Noninterest Expense Meaning Overview FAQ

What is Noninterest Expense?

Noninterest expense refers to the costs incurred by a business that are not directly related to generating interest income. These expenses include salaries and wages, rent, utilities, marketing expenses, and other general administrative costs. Noninterest expense is an important metric for businesses as it helps to determine the overall efficiency and profitability of the organization.

Why is Noninterest Expense Important?

Noninterest expense is an important measure for businesses as it provides insights into the cost structure and efficiency of the organization. By analyzing noninterest expenses, businesses can identify areas where costs can be reduced or optimized, leading to improved profitability. Additionally, noninterest expense is often used as a benchmark for comparing the performance of different businesses within the same industry.

How is Noninterest Expense Calculated?

Noninterest expense is calculated by adding up all the expenses that are not directly related to generating interest income. This includes expenses such as salaries and wages, rent, utilities, marketing expenses, and other general administrative costs. The total noninterest expense is typically reported on a company’s income statement.

What are Examples of Noninterest Expense?

Examples of noninterest expenses include salaries and wages, rent, utilities, marketing expenses, office supplies, insurance, legal fees, and other general administrative costs. These expenses are necessary for the day-to-day operations of a business but do not directly contribute to generating interest income.

How Can Businesses Reduce Noninterest Expense?

Businesses can reduce noninterest expenses by implementing cost-saving measures such as negotiating lower rent or utility rates, optimizing staffing levels, implementing energy-saving initiatives, and streamlining administrative processes. Additionally, businesses can also explore outsourcing certain functions or implementing technology solutions to automate manual tasks and reduce labor costs.

Conclusion

Noninterest expense is an important metric for businesses as it provides insights into the cost structure and efficiency of the organization. By analyzing noninterest expenses and implementing cost-saving measures, businesses can improve profitability and overall financial performance.

What is Noninterest Expense?

