Accrued Revenue: Definition, Examples, and How To Record It

Accrued revenue is a term used in accounting to describe revenue that has been earned but not yet received. It represents revenue that has been recognized by a company for goods or services that have been provided to a customer, but payment has not yet been received. This can occur when a company provides goods or services on credit or when there is a time lag between the delivery of goods or services and the receipt of payment.

Definition of Accrued Revenue

Accrued revenue is recorded as a current asset on a company’s balance sheet. It is recognized when a company has performed a service or delivered goods to a customer and has an unconditional right to receive payment. Even though the payment has not been received, the company recognizes the revenue because it has fulfilled its obligations and is entitled to the payment.

Accrued revenue is different from unearned revenue, which is revenue received in advance for goods or services that have not yet been provided. Unearned revenue is recorded as a liability on the balance sheet until the goods or services are delivered and the revenue can be recognized.

Examples of Accrued Revenue

There are several examples of accrued revenue. One common example is when a company provides services to a client on credit. For example, a law firm may provide legal services to a client and bill them at the end of the month. The revenue from these services is accrued because the law firm has performed the services and is entitled to payment, even though the client has not yet paid.

Another example is when a company sells goods to a customer on credit. For instance, a manufacturing company may ship goods to a customer and invoice them with payment terms of 30 days. The revenue from the sale is accrued because the company has delivered the goods and has an unconditional right to receive payment, even though the customer has not yet paid.

How to Record Accrued Revenue

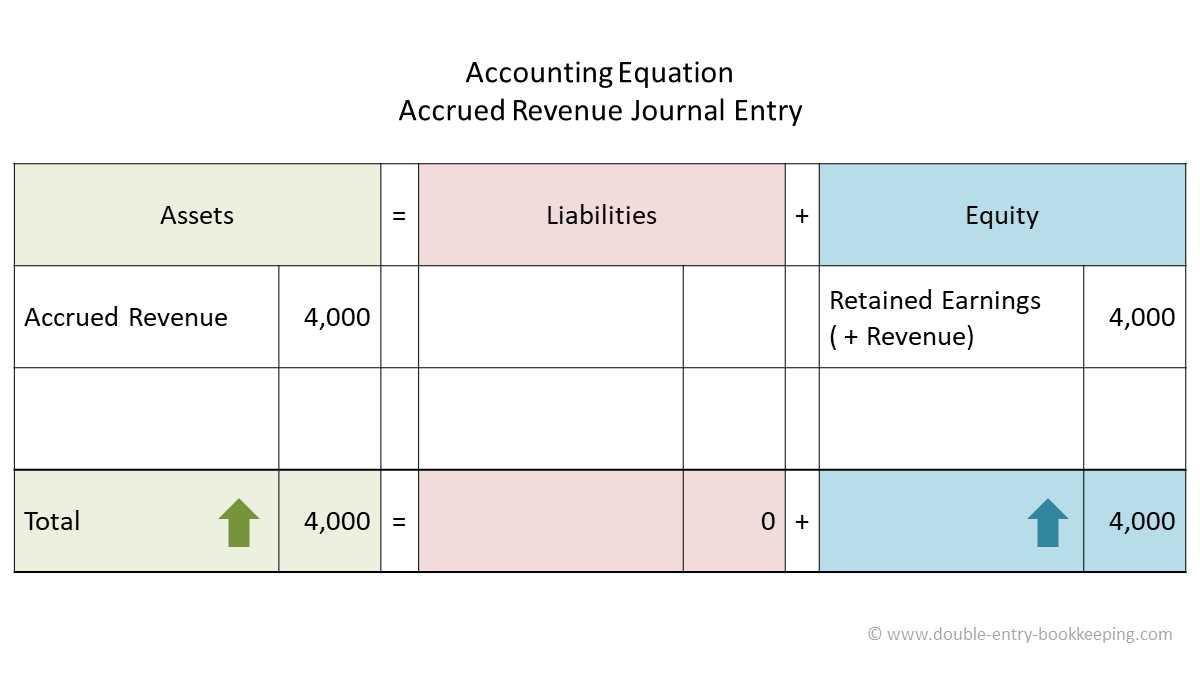

To record accrued revenue, a company must make an adjusting entry in its accounting records. The company debits an accrued revenue account and credits a revenue account. This recognizes the revenue and increases the company’s assets and equity.

