Bull Put Spread Trading: A Guide to This Options Strategy

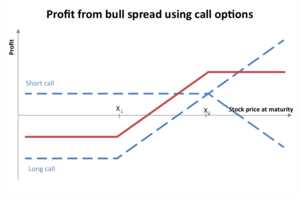

Options trading can be a complex and risky endeavor, but with the right strategies, it can also be highly profitable. One such strategy that traders employ is the bull put spread. This options strategy involves selling a put option with a higher strike price and simultaneously buying a put option with a lower strike price. The goal is to profit from a bullish market by collecting the premium from the sold put option while limiting potential losses with the purchased put option.

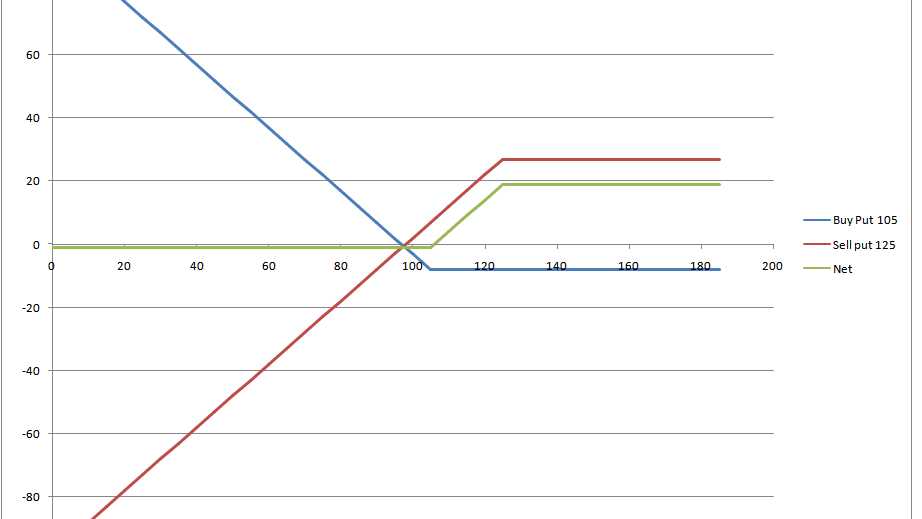

When implementing a bull put spread, it is important to understand the mechanics of the strategy. The trader sells a put option with a higher strike price, which gives the buyer the right to sell the underlying asset at that price. At the same time, the trader buys a put option with a lower strike price, which gives them the right to sell the underlying asset at that price. By selling the higher strike put option, the trader collects a premium, which provides immediate income. This income helps offset the cost of buying the lower strike put option.

The key to success with a bull put spread is selecting the appropriate strike prices and expiration dates. The strike prices should be chosen based on the trader’s outlook for the underlying asset. If the trader believes the asset will remain above a certain price, they can sell a put option with a strike price below that level. The purchased put option acts as a form of insurance, limiting potential losses if the market moves against the trader’s expectations.

However, it is important to be aware of the risks associated with bull put spread trading. If the market moves against the trader’s expectations and the price of the underlying asset falls below the lower strike price, losses can occur. Additionally, if the market remains stagnant or only experiences minimal upward movement, the potential profits from the strategy may be limited.

The bull put spread strategy is a popular options trading strategy that allows traders to profit from a bullish market outlook while limiting their downside risk. This strategy involves selling a put option with a higher strike price and buying a put option with a lower strike price.

When implementing a bull put spread, the trader receives a premium for selling the higher strike put option, which helps to offset the cost of buying the lower strike put option. The difference between the two strike prices represents the maximum potential profit for the trader.

If the underlying asset’s price falls below the lower strike price, the trader may face a potential loss. However, the loss is limited to the difference between the two strike prices minus the premium received. This limited risk is one of the main advantages of the bull put spread strategy.

Traders often use the bull put spread strategy when they have a moderately bullish outlook on the underlying asset. By selecting appropriate strike prices and expiration dates, traders can customize the risk and reward profile of their trades.

