What Are Qualifying Transactions?

A qualifying transaction is a term commonly used in the context of mergers and acquisitions (M&A) to refer to a specific type of transaction that meets certain criteria. It is an important concept in the M&A process as it determines whether a transaction can proceed and what regulatory requirements may apply.

Qualifying transactions are typically defined by regulatory bodies or stock exchanges and may vary depending on the jurisdiction or industry. In general, a qualifying transaction can include various types of corporate actions, such as mergers, acquisitions, asset purchases, share exchanges, or reorganizations.

The purpose of qualifying transactions is to ensure transparency and protect the interests of shareholders and investors. By setting specific criteria and requirements, regulatory bodies aim to prevent fraudulent or unfair transactions and maintain market integrity.

When a company plans to engage in a qualifying transaction, it is usually required to disclose relevant information to its shareholders and obtain their approval. This can involve providing financial statements, business plans, and other details to enable shareholders to make an informed decision.

Additionally, regulatory bodies may impose specific conditions or restrictions on qualifying transactions, such as minimum financial thresholds, voting requirements, or approval from regulatory authorities. These requirements are designed to safeguard the interests of all parties involved and ensure compliance with applicable laws and regulations.

Definition and Explanation of Qualifying Transactions

Criteria for Qualifying Transactions

The criteria for qualifying transactions can vary depending on the jurisdiction and the specific regulations in place. However, some common criteria include:

- The transaction must involve the transfer of assets or securities between two parties.

- The transaction must meet certain financial thresholds, such as a minimum value or a minimum percentage of ownership.

- The transaction must comply with relevant laws and regulations, including antitrust laws and securities laws.

- The transaction must be conducted in a transparent and fair manner, ensuring that all parties involved have access to relevant information and are treated fairly.

By meeting these criteria, qualifying transactions can benefit from various advantages, such as tax breaks, reduced regulatory requirements, or exemptions from certain reporting obligations.

Examples of Qualifying Transactions

There are several types of qualifying transactions that can occur in the M&A landscape. Some common examples include:

| Type of Qualifying Transaction | Description |

|---|---|

| Stock Acquisitions | When one company acquires a controlling interest in another company by purchasing its stock. |

| Asset Purchases | When one company acquires specific assets of another company, such as intellectual property or real estate. |

| Mergers | When two companies combine to form a new entity, typically with the goal of achieving synergies and expanding market presence. |

| Spin-offs | When a company separates a portion of its business into a new, independent entity, often to focus on its core operations. |

These are just a few examples, and there are many other types of qualifying transactions that can occur in the M&A field.

Types of Qualifying Transactions

Qualifying transactions can take various forms depending on the specific context and industry. Here are some common types of qualifying transactions:

1. Stock Acquisitions

A stock acquisition occurs when one company purchases the shares of another company. This type of qualifying transaction allows the acquiring company to gain control over the target company by acquiring a majority or all of its outstanding shares. Stock acquisitions can be friendly or hostile, depending on the willingness of the target company to be acquired.

2. Asset Acquisitions

3. Merger

A merger is a type of qualifying transaction where two or more companies combine to form a new entity. In a merger, the merging companies pool their assets, liabilities, and operations to create a single, larger entity. This type of transaction is often driven by the desire to achieve synergies and economies of scale.

4. Reverse Takeover

5. Joint Venture

A joint venture is a qualifying transaction where two or more companies collaborate to undertake a specific project or business venture. In a joint venture, the participating companies contribute resources, expertise, and capital to achieve a common goal. Joint ventures can be temporary or long-term partnerships, depending on the nature of the project.

6. Spin-Off

These are just a few examples of the types of qualifying transactions that can occur in the context of mergers and acquisitions. Each transaction has its own unique characteristics and considerations, and companies must carefully evaluate the potential benefits and risks before proceeding with any qualifying transaction.

How Qualifying Transactions Work in M&A

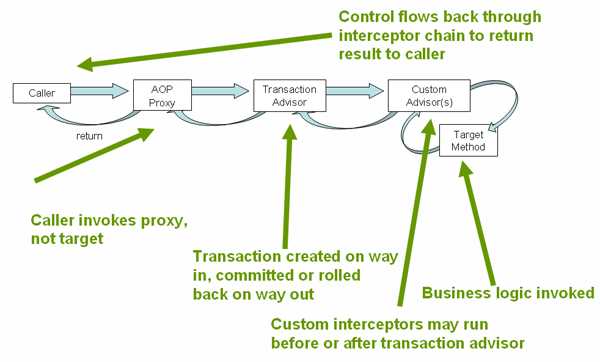

In the context of mergers and acquisitions (M&A), qualifying transactions play a crucial role in determining the success and legality of a deal. These transactions are a key component of the due diligence process and are designed to ensure that the acquiring company meets certain criteria before completing the acquisition.

1. Identification and Evaluation

The first step in the process of qualifying transactions is the identification and evaluation of potential targets. The acquiring company must carefully assess the target company’s financials, legal status, market position, and other relevant factors to determine if it meets the necessary criteria for acquisition.

2. Negotiation and Agreement

Once the acquiring company has identified a suitable target, the next step is to negotiate the terms of the acquisition. This involves discussions on the purchase price, payment terms, and other key details of the transaction.

During the negotiation process, the acquiring company may seek to obtain representations and warranties from the target company to ensure that the information provided during the evaluation process is accurate and complete. These representations and warranties serve as a form of protection for the acquiring company in case any undisclosed liabilities or issues arise after the acquisition is completed.

3. Due Diligence and Documentation

After reaching an agreement on the terms of the acquisition, the acquiring company conducts a detailed due diligence process to verify the information provided by the target company. This involves reviewing financial records, legal documents, contracts, and other relevant materials to ensure that there are no hidden risks or liabilities.

Based on the findings of the due diligence process, the acquiring company may need to revise the terms of the acquisition or even terminate the deal if significant issues are discovered. However, if the due diligence process is successful and no major concerns arise, the parties proceed with the documentation phase.

4. Closing and Integration

Once all the necessary documentation is in place, the acquisition can proceed to the closing stage. At this point, the acquiring company transfers the agreed-upon consideration to the target company, and the ownership of the target company is officially transferred.

After the closing, the acquiring company begins the process of integrating the target company into its operations. This may involve merging departments, aligning processes, and implementing any necessary changes to ensure a smooth transition.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.