The Concept of Crowding Out

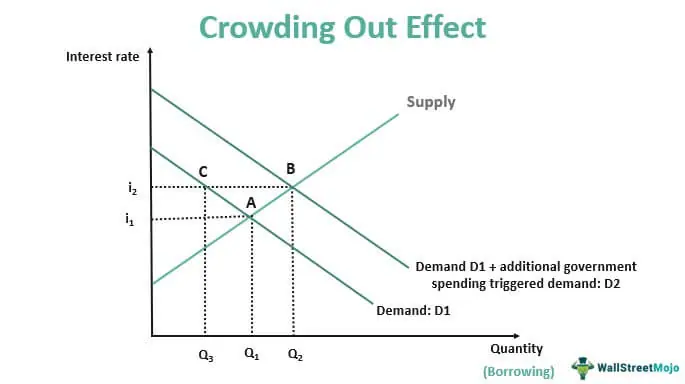

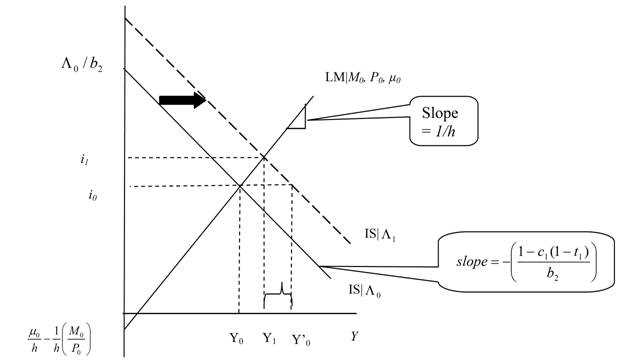

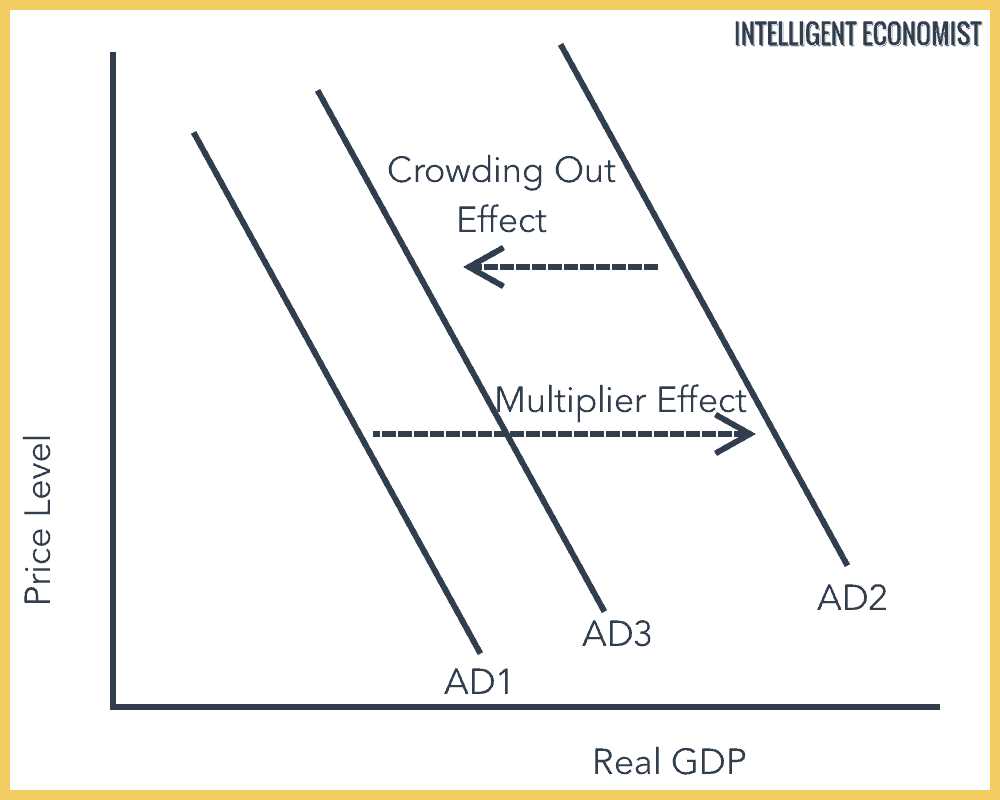

The concept of crowding out refers to the phenomenon in economics where increased government spending leads to a decrease in private sector spending. This occurs when the government borrows money to finance its spending, which increases the demand for loanable funds and drives up interest rates. As a result, private sector investment and consumption decrease.

Higher interest rates discourage private sector investment and consumption. Businesses may postpone or cancel investment projects due to the increased cost of borrowing. Similarly, individuals may delay making major purchases, such as buying a house or a car, because the cost of financing these purchases has become more expensive.

The crowding out effect can also occur through the displacement of resources. When the government spends more, it often requires more resources, such as labor and capital, to carry out its projects. This increased demand for resources can lead to higher prices, making it more costly for the private sector to acquire these resources. As a result, private sector firms may reduce their production or invest less in expanding their operations.

It is important to note that the crowding out effect is not always present or significant. In some cases, increased government spending can stimulate economic activity and lead to higher private sector investment. This can occur when the economy is operating below its full capacity and there is idle resources that can be utilized. Additionally, the crowding out effect can be mitigated if the central bank implements monetary policy measures to counteract the increase in interest rates.

