American Depository Share Definition Examples

An American Depository Share (ADS) is a negotiable security that represents a specified number of shares in a non-U.S. company. It is a way for U.S. investors to invest in foreign companies without having to directly purchase shares on foreign exchanges.

ADSs are issued by U.S. depository banks, which hold the underlying shares of the foreign company on behalf of the investors. The depository bank then issues the ADSs, which can be traded on U.S. stock exchanges just like regular stocks.

ADSs are denominated in U.S. dollars and trade in U.S. markets, making them more accessible and convenient for U.S. investors. They also provide U.S. investors with the opportunity to diversify their portfolios by investing in foreign companies.

Here are some examples of American Depository Shares:

| Company | Ticker Symbol | Exchange |

|---|---|---|

| Alibaba Group Holding Ltd | BABA | New York Stock Exchange |

| Samsung Electronics Co Ltd | SSNLF | OTC Markets |

| Tencent Holdings Ltd | TCEHY | OTC Markets |

These examples demonstrate how U.S. investors can easily access and invest in well-known foreign companies through American Depository Shares.

What is an American Depository Share?

An American Depository Share (ADS) is a negotiable security that represents a specified number of shares in a foreign company. It is issued by a U.S. depository bank and can be traded on U.S. stock exchanges, making it easier for American investors to invest in foreign companies.

ADSs are created when a foreign company decides to list its shares on a U.S. stock exchange. The company will enter into an agreement with a U.S. depository bank, which will then issue ADSs to represent the foreign company’s shares. Each ADS typically represents a certain number of underlying shares, such as one ADS representing two underlying shares.

ADSs are denominated in U.S. dollars and can be bought and sold in the same way as regular stocks. They provide American investors with a convenient way to invest in foreign companies without having to deal with the complexities of trading on foreign exchanges or converting currencies.

Overall, ADSs provide American investors with access to a wider range of investment opportunities and allow them to diversify their portfolios by investing in foreign companies. They also provide foreign companies with access to U.S. capital markets and a larger pool of potential investors.

Examples of American Depository Shares

An American Depository Share (ADS) is a negotiable security that represents ownership in a company’s shares, which are held by a depositary bank outside of the company’s home country. ADSs are traded on U.S. stock exchanges, making it easier for U.S. investors to invest in foreign companies.

Here are some examples of American Depository Shares:

1. Alibaba Group Holding Limited (BABA)

- Alibaba Group Holding Limited is a Chinese multinational conglomerate specializing in e-commerce, retail, internet, and technology.

- Each ADS of Alibaba represents one ordinary share of the company.

- BABA ADSs are listed on the New York Stock Exchange (NYSE).

2. Sony Corporation (SNE)

- Sony Corporation is a Japanese multinational conglomerate corporation known for its consumer electronics, gaming, entertainment, and financial services.

- Each ADS of Sony represents one common share of the company.

- SNE ADSs are listed on the New York Stock Exchange (NYSE).

3. Nestle S.A. (NSRGF)

- Nestle S.A. is a Swiss multinational food and drink processing conglomerate corporation.

- Each ADS of Nestle represents one ordinary share of the company.

- NSRGF ADSs are traded over-the-counter (OTC) in the United States.

These are just a few examples of the many companies that have issued American Depository Shares. Investing in ADSs allows investors to gain exposure to international markets and diversify their portfolios.

ADR [INTERNATIONAL MARKETS catname]

An American Depository Receipt (ADR) is a negotiable certificate issued by a U.S. bank that represents a specified number of shares in a foreign company. It allows U.S. investors to indirectly invest in foreign companies without the need to directly purchase shares on international exchanges.

