Average Age of Inventory: Overview Calculations

The average age of inventory is a financial metric that measures the average number of days it takes for a company to sell its inventory. It is an important indicator of a company’s efficiency in managing its inventory and can provide valuable insights into its operations and financial health.

Why is the Average Age of Inventory Important?

The average age of inventory is important for several reasons:

- Efficiency: It reflects how quickly a company is able to turn its inventory into sales. A lower average age of inventory indicates that a company is able to sell its products more quickly, which can lead to higher profitability.

- Inventory Management: It helps companies identify potential issues with their inventory management processes. A high average age of inventory may indicate that a company is holding onto excess inventory or facing difficulties in selling its products.

- Working Capital: It is closely related to a company’s working capital management. A high average age of inventory means that a company has tied up a significant amount of capital in its inventory, which can impact its cash flow and overall financial stability.

Calculating the Average Age of Inventory

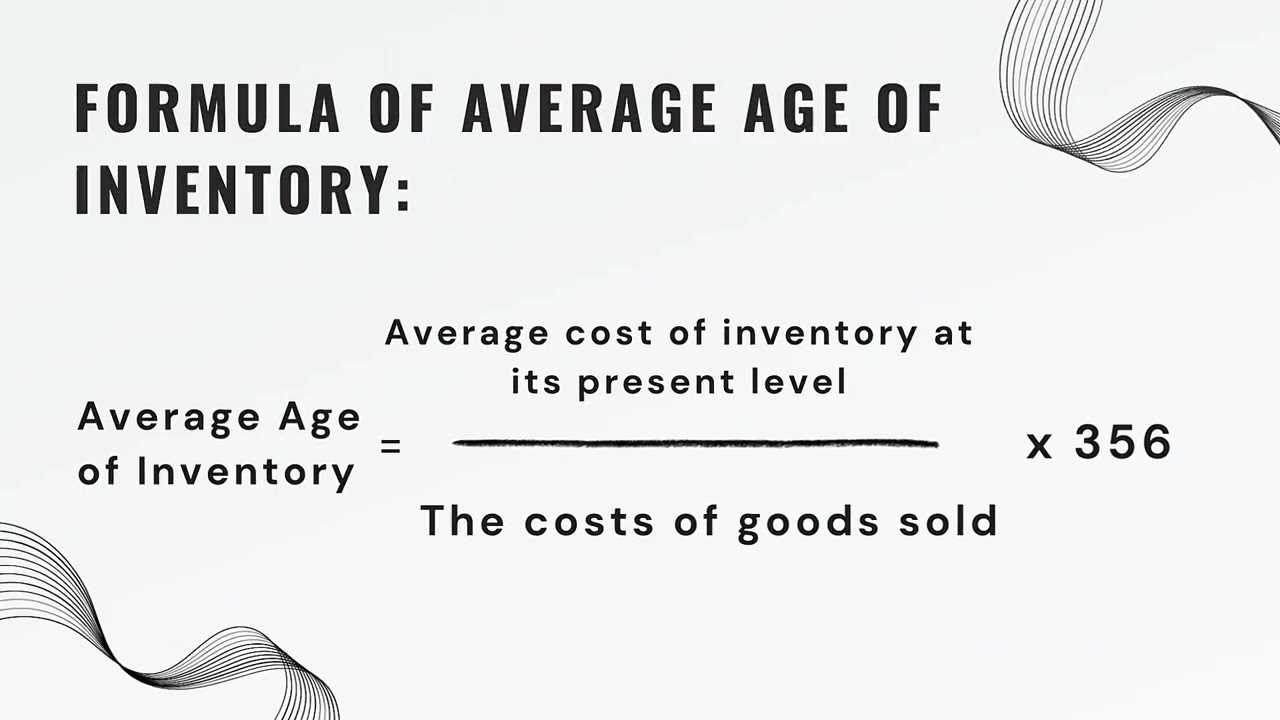

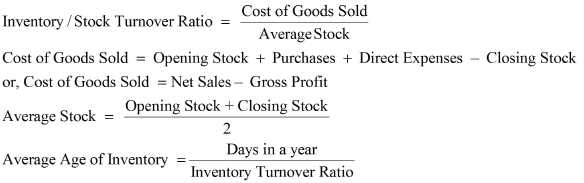

The average age of inventory is calculated by dividing the cost of goods sold (COGS) by the average inventory value and multiplying the result by the number of days in the period being analyzed. The formula is as follows:

Average Age of Inventory = (COGS / Average Inventory) * Number of Days

The cost of goods sold represents the direct costs associated with producing or purchasing the inventory. The average inventory value is calculated by taking the sum of the beginning and ending inventory values and dividing it by 2.