For example, if a company has provided services worth $1,000 to a client on credit, it would debit the accrued revenue account for $1,000 and credit the revenue account for $1,000. This entry recognizes the revenue and increases the company’s assets by $1,000.

Benefits of Accrued Revenue

Accrued revenue is beneficial for both companies and customers. For companies, it allows them to recognize revenue when it is earned, even if payment has not yet been received. This provides a more accurate picture of a company’s financial performance and allows for better financial planning.

For customers, accrued revenue ensures that they are billed accurately for goods or services received. It also allows them to delay payment until a later date, providing them with more flexibility in managing their cash flow.

What is Accrued Revenue?

Accrued revenue refers to the income that a company has earned but has not yet received payment for. It is a type of revenue that is recognized in the accounting records before the actual cash is received. This can occur when a company provides goods or services to a customer on credit or when there is a time lag between the delivery of goods or services and the receipt of payment.

Accrued revenue is recorded as a current asset on the balance sheet because it represents the company’s right to receive payment in the future. It is also considered a liability for the customer who owes the payment. The recognition of accrued revenue is important for accurate financial reporting and to reflect the true financial position of a company.

Accrued revenue can be seen in various industries. For example, a software company may provide a subscription service to its customers on a monthly basis. Even if the customers have not yet paid for the current month’s subscription, the company can still recognize the revenue as accrued revenue because it has provided the service and is entitled to receive payment in the future.

Accrued revenue is typically recorded through adjusting journal entries at the end of an accounting period. This ensures that the revenue is properly recognized in the period in which it is earned, even if the actual cash has not been received. The journal entry will debit an accrued revenue account and credit a revenue account, reflecting the increase in assets and revenue.

Overall, accrued revenue is an important concept in accounting as it allows companies to accurately report their earnings and financial position. It helps to provide a more accurate picture of a company’s performance and can also impact financial ratios and analysis. By recognizing revenue when it is earned, rather than when it is received, companies can better track their financial performance and make informed business decisions.

Examples of Accrued Revenue

Accrued revenue is a concept in accounting that refers to revenue that has been earned but not yet received. It is recorded as a current asset on the balance sheet and recognized as revenue on the income statement. Here are some examples of accrued revenue:

1. Service Revenue

Let’s say a consulting firm provides services to a client in December but does not receive payment until January. The revenue earned in December is considered accrued revenue because it has been earned but not yet received. The consulting firm would record this as an accrued revenue on their balance sheet and recognize it as revenue on their income statement for the month of December.

2. Rent Revenue

Suppose a landlord rents out a commercial space to a tenant for the month of January. The tenant is required to pay the rent at the end of the month. However, since the rental period falls within January, the landlord would record the rent revenue as accrued revenue for that month. The revenue would be recognized on the income statement for January and recorded as a current asset on the balance sheet.

3. Interest Revenue

Financial institutions often earn interest on loans or investments. If a bank has provided a loan to a customer that accrues interest monthly, the interest earned but not yet received would be considered accrued revenue. The bank would record this as accrued revenue on their balance sheet and recognize it as revenue on their income statement for the corresponding period.

These are just a few examples of accrued revenue. In each case, the revenue has been earned but not yet received, and therefore needs to be recorded as a current asset on the balance sheet and recognized as revenue on the income statement. Accrued revenue is an important concept in accounting as it helps provide a more accurate representation of a company’s financial position and performance.