Government Spending and Crowding Out

When the government increases its spending, it often needs to finance this spending through borrowing. This increases the demand for loanable funds, which in turn leads to an increase in interest rates. Higher interest rates make it more expensive for businesses and individuals to borrow money for investment purposes.

As a result, private sector investment decreases, as businesses and individuals are deterred by the higher cost of borrowing. This decrease in private investment can have detrimental effects on economic growth and productivity.

Furthermore, the crowding out effect can also occur through the displacement of resources. When the government increases its spending, it often needs to allocate resources towards its own projects and programs. This can lead to a decrease in resources available for the private sector, further reducing private sector investment.

It is important to note that the crowding out effect is not always present. In some cases, an increase in government spending can stimulate economic growth and investment. This is especially true in times of economic downturn, when private sector investment may be low. Government spending can help fill the gap and stimulate economic activity.

Overall, the crowding out effect is an important concept to understand in economic theory. It highlights the potential negative consequences of increased government spending on private sector investment. Policymakers need to carefully consider the trade-offs between government spending and private sector investment when making decisions about fiscal policy.

Implications of the Crowding Out Effect

1. Reduced Private Investment

One of the main implications of the crowding out effect is a reduction in private investment. When the government increases its spending, it often needs to borrow money by issuing bonds. This increases the demand for loanable funds and drives up interest rates. As a result, private businesses and individuals find it more expensive to borrow money for investment purposes. This leads to a decrease in private investment, which can hinder economic growth in the long run.

2. Higher Interest Rates

Another implication of the crowding out effect is higher interest rates. As mentioned earlier, government borrowing increases the demand for loanable funds, which puts upward pressure on interest rates. Higher interest rates can discourage consumer spending and business investment, as borrowing becomes more expensive. This can lead to a slowdown in economic activity and potentially lower overall economic output.

3. Inflationary Pressure

When the government increases its spending, it often does so by injecting money into the economy. This can lead to an increase in the money supply, which can potentially cause inflation. Inflation erodes the purchasing power of individuals and can lead to higher prices for goods and services. The crowding out effect, therefore, can contribute to inflationary pressure in the economy.

4. Fiscal Policy Constraints

The crowding out effect can also impose constraints on fiscal policy. When the government increases its spending and borrows money, it accumulates debt. This debt needs to be repaid in the future, which can limit the government’s ability to implement expansionary fiscal policies in the future. High levels of government debt can also lead to concerns about creditworthiness and increase borrowing costs, further constraining fiscal policy options.

5. Distributional Effects

The crowding out effect can also have distributional effects on different sectors of the economy. When government spending increases, it often targets specific sectors or industries. This can lead to a reallocation of resources away from other sectors, potentially causing disruptions and inequalities. For example, increased government spending on healthcare may lead to a decrease in funding for education or infrastructure projects.

| Implication | Description |

|---|---|

| Reduced Private Investment | Government spending crowds out private investment by increasing demand for loanable funds and driving up interest rates. |

| Higher Interest Rates | Government borrowing increases interest rates, which can discourage consumer spending and business investment. |

| Inflationary Pressure | Increased government spending can lead to an increase in the money supply and potentially cause inflation. |

| Fiscal Policy Constraints | Government debt accumulated through increased spending can limit future fiscal policy options. |

| Distributional Effects | Increased government spending can lead to a reallocation of resources and potentially cause inequalities between sectors. |

Overall, the crowding out effect highlights the trade-offs and limitations associated with government spending. While increased government spending may have short-term benefits, it can also have long-term negative consequences for private investment, interest rates, inflation, fiscal policy, and resource allocation.

Debate and Criticisms of the Crowding Out Effect

The crowding out effect is a concept in economic theory that suggests that increased government spending can lead to a decrease in private investment. While this idea has been widely accepted and studied, there are also debates and criticisms surrounding the validity and significance of the crowding out effect.

1. Empirical Evidence

One of the main criticisms of the crowding out effect is the lack of consistent empirical evidence to support its claims. Some studies have found a negative relationship between government spending and private investment, while others have found no significant relationship. This inconsistency in findings raises questions about the generalizability and reliability of the crowding out effect.

Furthermore, critics argue that the crowding out effect may be overstated or exaggerated in economic models. They argue that the effect may be more nuanced and context-dependent, with various factors influencing the relationship between government spending and private investment.

2. Ricardian Equivalence

Another criticism of the crowding out effect is based on the concept of Ricardian equivalence. This theory suggests that individuals anticipate future tax increases to finance government spending and adjust their behavior accordingly. According to this view, individuals may increase their savings or reduce their consumption in anticipation of higher taxes, thereby offsetting the crowding out effect.

Proponents of Ricardian equivalence argue that individuals are forward-looking and rational, and therefore, they adjust their behavior based on future expectations. This challenges the assumption that increased government spending necessarily leads to a decrease in private investment.

3. Other Factors

There are also other factors that critics argue should be taken into account when analyzing the crowding out effect. These factors include the composition of government spending, the efficiency of public investment, and the overall economic conditions.

For example, critics argue that if government spending is directed towards productive investments, such as infrastructure projects, it may crowd in private investment rather than crowding it out. Additionally, the efficiency of public investment can influence its impact on private investment. If government spending is inefficient or wasteful, it may have a negative effect on private investment.

Furthermore, the overall economic conditions, such as interest rates and business confidence, can also influence the relationship between government spending and private investment. In times of low interest rates or high business confidence, the crowding out effect may be less pronounced.

Conclusion

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.