Bretton Woods Agreement: Origins and Significance

The Bretton Woods Agreement, signed in 1944, was a landmark international agreement that established the framework for the post-World War II global economic system. It was named after the location of the conference, which took place in Bretton Woods, New Hampshire, USA.

The agreement was a response to the economic turmoil of the Great Depression and the destructive effects of World War II. Its primary goal was to promote economic stability and facilitate international trade and investment.

Origins of the Bretton Woods Agreement

The origins of the Bretton Woods Agreement can be traced back to the early 1940s when policymakers and economists recognized the need for a new international monetary system. The existing system, based on the gold standard, had collapsed during the Great Depression and was further disrupted by the war.

Under the gold standard, currencies were pegged to gold, and countries had to maintain a fixed exchange rate. However, this system proved to be inflexible and unable to cope with the economic challenges of the time.

Leading economists and policymakers, including John Maynard Keynes from the United Kingdom and Harry Dexter White from the United States, played a crucial role in shaping the new international monetary system. Their ideas formed the basis for the discussions and negotiations that took place at the Bretton Woods conference.

Significance of the Bretton Woods Agreement

The IMF was created to promote international monetary cooperation, stabilize exchange rates, and provide financial assistance to member countries facing balance of payments problems. It played a crucial role in managing the post-war economic recovery and has since become a key institution in the global financial system.

The World Bank, on the other hand, was established to provide financial and technical assistance to developing countries for development projects. It has played a vital role in promoting economic growth and poverty reduction in many parts of the world.

However, the fixed exchange rate system eventually proved to be unsustainable, and it collapsed in the early 1970s. This led to the adoption of a floating exchange rate system, where exchange rates are determined by market forces.

The Bretton Woods Agreement, signed in 1944, was a landmark international monetary system that aimed to stabilize global currencies and promote economic growth after World War II. This agreement laid the foundation for the creation of several key institutions, including the International Monetary Fund (IMF) and the World Bank.

Background

Before the Bretton Woods Agreement, the world faced economic instability and currency fluctuations, which hindered international trade and investment. The Great Depression of the 1930s further exacerbated these issues, leading to a need for a new global financial system.

The Bretton Woods Conference, held in Bretton Woods, New Hampshire, brought together delegates from 44 countries to discuss and negotiate the terms of the new monetary system. The conference was attended by prominent economists, policymakers, and government officials, all seeking to establish a framework that would prevent the economic crises of the past.

Key Principles

The Bretton Woods Agreement was based on several key principles:

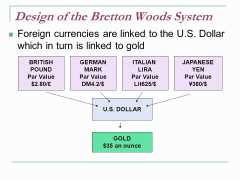

- Fixed Exchange Rates: Under this system, participating countries agreed to fix the value of their currencies in relation to the U.S. dollar, which was pegged to gold. This provided stability and predictability in international trade.

- International Monetary Fund (IMF): The IMF was established to promote global economic stability and provide financial assistance to member countries facing balance of payments problems. It also served as a forum for international cooperation on monetary matters.

- Free Trade: The Bretton Woods Agreement aimed to promote free trade by reducing trade barriers and encouraging economic cooperation among member countries.

Legacy and Criticisms

The Bretton Woods Agreement had a significant impact on the global economy and shaped the post-war economic order. It provided stability and facilitated economic growth for several decades. However, the system faced challenges and criticisms over time.

Despite its eventual demise, the Bretton Woods Agreement remains a significant milestone in the history of international finance. It laid the groundwork for the establishment of key institutions that continue to play a vital role in the global economy today.

The Impact of the Bretton Woods Institutions on Global Economy

The Bretton Woods Agreement, signed in 1944, established a new international monetary system and created several institutions that had a significant impact on the global economy. These institutions, namely the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD), played a crucial role in shaping the post-World War II economic order.

However, the Bretton Woods system faced challenges and eventually collapsed in the early 1970s. The fixed exchange rate regime became unsustainable due to economic imbalances and inflationary pressures. This led to the abandonment of the gold standard and the adoption of flexible exchange rates. Despite its eventual demise, the Bretton Woods system left a lasting legacy in terms of promoting economic stability, development, and cooperation.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.