Depository Trust Company (DTC) in Banking: All You Need to Know

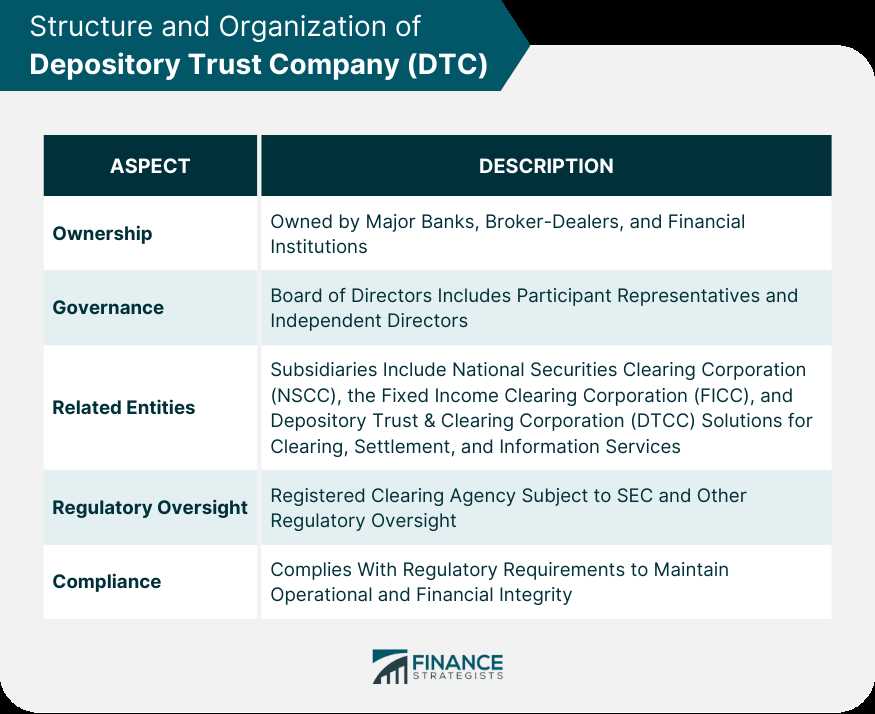

The DTC is a subsidiary of the Depository Trust & Clearing Corporation (DTCC), which is a leading post-trade financial services company. It was established in 1973 to improve the efficiency and reliability of the securities industry’s clearance, settlement, and asset servicing processes.

One of the primary functions of the DTC is to act as a central securities depository (CSD). It holds and safeguards securities in electronic form, eliminating the need for physical certificates. This electronic book-entry system allows for easy transfer and ownership changes of securities, reducing paperwork and operational risks.

As a central securities depository, the DTC offers numerous benefits and services to market participants. It enhances the efficiency of the settlement process by enabling same-day settlement and reducing the risk of failed trades. The DTC’s automated processes also improve accuracy and reduce the potential for human error.

Furthermore, the DTC provides asset servicing functions, such as corporate actions processing, dividend payments, and proxy voting services. It ensures that investors receive their entitlements and benefits associated with their securities holdings in a timely and accurate manner.

Market participants, including broker-dealers, banks, and institutional investors, rely on the DTC for safekeeping and transferring securities. The DTC’s services help to streamline the securities industry’s operations, reduce costs, and enhance overall market efficiency.

Overview of Depository Trust Company (DTC)

The Depository Trust Company (DTC) is a leading securities depository and clearinghouse in the United States. It was established in 1973 as a subsidiary of the Depository Trust & Clearing Corporation (DTCC) to provide efficient and secure clearing, settlement, and custody services for the financial markets.

DTC operates as a central securities depository, holding and safeguarding securities on behalf of its participants. It serves as a trusted intermediary between buyers and sellers, facilitating the transfer of securities ownership through electronic book-entry transfers. This eliminates the need for physical certificates and streamlines the settlement process.

As a regulated entity, DTC is subject to oversight by the Securities and Exchange Commission (SEC) and other regulatory authorities. It adheres to strict operational and risk management standards to ensure the safety and integrity of the securities held in its custody.

