What is a Notice to Creditors?

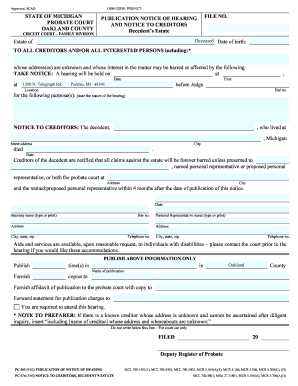

A Notice to Creditors is a legal document that is published to inform potential creditors of a deceased person’s estate that they have a limited amount of time to make a claim for any outstanding debts owed to them by the deceased. This notice is typically published in a local newspaper or other designated publication.

Purpose and Importance

The purpose of a Notice to Creditors is to provide a fair and transparent process for resolving any outstanding debts of a deceased person’s estate. By publishing this notice, it ensures that all potential creditors have an opportunity to come forward and make a claim for any money owed to them.

Additionally, a Notice to Creditors is important because it helps protect the executor or personal representative of the estate from future claims. By publishing the notice, it establishes a deadline for creditors to make a claim, after which the executor can distribute the remaining assets of the estate to the beneficiaries without the risk of future claims.

How to Publish a Notice to Creditors

Publishing a Notice to Creditors involves several steps to ensure compliance with the legal requirements. Here is a step-by-step guide:

- Determine the publication requirements: Research the specific laws and regulations in your jurisdiction to determine the publication requirements for a Notice to Creditors. This may include the specific newspaper or publication where the notice must be published.

- Submit the notice for publication: Contact the designated newspaper or publication and submit the notice for publication. Follow their specific guidelines and provide any required payment or documentation.

- Monitor the publication: Keep track of the publication dates and ensure that the notice is published for the required length of time as specified by the laws in your jurisdiction.

- File proof of publication: After the notice has been published, obtain a proof of publication from the newspaper or publication. This proof should include the publication dates and any other required information.

Following these steps will help ensure that the Notice to Creditors is properly published and that the executor or personal representative of the estate complies with the legal requirements.

A Notice to Creditors is a legal document that is used in the process of probate to notify potential creditors of a deceased person’s estate. It serves as a public notice that allows creditors to come forward and make claims against the estate for any outstanding debts. This notice is typically published in a local newspaper or other designated publication.

The purpose of a Notice to Creditors is to protect the rights of creditors and ensure that they have an opportunity to make a claim against the estate. It also helps to prevent fraudulent claims by providing a deadline for creditors to come forward. By publishing this notice, the personal representative of the estate is fulfilling their legal obligation to notify creditors of the deceased person’s passing.

Importance of a Notice to Creditors

There are several reasons why a Notice to Creditors is important in the probate process:

- Legal Requirement: In many jurisdictions, publishing a Notice to Creditors is a legal requirement. Failure to comply with this requirement can result in legal consequences for the personal representative.

- Protection of Creditors: By publishing a Notice to Creditors, potential creditors are given a fair chance to make a claim against the estate. This protects their rights and ensures that they are not left unpaid.

- Prevention of Fraudulent Claims: The publication of a Notice to Creditors sets a deadline for creditors to come forward. This helps to prevent fraudulent claims from being made after the estate has been distributed.

- Final Distribution of Assets: Once the deadline for creditors to make a claim has passed, the personal representative can proceed with the final distribution of assets to the beneficiaries. This provides closure to the probate process.

How to Publish a Notice to Creditors

Once you have determined that a Notice to Creditors is necessary for your trust or estate planning, it is important to understand the proper steps to publish it. Publishing a Notice to Creditors involves notifying potential creditors of the deceased person’s estate, giving them an opportunity to file a claim against the estate.

The first step in publishing a Notice to Creditors is to determine the appropriate newspaper or publication where the notice should be published. This will typically be a newspaper in the county where the deceased person resided or where the probate proceedings are taking place.

