What Is a Flow-Through Entity?

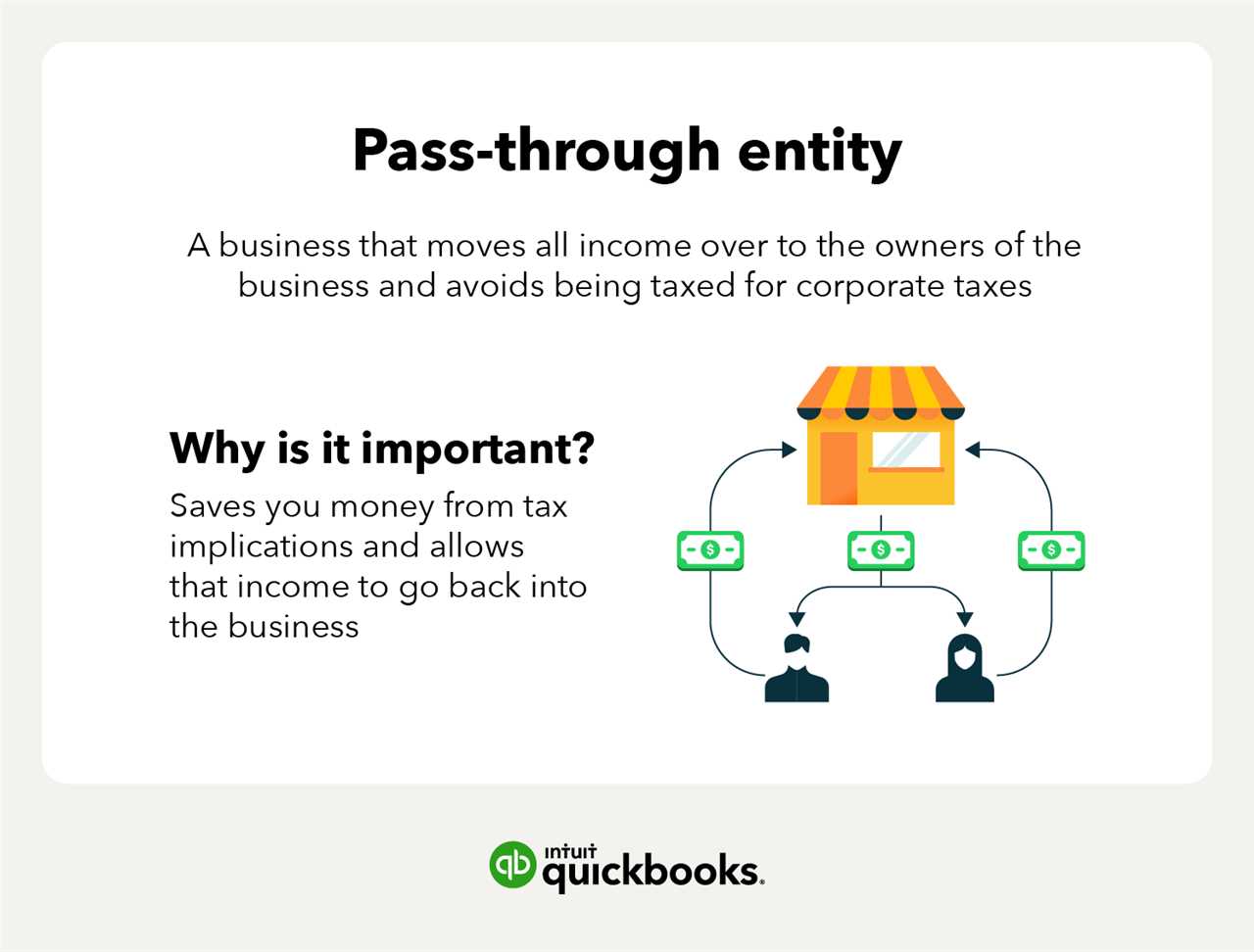

A flow-through entity is a type of business structure that passes its income and losses through to its owners or investors. This means that the entity itself does not pay taxes on its income, but rather the owners or investors report the income on their individual tax returns.

How Does a Flow-Through Entity Work?

Flow-through entities are commonly used by small businesses and startups because they offer certain advantages in terms of taxation and flexibility. These entities include partnerships, limited liability companies (LLCs), and S corporations.

When a business operates as a flow-through entity, the income and losses generated by the business are “passed through” to the owners or investors. This means that the business itself does not pay taxes on its income. Instead, the owners or investors report their share of the income or losses on their individual tax returns.

For example, if a partnership earns $100,000 in profit, the partners would each report their share of the profit on their individual tax returns. If there are two partners with a 50% ownership stake each, they would each report $50,000 of income.

Advantages of Flow-Through Entities

There are several advantages to operating as a flow-through entity:

- Tax Flexibility: Flow-through entities allow owners or investors to report their share of the income or losses on their individual tax returns, which can result in lower tax rates compared to corporate tax rates.

- Pass-Through of Losses: If a flow-through entity incurs losses, the owners or investors can use those losses to offset other income on their individual tax returns, potentially reducing their overall tax liability.

