Variability Definition in Statistics and Finance

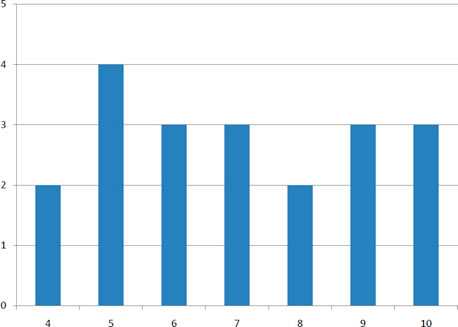

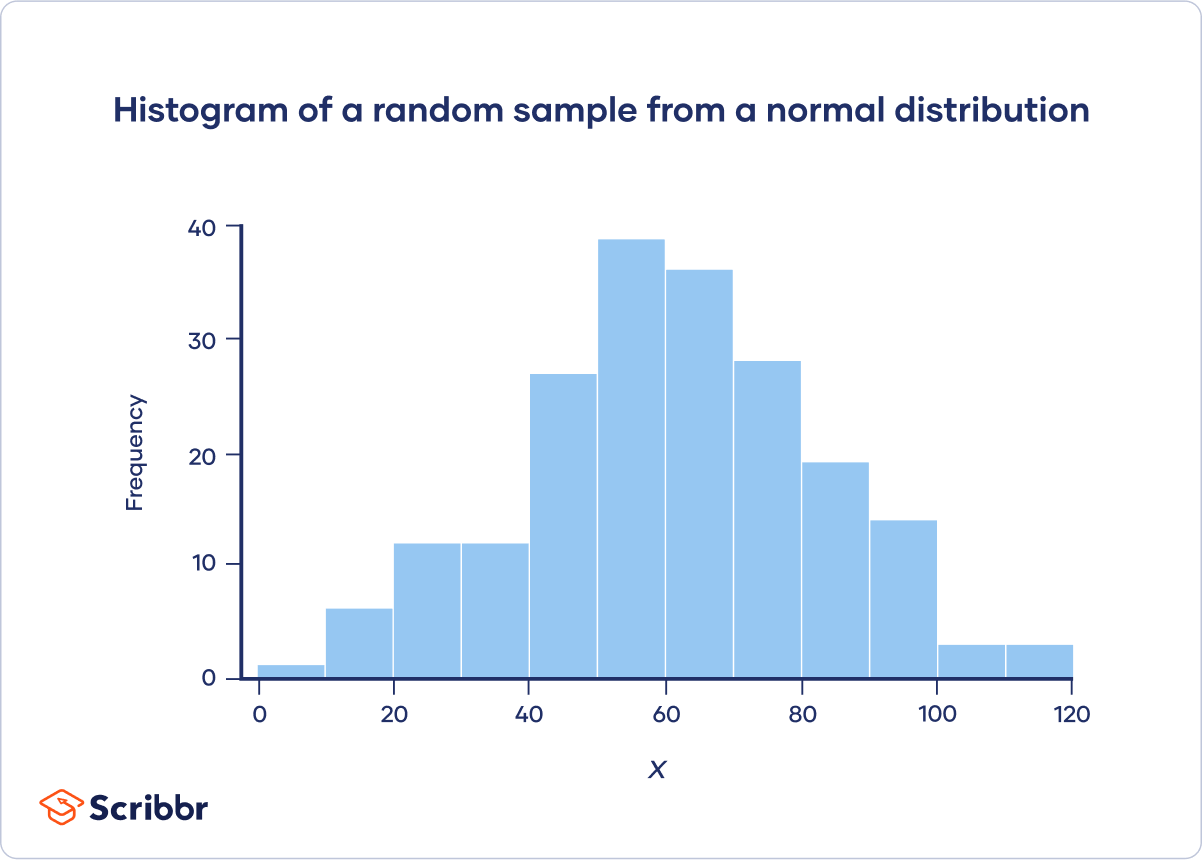

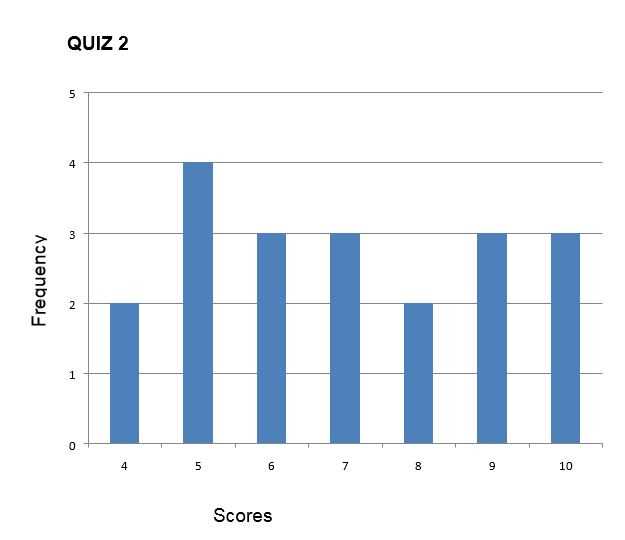

Variability is a concept that is commonly used in both statistics and finance to measure the dispersion or spread of data points. It provides valuable information about the range of values and the degree of uncertainty associated with a set of data.

In finance, variability is a key concept in risk management and investment analysis. It helps investors and analysts understand the potential fluctuations in the value of an asset or a portfolio. Higher variability is generally associated with higher risk, as it indicates a wider range of possible outcomes.

Measuring variability in finance involves analyzing historical data and calculating various statistical measures such as beta, volatility, and standard deviation. These measures provide insights into the potential risks and rewards associated with different investments.

| Statistics | Finance |

|---|---|

| Range | Beta |

| Variance | Volatility |

| Standard Deviation | Standard Deviation |

Variance and standard deviation, on the other hand, provide more comprehensive measures of variability by considering the distribution of values. Variance calculates the average squared deviation from the mean, while standard deviation is the square root of the variance. These measures provide a more accurate representation of the spread of values and are widely used in statistical analysis and financial modeling.

Additionally, variability is also important in quality control and process improvement. By analyzing the variability of product measurements or process outputs, companies can identify sources of variation and implement strategies to reduce it. This can lead to improved product quality, increased efficiency, and cost savings.

Measuring Variability in Financial Analysis

Standard Deviation

One common measure of variability in financial analysis is the standard deviation. The standard deviation provides a measure of how spread out the data points are from the mean. A higher standard deviation indicates a greater degree of variability, while a lower standard deviation suggests less variability.

To calculate the standard deviation, analysts typically use historical data or a sample of data points. The formula for calculating the standard deviation involves taking the square root of the variance, which is the average of the squared differences between each data point and the mean.

Range

Coefficient of Variation

The coefficient of variation (CV) is a relative measure of variability that is commonly used in financial analysis. It is calculated by dividing the standard deviation by the mean and multiplying by 100 to express it as a percentage. The CV allows analysts to compare the variability of different datasets, even if they have different units or scales.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.