How to Record Accrued Revenue

Recording accrued revenue is an important step in the accounting process. It allows businesses to accurately reflect their financial performance and ensure that revenue is recognized in the appropriate accounting period. Here are the steps to record accrued revenue:

Step 1: Identify the Accrued Revenue

The first step is to identify the accrued revenue that needs to be recorded. This can include any revenue that has been earned but not yet received. Examples of accrued revenue include services rendered but not yet billed, interest income, or rent income.

Step 2: Determine the Amount of Accrued Revenue

Next, determine the amount of accrued revenue that needs to be recorded. This can be done by calculating the value of the goods or services provided, or by using contractual agreements or other documentation to determine the amount owed.

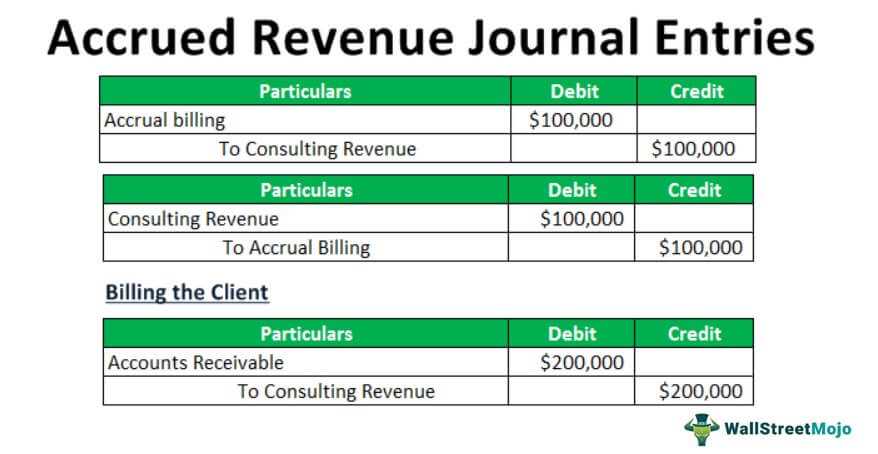

Step 3: Create an Accrued Revenue Journal Entry

Once the accrued revenue amount has been determined, create a journal entry to record the transaction. Debit the accounts receivable or accrued revenue account to increase the balance, and credit the revenue account to recognize the revenue.

Step 4: Post the Journal Entry

After creating the journal entry, post it to the general ledger. This will update the balances in the appropriate accounts and reflect the accrued revenue in the financial statements.

Step 5: Reconcile and Review

Finally, reconcile and review the accrued revenue accounts to ensure accuracy. This involves comparing the recorded amounts to supporting documentation and resolving any discrepancies.

| Account | Debit | Credit |

|---|---|---|

| Accounts Receivable/Accrued Revenue | XXXX | |

| Revenue | XXXX |

By following these steps, businesses can accurately record accrued revenue and ensure that their financial statements reflect the true financial position of the company. This is important for decision-making, financial analysis, and compliance with accounting standards.

Benefits of Accrued Revenue

1. Improved Financial Reporting Accuracy

Accrued revenue allows businesses to accurately report their financial performance by recognizing revenue when it is earned, rather than when it is received. This provides a more accurate picture of the company’s financial health and helps stakeholders make informed decisions.

2. Timely Revenue Recognition

Accrued revenue ensures that revenue is recognized in the period in which it is earned, even if payment has not been received. This helps businesses avoid delays in recognizing revenue and provides a more accurate representation of their financial performance.

3. Better Cash Flow Management

Accrued revenue helps businesses manage their cash flow more effectively. By recognizing revenue when it is earned, businesses can anticipate future inflows and plan their cash flow accordingly. This allows them to make informed decisions about investments, expenses, and debt management.

4. Enhanced Decision Making

Accrued revenue provides businesses with a more accurate and comprehensive view of their financial performance. This enables them to make better-informed decisions regarding pricing, product development, marketing strategies, and resource allocation. Accurate revenue recognition helps businesses identify profitable areas and make adjustments to improve overall profitability.

5. Compliance with Accounting Standards

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.