What are Leading Indicators?

Leading indicators are economic variables that are used to predict future trends and changes in the economy. They are called “leading” because they tend to change before the overall economy does, providing early signs of potential shifts in economic activity.

Types of Leading Indicators

There are several types of leading indicators that investors and economists commonly use:

- Interest rates: Changes in interest rates, particularly short-term rates set by central banks, can signal shifts in borrowing costs and economic activity.

- Consumer sentiment: Surveys and indices measuring consumer sentiment can provide insights into consumer spending patterns and future economic growth.

- Building permits: The number of building permits issued can indicate future construction activity and overall economic expansion.

These are just a few examples of leading indicators, and there are many more that investors and economists use to assess the state of the economy.

Application of Leading Indicators in Investment

Leading indicators are used by investors to make informed investment decisions. By analyzing leading indicators, investors can identify potential opportunities and risks in the market.

For example, if leading indicators suggest that the economy is entering a period of expansion, investors may choose to increase their exposure to stocks and other growth-oriented assets. Conversely, if leading indicators point to a potential economic downturn, investors may decide to reduce their risk exposure and allocate more capital to defensive assets.

Leading indicators can also be used to assess the performance of specific industries or sectors. By analyzing leading indicators relevant to a particular industry, investors can gain insights into its future prospects and make investment decisions accordingly.

Overall, leading indicators play a crucial role in investment decision-making by providing valuable insights into the direction of the economy and specific industries. By staying informed and analyzing these indicators, investors can make more informed and strategic investment decisions.

The Importance of Leading Indicators in Investment

Leading indicators play a crucial role in investment decision making. They provide valuable insights into the future direction of the economy and financial markets, helping investors make informed choices and mitigate risks. By analyzing leading indicators, investors can anticipate changes in economic conditions and adjust their investment strategies accordingly.

What are Leading Indicators?

Leading indicators are economic or financial variables that tend to change before the overall economy or specific sectors. They are used to forecast future economic trends and help investors predict the direction of financial markets. Leading indicators can include various factors such as consumer confidence, stock market performance, housing starts, and business inventories.

