What is a Guaranteed Lifetime Withdrawal Benefit?

A Guaranteed Lifetime Withdrawal Benefit (GLWB) is a feature offered by certain retirement planning products that provides a guaranteed income stream for life. It is designed to help individuals secure their retirement by providing a steady source of income even if their investments do not perform as expected.

With a GLWB, you can invest a portion of your retirement savings into a product that offers this benefit. In return, you are guaranteed a certain level of income for the rest of your life, regardless of market conditions or the performance of your investments.

This benefit can be particularly valuable for individuals who are concerned about outliving their savings or who want the security of a guaranteed income stream in retirement. It provides peace of mind and financial stability, allowing you to enjoy your retirement years without worrying about running out of money.

In summary, a Guaranteed Lifetime Withdrawal Benefit is a valuable tool for securing your retirement. It provides a guaranteed income stream for life, regardless of market conditions or investment performance, giving you peace of mind and financial stability in your golden years.

How Does a Guaranteed Lifetime Withdrawal Benefit Work?

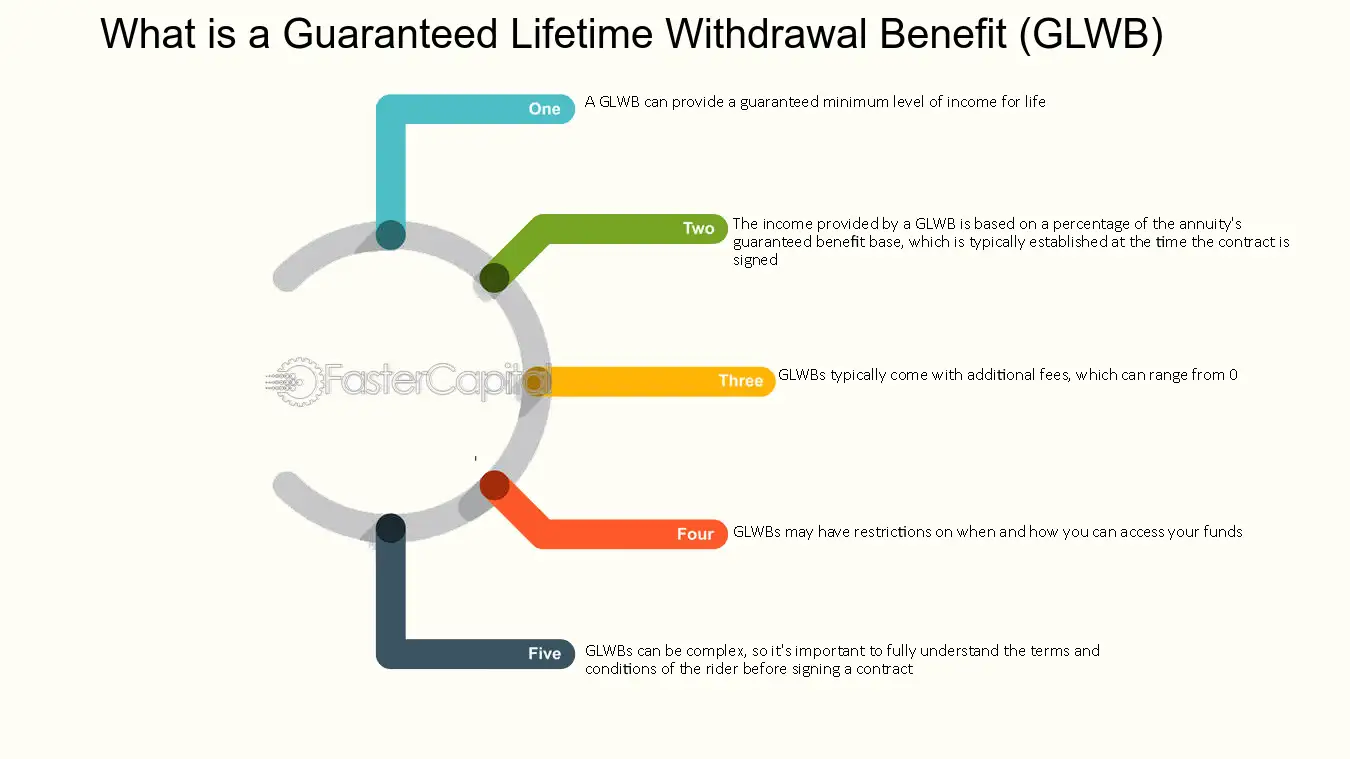

A Guaranteed Lifetime Withdrawal Benefit (GLWB) is a feature offered by certain retirement planning products that provides a guaranteed income stream for life. It works by allowing you to make withdrawals from your retirement savings while still ensuring that you will receive a certain level of income throughout your retirement years.

