Average Cost Basis Method

The average cost basis method is a commonly used accounting method for valuing inventory. It calculates the average cost of all units of inventory on hand to determine the cost of goods sold and the value of ending inventory.

Under the average cost basis method, the cost of each unit of inventory is determined by dividing the total cost of all units on hand by the total number of units. This average cost is then used to calculate the cost of goods sold and the value of ending inventory.

One advantage of the average cost basis method is that it smooths out the impact of price fluctuations. By taking into account the average cost of all units on hand, it reduces the impact of sudden increases or decreases in the cost of inventory.

However, one disadvantage of this method is that it may not accurately reflect the actual cost of individual units. If there are significant differences in the cost of different units of inventory, using the average cost may result in distorted financial statements.

Definition and Calculation of Average Cost Basis Method

The average cost basis method is a way to calculate the cost of an asset or investment by taking the average of the purchase prices over a specific period of time. This method is commonly used in accounting to determine the value of inventory or securities.

Calculation

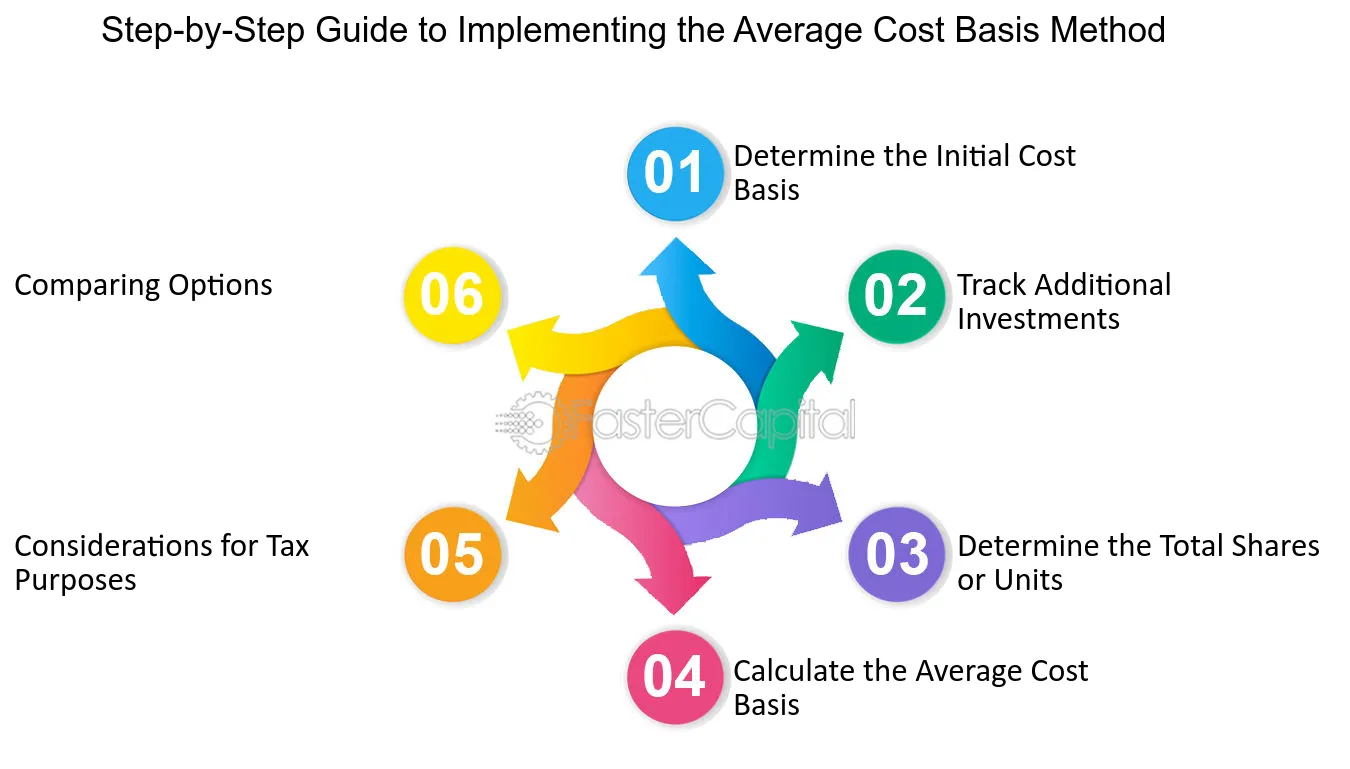

To calculate the average cost basis, you need to follow these steps:

- Record the purchase prices of the asset or investment over a specific period of time.

- Add up all the purchase prices.

- Divide the total purchase prices by the number of purchases to get the average cost per unit.

For example, let’s say you purchased 100 shares of a stock at $10 per share and 200 shares at $12 per share. To calculate the average cost basis, you would add up the purchase prices ($10 + $12 = $22) and divide by the total number of purchases (2). The average cost per share would be $11.

Advantages and Disadvantages

The average cost basis method has several advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Simple and easy to calculate. | Does not reflect the actual purchase prices. |

| Smooths out price fluctuations. | May not accurately reflect the current market value. |

| Reduces the impact of extreme price changes. | Not suitable for certain investments or assets. |

Overall, the average cost basis method is a useful tool for calculating the cost of assets or investments, but it may not always provide an accurate representation of the actual purchase prices or current market value. It is important to consider the specific circumstances and requirements of each situation before using this method.

Alternatives in Accounting

First-In, First-Out (FIFO) Method

The FIFO method assumes that the first items purchased are the first ones sold. In other words, the cost of the oldest inventory is matched with the revenue generated by the first sales. This method is often used when a business wants to reflect the actual flow of inventory and costs.

For example, if a company purchases 100 units of a product at $10 each and then purchases another 100 units at $15 each, the FIFO method would assume that the first 100 units sold were the ones purchased at $10 each.

Last-In, First-Out (LIFO) Method

The LIFO method assumes that the last items purchased are the first ones sold. This means that the cost of the most recent inventory is matched with the revenue generated by the first sales. This method is often used when a business wants to reflect the current cost of inventory.

Using the same example as before, if a company purchases 100 units of a product at $10 each and then purchases another 100 units at $15 each, the LIFO method would assume that the first 100 units sold were the ones purchased at $15 each.

Specific Identification Method

The specific identification method involves tracking the cost of each individual item in inventory. This method is often used when the items in inventory have unique serial numbers or other identifying characteristics. It allows businesses to match the exact cost of each item with the revenue generated by its sale.

For example, if a company sells laptops with unique serial numbers, the specific identification method would track the cost of each laptop and match it with the revenue generated when that specific laptop is sold.

Overall, the choice of which accounting method to use depends on the specific needs and goals of a business. Each method has its advantages and disadvantages, and businesses should carefully consider their inventory management and financial reporting requirements before making a decision.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.