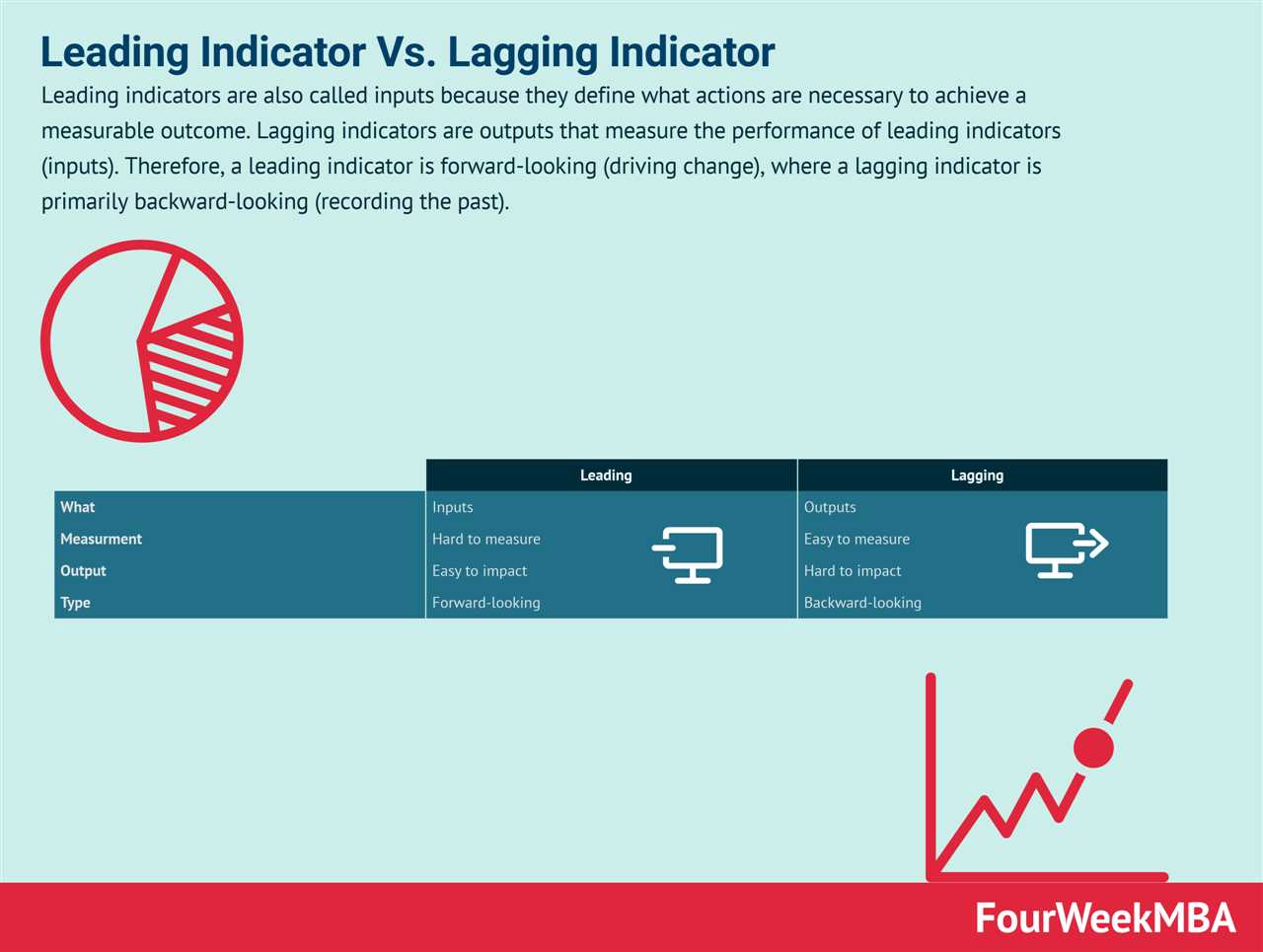

Leading indicators are forward-looking and provide early signals of economic activity. They can help investors identify potential turning points in the business cycle and adjust their investment portfolios accordingly. By monitoring leading indicators, investors can gain a competitive advantage and stay ahead of market trends.

The Role of Leading Indicators in Investment Decision Making

For example, if leading indicators suggest a slowdown in economic growth, investors may choose to reduce their exposure to stocks and increase their allocation to bonds or other defensive assets. On the other hand, if leading indicators point to a robust economy, investors may decide to increase their equity holdings and take on more risk.

Leading indicators can also help investors identify specific sectors or industries that are likely to outperform or underperform in the future. For instance, if leading indicators indicate a strong housing market, investors may consider investing in real estate-related stocks or funds.

Furthermore, leading indicators can help investors anticipate changes in interest rates, inflation, and corporate earnings, which are crucial factors affecting investment returns. By staying informed about leading indicators, investors can make more accurate predictions and adjust their investment strategies accordingly.

Overall, leading indicators provide investors with valuable insights into the future direction of the economy and financial markets. By incorporating leading indicators into their investment decision-making process, investors can make more informed choices and potentially achieve better investment outcomes.

How to Use Leading Indicators in Investment Decision Making

1. Identify the Relevant Leading Indicators

The first step in using leading indicators is to identify the ones that are most relevant to your investment strategy. This will depend on the specific market or industry you are interested in. For example, if you are investing in the technology sector, you may want to look at indicators such as semiconductor sales, patent applications, or consumer electronics sales.

2. Monitor and Analyze the Data

Once you have identified the relevant leading indicators, the next step is to monitor and analyze the data. This can be done through various sources such as government reports, industry publications, or financial websites. It is important to track the indicators regularly and look for any patterns or trends that may emerge.

For example, if you notice that semiconductor sales have been consistently increasing over the past few months, it could be a sign of growing demand in the technology sector. This information can help you make investment decisions such as buying stocks of semiconductor companies.

3. Use Leading Indicators in Combination with Other Factors

While leading indicators can provide valuable insights, it is important to use them in combination with other factors. This includes considering the overall economic conditions, market trends, and company-specific factors. By taking a holistic approach to investment decision making, you can reduce the risk of making decisions based solely on leading indicators.

4. Understand the Limitations

It is also important to understand the limitations of leading indicators. They are not foolproof and can sometimes provide false signals. For example, an increase in consumer electronics sales may not necessarily translate into higher profits for technology companies if there are other factors at play, such as increased competition or rising production costs.

Therefore, it is important to use leading indicators as one tool among many in your investment analysis. They should be used in conjunction with other research and analysis to make well-informed investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.