Interpreting the Average Age of Inventory

The interpretation of the average age of inventory depends on the industry and the company’s specific circumstances. In general, a lower average age of inventory is considered favorable, as it indicates that a company is able to sell its products quickly and efficiently.

However, it is important to consider industry norms and compare the average age of inventory to competitors or benchmarks. Some industries, such as fashion or technology, may have naturally higher average ages of inventory due to seasonality or product lifecycles.

Monitoring the average age of inventory over time can help companies identify trends and make informed decisions regarding their inventory management strategies. It can also be used as a benchmark to measure the effectiveness of process improvements or changes in sales and marketing strategies.

The average age of inventory is a financial metric that helps businesses assess the efficiency of their inventory management. It provides insights into how long it takes for a company to sell its inventory and generate revenue. By calculating the average age of inventory, businesses can identify potential issues in their supply chain, such as overstocking or slow-moving inventory.

Importance of the Average Age of Inventory

Calculating the Average Age of Inventory

The average age of inventory is calculated by dividing the total value of inventory by the cost of goods sold (COGS) and multiplying it by the number of days in the reporting period. The formula is as follows:

Average Age of Inventory = (Total Value of Inventory / COGS) x Number of Days

For example, if a company has a total inventory value of $100,000 and a COGS of $50,000 in a 365-day period, the average age of inventory would be:

Average Age of Inventory = ($100,000 / $50,000) x 365 = 730 days

This means that, on average, it takes the company 730 days to sell its entire inventory.

It is important to note that the average age of inventory should be monitored regularly to identify any changes or trends. A higher average age of inventory may indicate issues such as slow sales, excess inventory, or poor demand forecasting. On the other hand, a lower average age of inventory may suggest efficient inventory management and strong sales performance.

Interpreting the Average Age of Inventory

Interpreting the average age of inventory requires a comparison with industry benchmarks or historical data. This allows businesses to assess their performance relative to their competitors and identify areas for improvement. For example, if the average age of inventory for similar companies in the industry is lower, it may indicate that the business needs to improve its inventory turnover rate or implement better demand forecasting techniques.

Calculating the Average Age of Inventory

The average age of inventory is a key metric that helps businesses understand how long it takes for their inventory to sell. By calculating this metric, businesses can assess the efficiency of their inventory management and make informed decisions to optimize their operations.

To calculate the average age of inventory, you need to gather two pieces of information: the cost of goods sold (COGS) and the average inventory value. COGS represents the direct costs associated with producing or acquiring the goods sold during a specific period, while the average inventory value is the average value of inventory held during the same period.

Once you have these two values, you can use the following formula to calculate the average age of inventory:

Average Age of Inventory = (Average Inventory Value / COGS) x 365

First, divide the average inventory value by the COGS. This will give you the inventory turnover ratio, which represents how many times the inventory is sold and replaced during a specific period. Then, multiply this ratio by 365 to convert it into days.

For example, let’s say a business has an average inventory value of $100,000 and a COGS of $500,000. Using the formula, the average age of inventory would be:

Average Age of Inventory = ($100,000 / $500,000) x 365 = 73 days

This means that, on average, it takes 73 days for the inventory to sell and be replaced. A lower average age of inventory indicates a faster turnover and more efficient inventory management.

By calculating the average age of inventory regularly, businesses can track changes over time and identify trends. For example, if the average age of inventory increases, it may indicate issues such as slow sales, excess inventory, or inefficient purchasing practices. On the other hand, a decreasing average age of inventory may suggest improved sales performance or more effective inventory management strategies.

Interpreting the Average Age of Inventory

1. Efficiency of Inventory Management

The average age of inventory is a key indicator of how efficiently a company manages its inventory. A lower average age suggests that inventory turnover is high, meaning that products are sold quickly and the company is effectively managing its stock levels. On the other hand, a higher average age indicates slower inventory turnover and may suggest that the company is holding onto excess inventory or facing difficulties in selling its products.

2. Cash Flow and Working Capital

The average age of inventory also has a direct impact on a company’s cash flow and working capital. Holding onto inventory for a longer period ties up valuable capital that could be used for other business activities. By reducing the average age of inventory, companies can free up cash and improve their liquidity position, allowing them to invest in growth opportunities or meet other financial obligations.

3. Demand Forecasting and Inventory Planning

4. Seasonality and Obsolescence

The average age of inventory can also help businesses identify seasonal trends and potential obsolescence risks. By tracking this metric over time, companies can identify periods of high or low inventory turnover, allowing them to plan for seasonal fluctuations in demand. Additionally, a high average age of inventory may indicate that certain products are not selling well and are at risk of becoming obsolete. This information can help businesses make informed decisions about product assortment, pricing, and promotions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.