It is important for traders to carefully consider the potential risks and rewards of the bull put spread strategy before implementing it. While the strategy offers limited risk, there is still a possibility of loss if the underlying asset’s price falls significantly.

Benefits and Risks of Bull Put Spread Trading

Benefits of Bull Put Spread Trading:

1. Limited Risk: One of the main advantages of the bull put spread strategy is that it limits the trader’s risk. By combining a short put option with a long put option, the trader’s potential losses are capped at the difference between the two strike prices minus the premium received.

2. Income Generation: Bull put spread trading allows traders to generate income through the premium received from selling the short put option. This can be particularly beneficial in a sideways or slightly bullish market, where the options may expire worthless, allowing the trader to keep the premium.

3. Lower Margin Requirements: Compared to other options strategies, the bull put spread strategy typically requires lower margin requirements. This can make it more accessible for traders with limited capital or those looking to allocate their capital more efficiently.

4. Flexibility: The bull put spread strategy offers flexibility in terms of strike prices and expiration dates. Traders can choose strike prices that align with their risk tolerance and market expectations. Additionally, they can adjust the strategy by rolling the options or closing the position before expiration if market conditions change.

Risks of Bull Put Spread Trading:

1. Limited Profit Potential: While the bull put spread strategy limits the trader’s risk, it also limits their profit potential. The maximum profit is limited to the premium received from selling the short put option minus the premium paid for the long put option.

3. Assignment Risk: There is a risk of assignment if the short put option is in-the-money at expiration. If this happens, the trader may be obligated to buy the underlying stock at the strike price of the short put option. It is important to consider this risk and have a plan in place to manage potential assignments.

4. Limited Upside Potential: The bull put spread strategy is designed for slightly bullish or sideways markets. If the underlying stock or index experiences a significant rally, the trader’s potential upside may be limited. Traders should consider their market expectations and adjust their strategy accordingly.

Overall, the bull put spread strategy can be a useful tool for options traders, offering limited risk, income generation, and flexibility. However, it is important to understand the risks involved and have a solid trading plan in place to manage potential losses and maximize profits.

Implementing the Bull Put Spread Strategy

Implementing the bull put spread strategy involves a combination of buying and selling put options to create a spread. This strategy is typically used by options traders who are bullish on a particular stock or index and want to generate income while limiting their downside risk.

Step 1: Selecting the Options

The first step in implementing a bull put spread strategy is to select the options that will be used. This involves choosing a strike price for the sold put option and a strike price for the bought put option. The strike price of the sold put option should be higher than the strike price of the bought put option.

For example, if the stock is trading at $50, the trader may choose to sell a put option with a strike price of $45 and buy a put option with a strike price of $40.

Step 2: Selling the Put Option

Once the options have been selected, the trader will sell the put option with the higher strike price. This involves receiving a premium from the buyer of the put option in exchange for the obligation to buy the stock at the strike price if the option is exercised.

Using the previous example, if the trader sells the put option with a strike price of $45, they will receive a premium from the buyer of the option.

Step 3: Buying the Put Option

After selling the put option, the trader will then buy the put option with the lower strike price. This provides insurance against a large downside move in the stock price.

In the example, if the trader buys the put option with a strike price of $40, they will pay a premium for this option.

Step 4: Profit and Loss Potential

The profit potential of a bull put spread strategy is limited to the premium received from selling the put option minus the premium paid for buying the put option. The maximum profit is achieved when the stock price is above the strike price of the sold put option at expiration.

The loss potential is limited to the difference between the strike prices minus the premium received. The maximum loss is realized when the stock price is below the strike price of the bought put option at expiration.

Step 5: Monitoring and Adjusting the Position

Once the bull put spread strategy has been implemented, it is important to monitor the position and make adjustments as necessary. This may involve closing out the position early if the stock price moves against the trader’s expectations or adjusting the strike prices of the options to better align with the stock price.

Overall, implementing a bull put spread strategy requires careful consideration of the options selected and the potential profit and loss outcomes. Traders should also be prepared to make adjustments to the position as market conditions change.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.