- Reduced Administrative Burden: Flow-through entities generally have fewer reporting and compliance requirements compared to corporations, making them easier to manage and operate.

- Flexibility in Ownership and Management: Flow-through entities allow for flexibility in terms of ownership and management structure, making them suitable for small businesses and startups.

Types of Flow-Through Entities

A flow-through entity is a type of business structure that does not pay income taxes at the entity level. Instead, the profits and losses of the business “flow through” to the owners or shareholders, who report them on their individual tax returns. There are several types of flow-through entities, each with its own characteristics and advantages.

1. Sole Proprietorship

A sole proprietorship is the simplest form of flow-through entity. It is a business owned and operated by one individual, with no legal distinction between the owner and the business. The owner reports the business income and expenses on Schedule C of their personal tax return.

Pros:

- Easy and inexpensive to set up

- Owner has complete control over the business

- Business losses can offset other sources of income

Cons:

- Owner is personally liable for business debts and liabilities

- May have limited access to financing options

- Business ends upon the death or retirement of the owner

2. Partnership

A partnership is a flow-through entity owned by two or more individuals or entities. The partners contribute capital, share profits and losses, and jointly manage the business. The partnership files an informational tax return, but does not pay income taxes at the entity level.

Pros:

- Shared responsibility and decision-making

- Partners can contribute different skills and resources

- Flexibility in allocating profits and losses

Cons:

- Partners are personally liable for business debts and liabilities

- Potential for disagreements and conflicts among partners

- Partnership ends upon the withdrawal or death of a partner

3. Limited Liability Company (LLC)

Pros:

- Limited liability protection for owners

- Flexible management structure

- Pass-through taxation

Cons:

- More complex and expensive to set up than a sole proprietorship or partnership

- May require additional paperwork and compliance with state regulations

- Ownership interests may be more difficult to transfer

4. S Corporation

An S Corporation is a flow-through entity that elects to be taxed under Subchapter S of the Internal Revenue Code. It combines the limited liability protection of a corporation with the tax advantages of a flow-through entity. The shareholders report the business income and expenses on their personal tax returns.

Pros:

- Limited liability protection for shareholders

- Avoidance of self-employment taxes on business profits

- Ability to pass losses through to shareholders

Cons:

- Restrictions on ownership and number of shareholders

- More complex and expensive to set up and maintain

- Strict compliance with IRS regulations

Choosing the right flow-through entity depends on various factors, including the nature of the business, the number of owners, and the desired level of liability protection. It is advisable to consult with a tax professional or attorney to determine the most suitable structure for your specific situation.

Pros and Cons of Flow-Through Entities

Pros:

- Pass-through taxation: One of the main advantages of flow-through entities is that they do not pay taxes at the entity level. Instead, the profits and losses “flow through” to the owners’ personal tax returns. This means that the business itself does not have to pay federal income tax, potentially resulting in significant tax savings for the owners.

- Flexibility: Flow-through entities offer flexibility in terms of ownership structure and profit distribution. They can have multiple owners, each with different ownership percentages and profit-sharing arrangements. This flexibility allows for more customized ownership and management structures, which can be beneficial for businesses with complex ownership arrangements or changing ownership dynamics.

- Limited liability protection: Many flow-through entities, such as LLCs, offer limited liability protection to their owners. This means that the owners’ personal assets are generally protected from the entity’s debts and liabilities. Limited liability protection can provide peace of mind to business owners, as it helps shield their personal assets from potential business-related risks.

- Reduced self-employment taxes: Flow-through entities can potentially reduce self-employment taxes for their owners. Unlike sole proprietorships and partnerships, where all income is subject to self-employment taxes, flow-through entities allow owners to classify a portion of their income as distributions, which are not subject to self-employment taxes. This can result in significant tax savings for business owners.

Cons:

- Complexity: Flow-through entities can be more complex to set up and maintain compared to other business structures. They often require more extensive legal and accounting documentation, such as operating agreements and annual filings. Additionally, flow-through entities may have stricter regulations and compliance requirements, which can increase administrative burdens and costs for business owners.

- Passive loss limitations: Flow-through entities have passive loss limitations, which can restrict the ability to deduct losses against other sources of income. Passive losses are losses generated from business activities in which the owner does not materially participate. These limitations can limit the ability to offset losses against other income, potentially resulting in higher tax liabilities for business owners.

- Self-employment taxes: While flow-through entities can potentially reduce self-employment taxes, they do not eliminate them entirely. Owners of flow-through entities are still subject to self-employment taxes on their share of the entity’s income that is classified as self-employment income. This means that business owners may still have to pay a significant amount in self-employment taxes, depending on their income level.

Overall, flow-through entities offer several advantages, such as pass-through taxation, flexibility, and limited liability protection. However, they also come with some drawbacks, including complexity, passive loss limitations, and ownership restrictions. Business owners should carefully consider these pros and cons and consult with tax and legal professionals to determine the most suitable entity structure for their specific needs and goals.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.