What is Salvage Value?

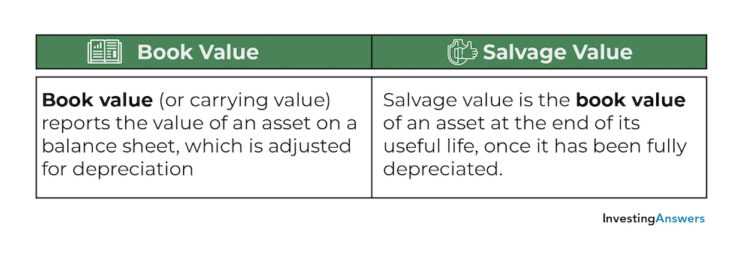

When an asset is purchased, it is expected to generate revenue or provide some other benefit to the business over a certain period of time. However, over time, the asset’s value decreases due to wear and tear, obsolescence, or other factors. The salvage value represents the residual value of the asset after taking into account these factors.

Calculating Salvage Value

The salvage value of an asset can be calculated in different ways, depending on the method used to depreciate the asset. One common method is the straight-line depreciation method, which evenly spreads the cost of the asset over its useful life. To calculate the salvage value using this method, you would subtract the total depreciation expense from the original cost of the asset.

Importance of Salvage Value

The salvage value is an important factor to consider when determining the overall value of an asset. It affects the calculation of depreciation expense, which in turn affects the profitability and financial statements of a business. A higher salvage value can result in lower depreciation expense and higher net income, while a lower salvage value can have the opposite effect.

In addition, the salvage value is also important for financial decision-making. It can help businesses determine whether it is more cost-effective to repair or replace an asset at the end of its useful life. If the salvage value is high, it may be more beneficial to sell the asset and purchase a new one, rather than investing in costly repairs.

Conclusion

Salvage value is the estimated worth of an asset at the end of its useful life. It is an important concept in accounting and finance, as it affects the calculation of depreciation expense and the overall value of an asset. By considering the salvage value, businesses can make informed decisions about the repair or replacement of assets, ultimately impacting their profitability and financial statements.

Examples of Salvage Value

Salvage value is an important concept in asset valuation and depreciation. It represents the estimated residual value of an asset at the end of its useful life. Here are a few examples to help illustrate the concept of salvage value:

Example 1: Vehicles

Let’s say a company purchases a delivery truck for $50,000. The estimated useful life of the truck is 10 years, and the salvage value is estimated to be $5,000. After 10 years of use, the company decides to sell the truck. At this point, the truck’s book value is $5,000, which is equal to its salvage value. The company sells the truck for $5,000, which means it has recovered the salvage value.

Example 2: Machinery

A manufacturing company purchases a piece of machinery for $100,000. The estimated useful life of the machinery is 15 years, and the salvage value is estimated to be $10,000. After 15 years, the company decides to replace the machinery with a newer model. The book value of the machinery at this point is $10,000, which is equal to its salvage value. The company sells the old machinery for $10,000, recovering the salvage value.

Example 3: Buildings

A real estate company constructs a commercial building at a cost of $1 million. The estimated useful life of the building is 50 years, and the salvage value is estimated to be $200,000. After 50 years, the building is no longer suitable for use and needs to be demolished. The book value of the building at this point is $200,000, which is equal to its salvage value. The company sells the land and recovers the salvage value.

These examples demonstrate how salvage value is used to determine the value of an asset at the end of its useful life. It is an important consideration for businesses when calculating depreciation expenses and determining the overall value of their assets.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.