Types of Noninterest Expenses

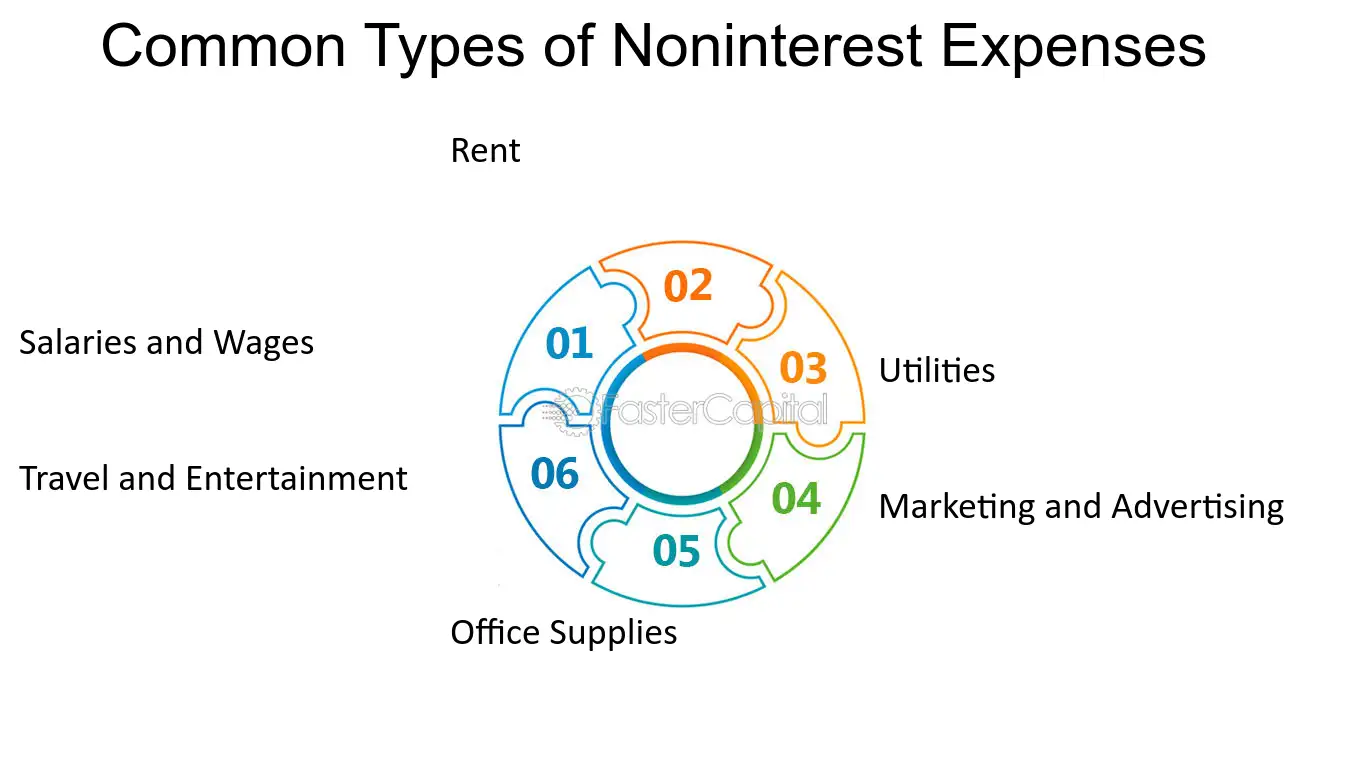

There are several types of noninterest expenses that a company may incur:

- Salaries and Wages: This includes the compensation paid to employees for their work.

- Rent and Utilities: This includes the cost of renting office space and the expenses related to utilities such as electricity, water, and internet.

- Depreciation and Amortization: This includes the reduction in value of assets over time and the allocation of the cost of intangible assets over their useful life.

- Marketing and Advertising: This includes the expenses incurred for promoting the company’s products or services.

- Professional Fees: This includes the fees paid to external consultants, lawyers, accountants, and other professionals.

- Insurance: This includes the cost of insurance coverage for the company’s assets, liabilities, and employees.

- Office Supplies: This includes the cost of purchasing and maintaining office supplies such as stationery, computers, and furniture.

- Travel and Entertainment: This includes the expenses related to business travel, meals, and entertainment.

- Repairs and Maintenance: This includes the cost of repairing and maintaining the company’s assets and equipment.

Importance of Noninterest Expense

Noninterest expenses play a crucial role in determining a company’s profitability and financial health. By managing and controlling these expenses, a company can improve its bottom line and increase its overall efficiency. It is important for companies to analyze their noninterest expenses and identify areas where cost-saving measures can be implemented without compromising the quality of their products or services.

Furthermore, noninterest expenses are often used as a benchmark to compare the performance of different companies within the same industry. Investors and analysts use this information to evaluate a company’s operational efficiency and its ability to generate profits.

An Overview of Noninterest Expense

Noninterest expense refers to the costs incurred by a business that are not directly related to generating interest income. These expenses can include salaries and benefits for employees, rent and utilities for office space, marketing and advertising costs, legal and professional fees, and other general operating expenses.

Noninterest expense is an important metric for businesses as it helps to determine the overall efficiency and profitability of the organization. By analyzing and managing noninterest expenses, businesses can identify areas where costs can be reduced or eliminated, leading to improved financial performance.

Types of Noninterest Expenses

There are several categories of noninterest expenses that businesses may incur:

- Employee Expenses: This includes salaries, wages, bonuses, and benefits for employees. It also includes expenses related to training and development programs.

- Occupancy Expenses: These expenses include rent, utilities, property taxes, and maintenance costs for office space, warehouses, or other facilities.

- Marketing and Advertising Expenses: This category includes expenses related to advertising campaigns, promotional activities, market research, and public relations.

- Professional Fees: Businesses may incur expenses for legal services, accounting services, consulting fees, and other professional services.

- Technology Expenses: This includes expenses for software, hardware, IT infrastructure, and other technology-related costs.

- General and Administrative Expenses: These expenses include office supplies, insurance premiums, travel expenses, and other miscellaneous costs.

Managing Noninterest Expenses

Managing noninterest expenses is crucial for businesses to maintain profitability and financial stability. Here are some strategies that businesses can employ:

- Expense Analysis: Regularly review and analyze noninterest expenses to identify areas where costs can be reduced or eliminated.

- Budgeting: Develop and adhere to a budget that includes specific targets for noninterest expenses.

- Negotiating Contracts: Negotiate favorable terms with suppliers, vendors, and service providers to reduce costs.

- Process Improvement: Streamline operational processes to eliminate inefficiencies and reduce costs.

- Employee Training: Provide training and development programs to enhance employee skills and productivity.

- Technology Adoption: Implement technology solutions that can automate tasks and reduce manual labor costs.

By effectively managing noninterest expenses, businesses can optimize their operations, improve profitability, and achieve long-term success.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.