DTC’s participants include broker-dealers, banks, custodians, and other financial institutions. These participants can access DTC’s services through direct membership or through indirect membership via a clearing firm. By consolidating securities holdings in a single location, DTC enables efficient processing of transactions and reduces operational risks.

In addition to its core clearing and settlement services, DTC offers a range of value-added services to its participants. These include corporate actions processing, dividend and interest payments, proxy voting, and collateral management. DTC also provides connectivity options for participants to access its services electronically.

The use of DTC’s services has become widespread in the US financial markets, with the majority of securities transactions being settled through DTC. Its efficient and reliable infrastructure has contributed to the growth and stability of the US capital markets.

In summary, the Depository Trust Company plays a crucial role in the US financial system by providing secure and efficient clearing, settlement, and custody services. Its central depository model and value-added services have made it an integral part of the US capital markets infrastructure.

Role of Depository Trust Company (DTC) in the US Markets

The Depository Trust Company (DTC) plays a crucial role in the US markets as a central securities depository. It provides efficient and secure clearing, settlement, and asset servicing for a wide range of financial instruments, including equities, corporate and municipal bonds, money market instruments, and mortgage-backed securities.

One of the primary functions of the DTC is to facilitate the electronic transfer of securities. It operates a book-entry system, which eliminates the need for physical certificates and allows for the seamless transfer of ownership. This electronic system not only reduces costs and paperwork but also enhances the speed and efficiency of transactions.

The DTC acts as a central counterparty for all transactions settled through its system. It ensures the timely and accurate settlement of trades by netting obligations and providing risk management services. By acting as a trusted intermediary, the DTC minimizes counterparty risk and enhances market stability.

In addition to clearing and settlement services, the DTC also provides various asset servicing functions. It offers dividend and interest payment processing, corporate actions processing, and proxy voting services. These services help to streamline administrative tasks and ensure that investors receive their entitlements in a timely manner.

Furthermore, the DTC plays a vital role in promoting market efficiency and transparency. It provides a centralized repository of information on securities holdings and transactions, which facilitates regulatory oversight and market surveillance. This information is also used by market participants for risk management, compliance, and reporting purposes.

In summary, the Depository Trust Company (DTC) plays a critical role in the US markets by providing efficient clearing, settlement, and asset servicing for a wide range of financial instruments. Its electronic book-entry system, central counterparty services, and asset servicing functions contribute to market efficiency, transparency, and stability.

Benefits and Services Provided by Depository Trust Company (DTC)

The Depository Trust Company (DTC) offers a range of benefits and services that are crucial to the functioning of the US markets. These services provide efficiency, security, and transparency to market participants, ensuring smooth operations and reducing risk.

1. Depository Services

DTC acts as a central depository for a wide range of securities, including equities, corporate and municipal bonds, government securities, and money market instruments. By holding these securities in electronic form, DTC eliminates the need for physical certificates, reducing the risk of loss, theft, and forgery.

2. Settlement Services

DTC facilitates the settlement of securities transactions by acting as a central counterparty. It ensures the timely and accurate transfer of securities and funds between buyers and sellers, reducing settlement risk and streamlining the process.

3. Asset Servicing

DTC provides various asset servicing functions, including corporate actions processing, dividend and interest payments, and proxy voting. These services help investors and issuers manage their securities holdings and ensure accurate and efficient processing of related transactions.

4. Global Custody Services

DTC offers global custody services, allowing market participants to hold and settle international securities efficiently. This service eliminates the need for multiple custodians and simplifies the management of cross-border transactions.

5. Risk Management

DTC plays a crucial role in managing risk in the US markets. It operates a robust risk management framework that includes collateral management, margining, and default management services. These services help mitigate counterparty and systemic risks, ensuring the stability and integrity of the financial system.

6. Regulatory Compliance

DTC assists market participants in meeting regulatory requirements by providing comprehensive reporting and compliance services. It ensures compliance with various regulations, including anti-money laundering (AML) and know-your-customer (KYC) rules, enhancing the integrity and transparency of the markets.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.