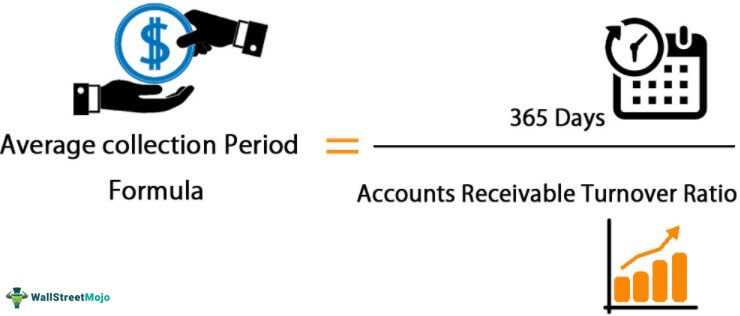

Average Collection Period Formula

The average collection period is a financial metric that measures the average number of days it takes for a company to collect its accounts receivable. It provides insight into the efficiency of a company’s credit and collection policies.

The formula for calculating the average collection period is:

Average Collection Period = Accounts Receivable / (Net Credit Sales / Number of Days)

Where:

- Accounts Receivable is the total amount of money owed to the company by its customers.

- Net Credit Sales is the total amount of sales made on credit, minus any returns or allowances.

- Number of Days is the time period over which the average collection period is calculated.

The average collection period is an important metric for businesses as it helps them assess their cash flow and liquidity. A shorter average collection period indicates that a company is collecting its receivables more quickly, which is generally a positive sign. On the other hand, a longer average collection period may indicate that a company is having difficulty collecting payments from its customers.

By monitoring and analyzing the average collection period, businesses can identify areas for improvement in their credit and collection processes. They can also compare their average collection period to industry benchmarks to assess their performance relative to their peers.

The average collection period is a financial metric used to assess the efficiency of a company’s accounts receivable management. It measures the average number of days it takes for a company to collect payments from its customers after a sale has been made. This metric is important for businesses as it provides insights into their cash flow and liquidity.

By analyzing the average collection period, businesses can identify any issues with their accounts receivable process. A shorter average collection period indicates that a company is able to collect payments from its customers quickly, which is a positive sign. On the other hand, a longer average collection period may indicate that a company is struggling to collect payments, which can lead to cash flow problems.

The average collection period is calculated by dividing the average accounts receivable by the average daily sales. The average accounts receivable is the sum of the beginning and ending accounts receivable divided by two. The average daily sales is calculated by dividing the total sales for a given period by the number of days in that period.

Once the average collection period is calculated, it can be compared to industry benchmarks or historical data to assess the company’s performance. If the average collection period is significantly longer than the industry average or previous periods, it may indicate that the company needs to improve its accounts receivable management.

Improving the average collection period can be achieved through various strategies, such as implementing stricter credit policies, offering discounts for early payments, or using automated invoicing and payment systems. By reducing the average collection period, companies can improve their cash flow, reduce the risk of bad debts, and potentially increase their profitability.

| Benefits of a shorter average collection period: | Consequences of a longer average collection period: |

|---|---|

| – Improved cash flow | – Cash flow problems |

| – Reduced risk of bad debts | – Increased risk of bad debts |

| – Increased profitability | – Decreased profitability |

How to Calculate the Average Collection Period

The average collection period is a financial metric used to measure the average number of days it takes for a company to collect payment from its customers. It is an important indicator of a company’s efficiency in managing its accounts receivable.

Formula for Average Collection Period

The formula for calculating the average collection period is:

| Average Collection Period | = | Accounts Receivable | / | (Net Credit Sales / 365) |

To calculate the average collection period, you need to know the company’s accounts receivable balance and its net credit sales. The accounts receivable balance represents the amount of money owed to the company by its customers, while net credit sales are the total sales made on credit minus any returns or allowances.

Once you have these two figures, you can plug them into the formula to calculate the average collection period. Divide the accounts receivable balance by the net credit sales divided by 365 (the number of days in a year) to get the average number of days it takes for the company to collect payment.

Interpreting the Average Collection Period

The average collection period is typically expressed in terms of days. A lower average collection period indicates that a company is able to collect payment from its customers more quickly, which is generally seen as a positive sign. It suggests that the company has effective credit and collection policies in place and is able to convert its accounts receivable into cash in a timely manner.

On the other hand, a higher average collection period may indicate that a company is having difficulty collecting payment from its customers. This could be a sign of poor credit and collection practices, or it could indicate that the company’s customers are facing financial difficulties and are unable to pay their bills on time.

By calculating and monitoring the average collection period, companies can gain insights into their cash flow and the effectiveness of their credit and collection processes. It can help identify potential issues and areas for improvement, allowing companies to take proactive measures to address them.

An Example of the Average Collection Period Formula

Suppose a company has an accounts receivable balance of $100,000 at the beginning of the year and $120,000 at the end of the year. During the year, the company made credit sales totaling $500,000. To calculate the average collection period, we need to divide the average accounts receivable by the average daily credit sales.

First, we calculate the average accounts receivable by adding the beginning and ending accounts receivable and dividing the sum by 2:

Average Accounts Receivable = ($100,000 + $120,000) / 2 = $110,000

Next, we need to determine the average daily credit sales. To do this, we divide the total credit sales by the number of days in the year:

Average Daily Credit Sales = $500,000 / 365 = $1,369.86

Finally, we can calculate the average collection period by dividing the average accounts receivable by the average daily credit sales:

Average Collection Period = $110,000 / $1,369.86 = 80.29 days

Therefore, the average collection period for this company is approximately 80.29 days. This means that, on average, it takes the company around 80 days to collect payment from its customers.

By calculating the average collection period, businesses can assess their efficiency in collecting payments and identify any potential issues with their accounts receivable management. This information can help them make informed decisions to improve cash flow and optimize their credit policies.

Importance of the Average Collection Period in Accounting

The average collection period is a crucial metric in accounting that helps businesses evaluate their efficiency in collecting accounts receivable. It provides valuable insights into the company’s cash flow management and overall financial health. By analyzing the average collection period, businesses can identify potential issues and take appropriate actions to improve their collection processes.

1. Cash Flow Management

The average collection period helps businesses assess their cash flow management by determining the time it takes to convert accounts receivable into cash. A shorter average collection period indicates that the company is collecting payments from customers more quickly, resulting in a healthier cash flow. On the other hand, a longer average collection period suggests that the company may be experiencing delays in receiving payments, which can negatively impact cash flow and hinder the company’s ability to meet its financial obligations.

2. Credit Policies and Terms

By analyzing the average collection period, businesses can evaluate the effectiveness of their credit policies and terms. A longer average collection period may indicate that the company’s credit terms are too lenient, resulting in delayed payments from customers. In contrast, a shorter average collection period suggests that the company’s credit policies are effective in encouraging prompt payment. This information can help businesses adjust their credit policies and terms to optimize their cash flow and minimize the risk of bad debts.

3. Customer Relationships

The average collection period can also provide insights into the company’s customer relationships. A longer average collection period may indicate that the company has customers who consistently delay payment, which could be a sign of dissatisfaction or financial difficulties. By identifying these customers, businesses can proactively address any issues and work towards improving customer relationships. Additionally, a shorter average collection period may indicate strong customer relationships, as customers are more likely to prioritize timely payment to maintain a good business partnership.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.