Here’s how it works:

- Investment Phase: During the accumulation phase of your retirement planning, you contribute funds to a retirement product that offers a GLWB. These funds are typically invested in a diversified portfolio to grow your savings over time.

- Income Base: As your retirement savings grow, a separate income base is established. This income base is used to calculate the guaranteed income you will receive during your retirement years.

- Withdrawal Percentage: Once you reach the retirement age specified in the product, you can start making withdrawals from your retirement savings. The withdrawal percentage is determined based on your age and the terms of the product. This percentage is applied to your income base to calculate the amount you can withdraw each year.

- Guaranteed Income: The GLWB guarantees that you will receive a certain level of income for the rest of your life, regardless of how long you live or how your investments perform. This income is paid out regularly, usually on a monthly basis, providing you with financial security and peace of mind in retirement.

By incorporating a Guaranteed Lifetime Withdrawal Benefit into your retirement planning, you can ensure that you have a reliable source of income throughout your retirement years, helping you to maintain your desired standard of living and enjoy a worry-free retirement.

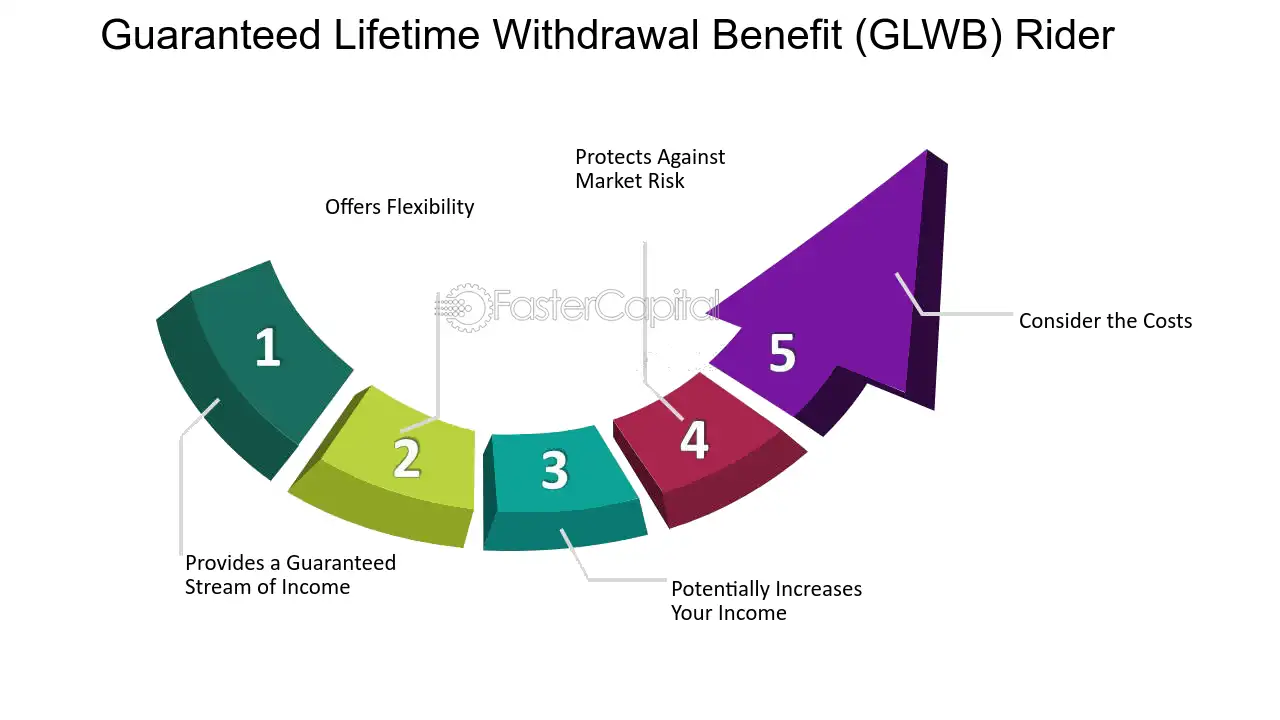

The Benefits of a Guaranteed Lifetime Withdrawal Benefit

A Guaranteed Lifetime Withdrawal Benefit (GLWB) offers several benefits that can help secure your retirement:

1. Lifetime Income

With a GLWB, you can receive a guaranteed income stream for the rest of your life, regardless of market conditions. This provides peace of mind and ensures that you will have a steady source of income throughout your retirement years.

2. Protection against Market Volatility

One of the main advantages of a GLWB is that it protects you against market downturns. Even if the value of your investments decreases, you can still receive a guaranteed income based on a predetermined withdrawal rate. This protects your retirement savings from the impact of market volatility.

3. Flexibility

A GLWB offers flexibility in terms of how much income you can withdraw. You can choose a withdrawal rate that suits your needs and adjust it as necessary. This allows you to have control over your retirement income and make adjustments based on your changing financial situation.

4. Potential for Growth

While a GLWB provides a guaranteed income, it also offers the potential for growth. Some GLWBs are linked to investment portfolios, which means that if the market performs well, your income can increase. This allows you to benefit from market gains while still having the security of a guaranteed income.

5. Legacy Planning

