What is the Gas Guzzler Tax?

The Gas Guzzler Tax is a federal tax imposed on vehicles that have low fuel efficiency. It was introduced in the United States in the 1970s as a response to the oil crisis and the need to reduce fuel consumption and greenhouse gas emissions.

The tax is levied on vehicles that do not meet certain fuel economy standards set by the Environmental Protection Agency (EPA). These standards are based on the vehicle’s combined city and highway fuel economy rating, which is measured in miles per gallon (MPG).

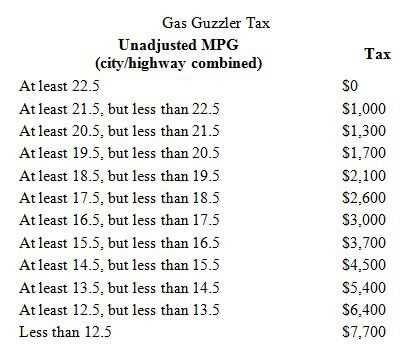

How is the Gas Guzzler Tax calculated?

The amount of the tax is determined by the difference between the vehicle’s actual fuel economy and the fuel economy standard set by the EPA. The tax rate is based on a formula that takes into account the vehicle’s fuel economy rating and the number of gallons of fuel consumed over a specified distance.

For example, if a vehicle has a fuel economy rating of 15 MPG and the standard set by the EPA is 25 MPG, the tax will be calculated based on the difference of 10 MPG. The tax rate is multiplied by the number of gallons of fuel consumed over a specified distance, which is typically 15,000 miles.

The Gas Guzzler Tax was introduced to incentivize automakers to produce more fuel-efficient vehicles and to discourage consumers from purchasing vehicles with low fuel economy. By imposing a tax on gas-guzzling vehicles, the government aims to promote the use of more environmentally friendly vehicles and reduce the dependence on fossil fuels.

In addition to reducing fuel consumption and greenhouse gas emissions, the tax also generates revenue for the government. The revenue collected from the tax is used to fund various environmental and energy conservation programs.

Complying with the Gas Guzzler Tax regulations is important for both automakers and consumers. Automakers need to ensure that their vehicles meet the fuel economy standards set by the EPA to avoid paying the tax. Consumers, on the other hand, should consider the fuel economy of a vehicle before making a purchase to avoid higher fuel costs and potential tax liability.

How does the Gas Guzzler Tax affect vehicle efficiency?

The Gas Guzzler Tax is a federal tax imposed on vehicles that have low fuel efficiency. This tax is designed to discourage the production and purchase of vehicles that consume excessive amounts of fuel, thereby promoting the use of more fuel-efficient vehicles.

The Gas Guzzler Tax has a direct impact on vehicle efficiency as it creates a financial incentive for manufacturers to improve the fuel economy of their vehicles. In order to avoid paying higher taxes, manufacturers invest in research and development to develop more fuel-efficient technologies and improve the overall efficiency of their vehicles.

For consumers, the Gas Guzzler Tax serves as a guide when making purchasing decisions. The tax is reflected in the sticker price of the vehicle, making it more expensive to purchase a vehicle with low fuel efficiency. This encourages consumers to consider more fuel-efficient options, ultimately reducing their fuel consumption and saving money on fuel costs.

Additionally, the Gas Guzzler Tax helps to promote environmental sustainability by reducing greenhouse gas emissions. Vehicles with low fuel efficiency tend to emit more carbon dioxide and other pollutants into the atmosphere. By discouraging the production and purchase of these vehicles, the tax contributes to the overall goal of reducing the environmental impact of transportation.

The Importance of Complying with the Gas Guzzler Tax Regulations

Complying with the Gas Guzzler Tax regulations is of utmost importance for both vehicle manufacturers and consumers. This tax is designed to encourage the production and purchase of fuel-efficient vehicles, ultimately reducing the overall carbon footprint and promoting environmental sustainability.

Benefits for Vehicle Manufacturers

Secondly, complying with the Gas Guzzler Tax regulations can lead to cost savings for manufacturers. By investing in research and development to improve vehicle efficiency, manufacturers can reduce the tax liabilities associated with producing gas-guzzling vehicles. This can result in lower production costs and increased profitability in the long run.

Benefits for Consumers

Complying with the Gas Guzzler Tax regulations also benefits consumers in several ways. Firstly, purchasing a fuel-efficient vehicle can result in significant savings on fuel costs. With rising fuel prices, owning a vehicle that consumes less fuel can help consumers save money in the long term.

Secondly, fuel-efficient vehicles are often eligible for various incentives and tax credits. By complying with the Gas Guzzler Tax regulations and producing fuel-efficient vehicles, manufacturers can pass on these benefits to consumers in the form of lower prices or additional incentives. This makes fuel-efficient vehicles more affordable and accessible to a wider range of consumers.

Lastly, complying with the Gas Guzzler Tax regulations contributes to a cleaner and healthier environment. By reducing carbon emissions and promoting fuel efficiency, we can mitigate the impact of climate change and improve air quality. This benefits not only the current generation but also future generations who will inherit a more sustainable planet.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.