How ADRs Work

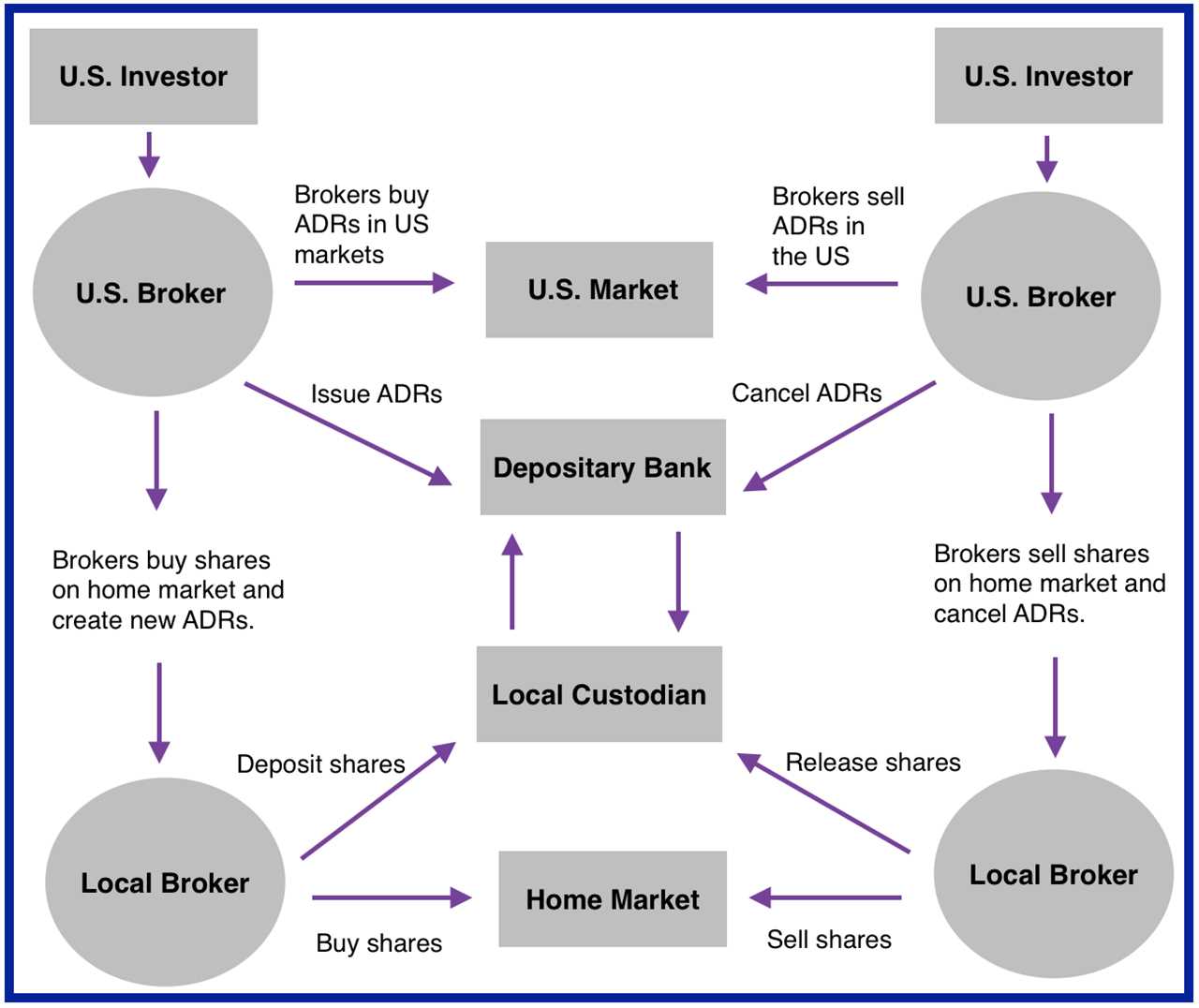

ADRs are created by U.S. banks through a process called depositary receipt programs. The bank purchases shares of the foreign company on the local stock exchange and then issues ADRs in the U.S. market. Each ADR represents a certain number of underlying shares, typically one or a fraction of a share.

ADRs are traded on U.S. stock exchanges just like regular stocks. U.S. investors can buy and sell ADRs through their brokerage accounts, making it convenient and easy to invest in foreign companies. The prices of ADRs are usually quoted in U.S. dollars and may differ from the prices of the underlying shares on the foreign exchange due to currency exchange rates and other factors.

Benefits of ADRs

Types of ADRs

There are two main types of ADRs: sponsored ADRs and unsponsored ADRs. Sponsored ADRs are created with the cooperation and involvement of the foreign company, while unsponsored ADRs are created without the company’s participation. Sponsored ADRs generally have more benefits and investor protections compared to unsponsored ADRs.

