What Does Travel Insurance Cover?

Travel insurance is a type of insurance that provides coverage for unexpected events that may occur while you are traveling. It is designed to protect you financially and provide assistance in case of emergencies. Travel insurance policies can vary, but here are some common types of coverage that are typically included:

Medical Expenses Coverage

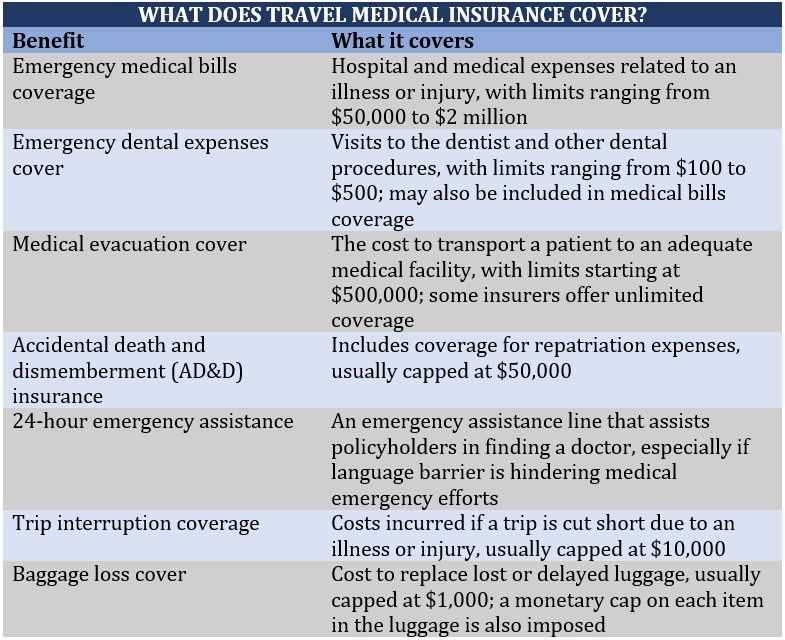

One of the most important aspects of travel insurance is medical expenses coverage. This coverage helps to pay for medical treatment and hospitalization costs if you become ill or injured while traveling. It can also cover the cost of emergency medical evacuation if you need to be transported to a different location for medical treatment.

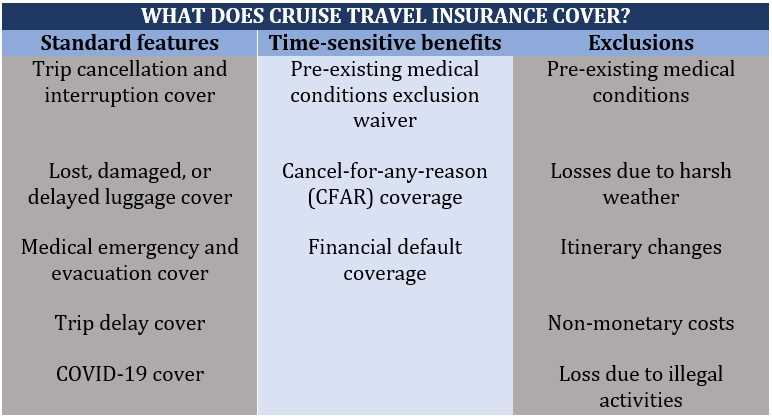

Trip Cancellation and Interruption Coverage

Travel insurance can also provide coverage for trip cancellation or interruption. This means that if you need to cancel or cut short your trip due to unforeseen circumstances, such as illness, injury, or a natural disaster, you may be able to recoup some or all of the costs associated with your trip, including flights, accommodations, and other prepaid expenses.

Baggage and Personal Belongings Coverage

Travel insurance can also offer coverage for lost, stolen, or damaged baggage and personal belongings. This coverage can help reimburse you for the cost of replacing essential items, such as clothing, toiletries, and electronics, if they are lost or damaged during your trip.

Emergency Assistance and Evacuation Coverage

Another important aspect of travel insurance is emergency assistance and evacuation coverage. This coverage can provide assistance and financial support if you encounter an emergency situation while traveling, such as a natural disaster, political unrest, or a medical emergency.

Emergency assistance and evacuation coverage can help cover the cost of emergency medical transportation, repatriation, and other necessary services to ensure your safety and well-being while traveling.

Medical Expenses Coverage

Medical expenses coverage typically includes coverage for doctor visits, hospital stays, prescription medications, and emergency medical transportation. It can also cover the cost of emergency dental treatment and medical evacuation if necessary.

What Does Medical Expenses Coverage Include?

Medical expenses coverage can vary depending on the travel insurance policy you choose, but it generally includes the following:

- Doctor Visits: If you need to see a doctor while you’re traveling, your travel insurance can cover the cost of the visit.