A GLWB can also be used for legacy planning. If you pass away before exhausting your account balance, the remaining funds can be passed on to your beneficiaries. This ensures that your loved ones are taken care of and can provide a financial legacy for future generations.

How a Guaranteed Lifetime Withdrawal Benefit Can Secure Your Retirement

Retirement planning can be a daunting task, but with the help of a Guaranteed Lifetime Withdrawal Benefit (GLWB), you can secure your future and enjoy a worry-free retirement. A GLWB is a valuable feature offered by certain financial products, such as annuities, that provides you with a guaranteed income stream for life.

What is a Guaranteed Lifetime Withdrawal Benefit?

A Guaranteed Lifetime Withdrawal Benefit is a rider or add-on feature that can be added to an annuity contract. It allows you to withdraw a certain percentage of your account value each year, regardless of market performance, for the rest of your life. This provides you with a predictable and stable income stream, even if your investments do not perform as expected.

How Does a Guaranteed Lifetime Withdrawal Benefit Work?

When you purchase an annuity with a GLWB, you make a lump sum payment or a series of payments to the insurance company. In return, the insurance company guarantees you a certain amount of income for the rest of your life, based on a predetermined withdrawal rate. This withdrawal rate is typically a percentage of your account value, and it remains fixed regardless of market conditions.

With a GLWB, you have the flexibility to choose when to start receiving your guaranteed income. You can begin withdrawals immediately or defer them to a later date. By deferring withdrawals, you can potentially increase the amount of guaranteed income you will receive in the future.

The Benefits of a Guaranteed Lifetime Withdrawal Benefit

A GLWB offers several benefits that can help secure your retirement:

- Income Security: With a GLWB, you have the peace of mind knowing that you will receive a guaranteed income stream for life, regardless of market fluctuations.

- Market Protection: A GLWB protects you from market downturns. Even if your investments perform poorly, you can still receive a steady income.

- Flexibility: You have the flexibility to choose when to start receiving your guaranteed income. This allows you to align your income stream with your retirement goals and financial needs.

- Legacy Planning: A GLWB can also provide a death benefit to your beneficiaries, ensuring that your loved ones are taken care of after you pass away.

Conclusion

A Guaranteed Lifetime Withdrawal Benefit can be a powerful tool in securing your retirement. It provides you with a guaranteed income stream for life, regardless of market conditions, and offers flexibility and peace of mind. Consider adding a GLWB to your retirement plan to ensure a worry-free and financially stable future.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.