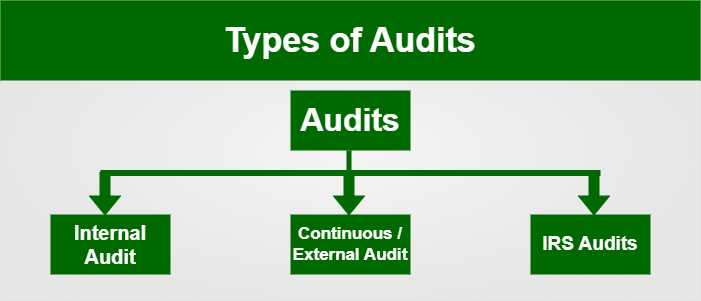

Audit in Finance and Accounting: Exploring the 3 Main Types

Audit plays a crucial role in the field of finance and accounting. It is a systematic examination and verification of financial records and statements to ensure accuracy, reliability, and compliance with laws and regulations. There are three main types of audits that are commonly conducted in finance and accounting: financial audit, operational audit, and compliance audit.

1. Financial Audit:

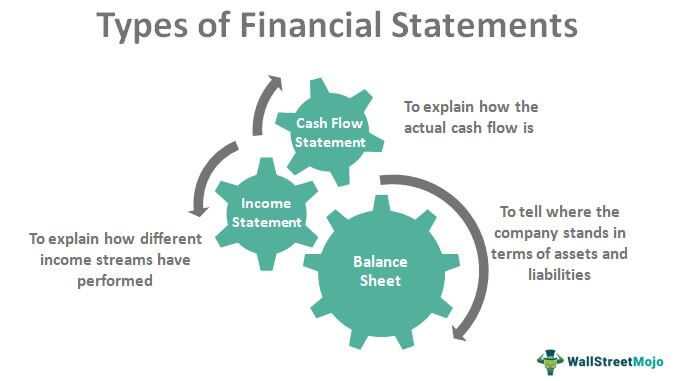

A financial audit is the most common type of audit in finance and accounting. It focuses on examining the financial statements of an organization to determine their fairness and accuracy. The main objective of a financial audit is to provide assurance to stakeholders, such as investors, creditors, and regulators, that the financial statements present a true and fair view of the organization’s financial position and performance.

During a financial audit, auditors review the organization’s accounting records, financial transactions, and internal controls. They assess the reliability of the financial information, identify any errors or irregularities, and provide recommendations for improvement. Financial audits are typically conducted by external auditors who are independent from the organization being audited.

2. Operational Audit:

An operational audit focuses on evaluating the efficiency and effectiveness of an organization’s operations, processes, and procedures. It aims to identify areas of improvement and enhance the overall performance of the organization. Operational audits are not limited to financial aspects but also cover non-financial areas such as production, marketing, and human resources.

During an operational audit, auditors assess the organization’s internal controls, risk management practices, and compliance with policies and procedures. They analyze the efficiency of processes, identify bottlenecks or inefficiencies, and recommend changes to streamline operations and reduce costs. Operational audits are usually conducted by internal auditors who are employees of the organization.

3. Compliance Audit:

A compliance audit focuses on ensuring that an organization complies with applicable laws, regulations, and industry standards. It aims to assess the organization’s adherence to legal and regulatory requirements and identify any non-compliance issues. Compliance audits are important for maintaining the organization’s reputation, avoiding legal penalties, and mitigating risks.

During a compliance audit, auditors review the organization’s policies, procedures, and practices to ensure they align with legal and regulatory requirements. They assess the organization’s compliance with laws related to financial reporting, taxation, data protection, and other relevant areas. Compliance audits can be conducted by both internal and external auditors, depending on the nature and scope of the audit.

External Audit: Importance and Process

An external audit is a crucial process in finance and accounting that plays a significant role in ensuring the accuracy and reliability of financial statements. It is conducted by an independent auditor who is not affiliated with the organization being audited.

The importance of external audits cannot be overstated. They provide assurance to stakeholders, such as investors, creditors, and regulators, that the financial statements present a true and fair view of the organization’s financial position and performance. This assurance helps build trust and confidence in the organization, which is essential for attracting investments and maintaining a strong reputation in the market.

During the audit, the auditor may also conduct interviews with key personnel and review supporting documentation to gather evidence and corroborate the financial information presented in the statements. They may also perform analytical procedures to identify any unusual trends or fluctuations that may indicate errors or fraud.

Once the audit procedures are complete, the auditor prepares a report that includes their findings and opinions. This report is shared with the organization’s management, board of directors, and other stakeholders. It provides an independent assessment of the organization’s financial statements, highlighting any material misstatements or weaknesses in internal controls that need to be addressed.

Internal Audit: Role and Benefits

An internal audit is a crucial function within an organization that plays a vital role in ensuring the effectiveness of internal controls, risk management, and governance processes. This article explores the role and benefits of internal audit in finance and accounting.

Role of Internal Audit

The primary role of internal audit is to provide independent and objective assurance to the organization’s management and board of directors. Internal auditors are responsible for evaluating and improving the effectiveness of the organization’s internal controls, risk management, and governance processes. They assess the reliability and integrity of financial and operational information, the efficiency and effectiveness of operations, and compliance with laws and regulations.

Internal auditors also play a crucial role in identifying and assessing risks within the organization. They help management understand and manage risks by providing recommendations for mitigating risks and improving controls. By conducting regular audits, internal auditors help to ensure that the organization’s assets are safeguarded, financial statements are accurate, and operations are conducted in compliance with applicable laws and regulations.

Benefits of Internal Audit

The internal audit function provides several benefits to the organization:

| Benefits | Description |

|---|---|

| Enhanced Internal Controls | Internal audit helps to identify weaknesses in internal controls and provides recommendations for improvement. This helps the organization to strengthen its control environment and reduce the risk of fraud and errors. |

| Risk Management | Internal auditors assess and monitor risks within the organization, helping management to identify and mitigate potential risks. This enables the organization to make informed decisions and effectively manage risks. |

| Compliance | Internal auditors ensure that the organization complies with applicable laws, regulations, and internal policies. This helps to avoid legal and regulatory penalties and maintain the organization’s reputation. |

| Operational Efficiency | By evaluating the efficiency and effectiveness of operations, internal auditors help to identify areas for improvement and cost-saving opportunities. This leads to increased operational efficiency and effectiveness. |

| Management Support | Internal auditors provide management with valuable insights and recommendations for improving processes and controls. This helps management to make informed decisions and achieve organizational objectives. |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.