- Hospital Stays: If you require hospitalization due to an illness or injury, your travel insurance can cover the cost of the stay.

- Prescription Medications: If you need to purchase prescription medications while you’re traveling, your travel insurance can cover the cost.

- Emergency Medical Transportation: If you need to be transported to a medical facility for treatment, your travel insurance can cover the cost of the transportation.

- Emergency Dental Treatment: If you experience a dental emergency while you’re traveling, your travel insurance can cover the cost of the treatment.

- Medical Evacuation: If you need to be evacuated to your home country for medical treatment, your travel insurance can cover the cost of the evacuation.

Having travel insurance with medical expenses coverage can give you peace of mind knowing that you’re financially protected in case of a medical emergency while you’re traveling. It’s always better to be prepared and have the necessary coverage in place to handle unexpected situations.

Trip Cancellation and Interruption Coverage

When planning a trip, there are always unforeseen circumstances that can disrupt your plans. Trip cancellation and interruption coverage is designed to protect you financially in case you need to cancel or cut short your trip due to certain covered reasons.

What is Covered?

Travel insurance policies typically cover trip cancellation or interruption due to the following reasons:

- Illness, Injury, or Death: If you or a travel companion become seriously ill, injured, or pass away before or during your trip, you may be eligible for reimbursement of your prepaid expenses.

- Unforeseen Events: This can include natural disasters, severe weather conditions, terrorist attacks, or other unforeseen events that make it impossible or unsafe to travel to your destination.

- Job Loss: If you lose your job unexpectedly and it prevents you from going on your trip, you may be covered for trip cancellation or interruption.

- Travel Supplier Bankruptcy: If your travel supplier, such as an airline or cruise line, goes bankrupt and cancels your trip, you may be eligible for reimbursement.

What is Not Covered?

- Pre-existing Medical Conditions: If your trip is canceled or interrupted due to a pre-existing medical condition, it may not be covered unless you purchased a policy with a pre-existing condition waiver.

- Change of Mind: If you simply change your mind about going on the trip and decide to cancel or interrupt it, travel insurance typically does not cover this.

- Financial Default of Travel Agency: If your trip is canceled due to the financial default of your travel agency, it may not be covered unless you purchased a policy with this specific coverage.

Baggage and Personal Belongings Coverage

What does it cover?

Baggage and personal belongings coverage typically includes the following:

- Lost or stolen luggage: If your luggage goes missing or is stolen during your trip, this coverage can reimburse you for the value of your lost items.

- Damaged belongings: If your personal belongings are damaged during your trip, this coverage can help cover the cost of repair or replacement.

- Delayed baggage: If your luggage is delayed and you need to purchase essential items, such as clothing or toiletries, this coverage can reimburse you for those expenses.

Exclusions and limitations

How to make a claim

Having baggage and personal belongings coverage can provide you with peace of mind while traveling. It can help protect your belongings and ensure that you are financially covered in case of any unforeseen events. Before your next trip, consider purchasing travel insurance that includes this coverage to protect your valuable items.

Emergency Assistance and Evacuation Coverage

When you’re traveling, unexpected emergencies can happen at any time. That’s why having emergency assistance and evacuation coverage is crucial. This type of coverage provides you with the necessary support and resources in case of a medical emergency or other unforeseen circumstances.

What does emergency assistance coverage include?

Emergency assistance coverage typically includes services such as:

- 24/7 Assistance: Travel insurance companies have dedicated helplines that you can call anytime, day or night, to get immediate assistance in case of an emergency.

- Medical Advice: If you fall ill or get injured while traveling, you can consult with medical professionals over the phone to get advice on what steps to take next.

- Medical Referrals: In case you need medical treatment while abroad, the insurance company can provide you with a list of trusted healthcare providers in the area.

- Language Interpretation: If you find yourself in a foreign country and don’t speak the local language, the insurance company can arrange for interpretation services to help you communicate with medical professionals.

What does evacuation coverage include?

Evacuation coverage is designed to cover the costs associated with emergency medical evacuations. This can include:

- Medical Transportation: If you require specialized medical transportation, such as an air ambulance or medical repatriation, the insurance company will arrange and cover the expenses.

- Transportation to a Suitable Medical Facility: If the local medical facilities are unable to provide the necessary treatment, evacuation coverage can cover the costs of transporting you to a more suitable facility.

- Repatriation of Remains: In the unfortunate event of death while traveling, evacuation coverage can cover the costs of repatriating your remains back to your home country.

Having emergency assistance and evacuation coverage can provide you with peace of mind knowing that you’ll have access to support and resources when you need them the most. It’s important to carefully review your travel insurance policy to understand the specific coverage limits and exclusions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.