After the Notice to Creditors has been published, it is important to keep documentation of the publication. This may include obtaining a copy of the published notice or a receipt from the publication. This documentation can be important in the event that a creditor later disputes receiving proper notice.

Finally, it is important to monitor the deadline for creditors to file claims. This deadline is typically set by state law and will vary depending on the jurisdiction. If a creditor files a claim within the deadline, it will need to be evaluated and potentially paid from the assets of the estate.

Publishing a Notice to Creditors is an important step in the trust and estate planning process. It helps to protect the interests of both the deceased person’s estate and potential creditors. By following the proper steps and ensuring compliance, you can help ensure that the process goes smoothly and that the estate is properly administered.

Step-by-Step Guide to Ensure Compliance

When publishing a Notice to Creditors, it is important to follow the proper steps to ensure compliance with legal requirements. Here is a step-by-step guide to help you through the process:

1. Determine the Appropriate Publication

First, you need to determine where the Notice to Creditors should be published. This will depend on the laws of your jurisdiction. In some cases, it may need to be published in a local newspaper, while in others it may need to be published in a legal publication.

2. Prepare the Notice

3. Submit the Notice for Publication

Once the Notice to Creditors is prepared, you need to submit it for publication. This may involve contacting the local newspaper or legal publication and providing them with the necessary information. Be sure to inquire about any fees or requirements for publication.

4. Publish the Notice

After submitting the Notice to Creditors, it will be published according to the guidelines of the chosen publication. This may involve publishing it in a specific section or category of the publication. It is important to follow any instructions provided by the publication to ensure proper placement.

5. Keep Proof of Publication

Once the Notice to Creditors has been published, it is important to keep proof of publication. This may include obtaining copies of the published notice or a certificate of publication from the publication itself. This proof may be required for legal purposes or to provide evidence that the notice was properly published.

6. Monitor for Claims

After the Notice to Creditors has been published, it is important to monitor for any claims that may be submitted by creditors. These claims should be reviewed and evaluated according to the laws of your jurisdiction. It is important to respond to any valid claims in a timely manner.

By following this step-by-step guide, you can ensure compliance with legal requirements when publishing a Notice to Creditors. This will help protect the rights of creditors and ensure the proper administration of the estate.

Trust & Estate Planning

What is a Notice to Creditors?

A Notice to Creditors is a legal document that notifies potential creditors of a deceased person’s estate. It serves as an announcement to inform creditors that they have a limited time to make claims against the estate for any outstanding debts or obligations. The notice typically includes information about the deceased, the appointed executor or administrator, and the deadline for submitting claims.

The purpose of a Notice to Creditors is to provide an opportunity for creditors to come forward and make their claims against the estate. By publishing this notice, the executor or administrator ensures that all debts and obligations are properly addressed and resolved before distributing the assets to the beneficiaries. It helps prevent any future legal disputes or complications that may arise due to undisclosed debts.

Moreover, publishing a Notice to Creditors is a legal requirement in many jurisdictions. Failure to comply with this requirement may result in delays in the probate process and potential legal consequences for the executor or administrator.

How to Publish a Notice to Creditors: Step-by-Step Guide to Ensure Compliance

1. Consult an attorney: It is advisable to seek legal guidance from an experienced attorney who specializes in trust and estate planning. They can provide expert advice and ensure that all legal requirements are met.

2. Gather necessary information: Collect all relevant information about the deceased, including their full name, date of death, and the appointed executor or administrator.

4. Publish the notice: Publish the Notice to Creditors in local newspapers or other publications as required by law. Ensure that the notice is published for the specified duration and in the appropriate format.

5. Keep records: Maintain detailed records of the publication, including copies of the published notice and proof of compliance with the legal requirements. These records will serve as evidence of compliance in case of any future disputes or challenges.

6. Monitor claims: After publishing the Notice to Creditors, monitor any claims that are submitted within the specified deadline. Evaluate each claim carefully and address them according to the applicable laws and regulations.

By following these steps, you can ensure compliance with the legal requirements and protect the interests of the deceased and their beneficiaries.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.