GUIDE TO MUTUAL FUNDS

Are you looking to secure your financial future? Do you want to build wealth on your terms? Look no further than the Voluntary Accumulation Plan.

With the Voluntary Accumulation Plan, you have the power to take control of your financial destiny. Whether you are a seasoned investor or just starting out, this guide to mutual funds will provide you with the knowledge and tools you need to succeed.

Why choose the Voluntary Accumulation Plan?

- Flexibility: The Voluntary Accumulation Plan allows you to invest at your own pace and on your own terms. You can start with as little as $100 and increase your investments as you see fit.

- Diversification: By investing in a wide range of mutual funds, you can spread your risk and increase your chances of earning a higher return on investment.

- Professional Management: With the Voluntary Accumulation Plan, you have access to experienced fund managers who will make investment decisions on your behalf, ensuring that your money is in good hands.

How does it work?

- Choose your funds: Select from a variety of mutual funds that suit your investment goals and risk tolerance.

- Set your contribution: Decide how much you want to invest and how often. You have the flexibility to change your contribution amount at any time.

Don’t wait any longer to start building wealth on your terms. Take control of your financial future with the Voluntary Accumulation Plan and our comprehensive guide to mutual funds.

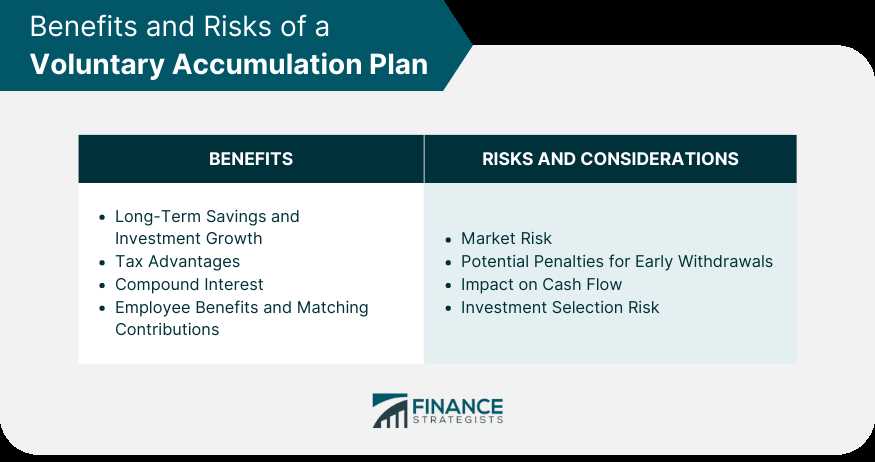

Disclaimer: Mutual fund investments are subject to market risks. Please read the scheme-related documents carefully before investing.

- Flexibility: With a VAP, you have the flexibility to choose how much and how often you want to invest. Whether you want to make monthly contributions or invest a lump sum, a VAP allows you to tailor your investment strategy to fit your financial goals and needs.

- Diversification: A VAP offers access to a wide range of mutual funds, allowing you to diversify your portfolio. By investing in different asset classes and sectors, you can spread your risk and potentially increase your returns.

- Tax Advantages: VAPs can provide tax advantages, such as tax-deferred growth and the ability to defer capital gains taxes. These benefits can help you keep more of your investment returns and potentially grow your wealth faster.

- Convenience: With a VAP, you can easily manage your investments online. You can track your portfolio, make changes, and access your account information anytime, anywhere, making it a convenient option for busy individuals.

- Long-Term Growth: One of the main benefits of a VAP is the potential for long-term growth. By consistently investing over time, you can take advantage of compounding returns and potentially achieve your financial goals faster.

Overall, a VAP offers a range of benefits that can help you build wealth on your terms. Whether you are a seasoned investor or just starting out, a VAP can provide the flexibility, diversification, professional management, tax advantages, convenience, and long-term growth potential that you need to achieve your financial goals.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.