Conclusion

ADRs are a popular investment vehicle for U.S. investors looking to diversify their portfolios and gain exposure to international markets. They provide a convenient and accessible way to invest in foreign companies without the need for direct international trading. However, investors should carefully research and consider the specific ADRs they are interested in, as each ADR represents a specific foreign company and carries its own risks and potential rewards.

| ADR | American Depository Share |

|---|---|

| Represents a specified number of shares in a foreign company | Represents ownership of shares in a foreign company |

| Created by U.S. banks through depositary receipt programs | Created by a foreign company and issued on international exchanges |

| Traded on U.S. stock exchanges | Traded on international exchanges |

| Quoted in U.S. dollars | Quoted in the local currency of the foreign company |

| Provides access to international markets for U.S. investors | Provides access to U.S. markets for foreign investors |

What is an ADR?

An American Depository Receipt (ADR) is a negotiable certificate issued by a U.S. bank representing a specified number of shares in a foreign company. It is a way for U.S. investors to invest in foreign companies without having to buy the actual shares on a foreign stock exchange.

ADRs are denominated in U.S. dollars and trade on U.S. stock exchanges, making them easily accessible to U.S. investors. Each ADR represents a certain number of underlying shares in the foreign company, which are held by a U.S. bank on behalf of the ADR holders.

There are different types of ADRs, including sponsored ADRs and unsponsored ADRs. Sponsored ADRs are issued by a foreign company in cooperation with a U.S. bank, while unsponsored ADRs are issued without the involvement of the foreign company. Sponsored ADRs are more common and generally have more investor protections and reporting requirements.

ADRs are subject to the regulations of both the U.S. Securities and Exchange Commission (SEC) and the foreign country where the underlying shares are traded. This provides investors with a certain level of transparency and oversight.

In summary, ADRs are a popular investment vehicle for U.S. investors looking to diversify their portfolios with foreign companies. They provide easy access to foreign markets, liquidity, and convenience, while still being subject to regulatory oversight.

| Advantages of ADRs | Disadvantages of ADRs |

|---|---|

|

|

Comparison of ADRs and American Depository Shares

ADRs (American Depository Receipts) and American Depository Shares (ADS) are both financial instruments that allow investors to gain exposure to foreign companies without having to directly invest in their local stock markets. While they are similar in many ways, there are some key differences between the two.

1. Definition:

- ADRs: ADRs are certificates issued by a U.S. bank that represent a specified number of shares in a foreign company. They are traded on U.S. stock exchanges and are denominated in U.S. dollars.

- American Depository Shares: ADS is a specific type of ADR that represents a specific number of shares in a foreign company. ADSs are also traded on U.S. stock exchanges and are denominated in U.S. dollars.

2. Trading:

- American Depository Shares: ADSs are also traded on U.S. stock exchanges, just like ADRs. They follow the same trading hours and can be bought and sold like regular stocks.

3. Underlying Shares:

- ADRs: ADRs represent a specific number of shares in a foreign company. The ratio of ADRs to the underlying shares is determined by the company and is usually mentioned in the ADR prospectus.

- American Depository Shares: ADSs also represent a specific number of shares in a foreign company. The ratio of ADSs to the underlying shares is determined by the company and is usually mentioned in the ADS prospectus.

4. Dividends and Voting Rights:

- ADRs: ADR holders are entitled to receive dividends and have voting rights in the foreign company. However, the voting rights may be limited compared to the rights of shareholders who hold the underlying shares directly.

- American Depository Shares: ADS holders are also entitled to receive dividends and have voting rights in the foreign company. However, the voting rights may be limited compared to the rights of shareholders who hold the underlying shares directly.

5. Currency Conversion:

- ADRs: ADRs are denominated in U.S. dollars, so any dividends or capital gains are paid in U.S. dollars. Currency conversion may be required when buying or selling ADRs.

- American Depository Shares: ADSs are also denominated in U.S. dollars, so any dividends or capital gains are paid in U.S. dollars. Currency conversion may be required when buying or selling ADSs.

6. Regulatory Requirements:

- ADRs: ADRs are subject to the regulations of the U.S. Securities and Exchange Commission (SEC) and the Depository Trust Company (DTC).

- American Depository Shares: ADSs are also subject to the regulations of the U.S. Securities and Exchange Commission (SEC) and the Depository Trust Company (DTC).

Overall, ADRs and American Depository Shares (ADS) are similar in many ways, but they have some differences in terms of their definition, trading, underlying shares, dividends and voting rights, currency conversion, and regulatory requirements. Investors should carefully consider these factors before deciding to invest in either ADRs or ADSs.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.