:

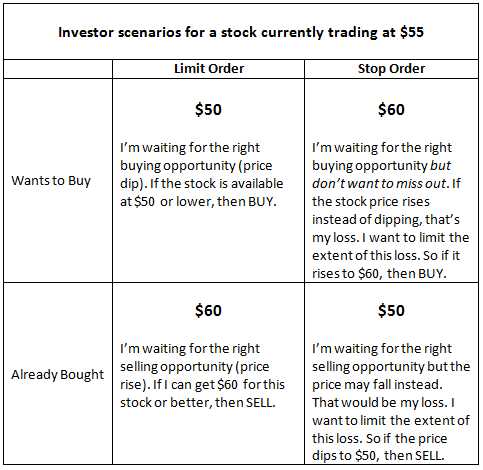

1. Possibility of Missed Opportunities: One of the main drawbacks of buy limit orders is that there is a chance that the desired price may never be reached. If the market price does not drop to the specified limit price, the order will remain unfilled, potentially causing the investor to miss out on potential gains.

2. Execution Risk: Another disadvantage of buy limit orders is the risk of execution. Even if the market price reaches the specified limit price, there is no guarantee that the order will be executed. This can occur if there is not enough liquidity in the market or if other orders are prioritized.

3. Delayed Execution: Buy limit orders may also suffer from delayed execution. The order will only be executed when the market price reaches the specified limit price, which means there may be a delay between placing the order and its execution. During this time, the market conditions may change, potentially affecting the desired outcome.

4. Potential for Partial Fills: Buy limit orders may also result in partial fills. If the market price reaches the limit price but there is not enough supply to fill the entire order, only a portion of the order will be executed. This can lead to a fragmented position and may not achieve the desired investment strategy.

5. Emotional Bias: Lastly, buy limit orders can be influenced by emotional bias. Investors may become attached to a specific price and be unwilling to adjust their limit price, even if market conditions change. This can lead to missed opportunities or suboptimal execution.

Overall, while buy limit orders offer advantages such as price control and potential cost savings, it is important to consider the potential drawbacks and assess whether they align with your investment goals and risk tolerance.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.