Overview of Kiddie Tax

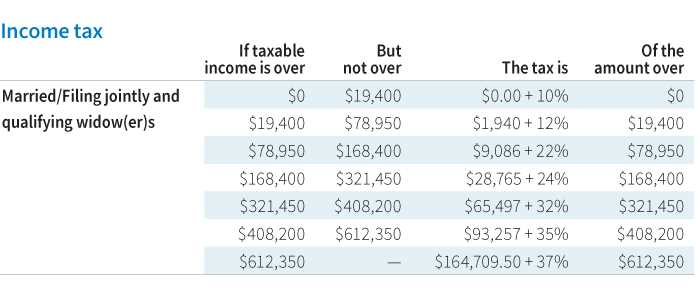

Under the Kiddie Tax rules, a child’s investment income above a certain threshold is subject to the parent’s tax rate, rather than the child’s own tax rate. This threshold is currently set at $2,200 for the tax year 2021. Any investment income above this threshold is taxed at the parent’s marginal tax rate.

Who is affected by the Kiddie Tax?

The Kiddie Tax applies to children who meet the following criteria:

- The child is under the age of 19, or under the age of 24 if they are a full-time student.

- The child has unearned income, such as interest, dividends, capital gains, or rental income.

- The child’s unearned income exceeds the threshold amount set by the IRS.

How is the Kiddie Tax calculated?

For example, if a child has $3,000 in investment income and their parent’s marginal tax rate is 25%, the Kiddie Tax would be calculated as follows:

| Child’s Investment Income | Parent’s Marginal Tax Rate | Kiddie Tax |

|---|---|---|

| $3,000 | 25% | $750 |

Exceptions to the Kiddie Tax

There are certain exceptions to the Kiddie Tax that may apply in certain situations. For example, if a child is married and filing a joint tax return, the Kiddie Tax does not apply. Additionally, if a child has earned income that exceeds half of their support, the Kiddie Tax may not apply.

Impact on Your Child’s Investment Income

Under the Kiddie Tax rules, a child’s investment income above a certain threshold is subject to taxation at the parents’ marginal tax rate, rather than the child’s lower tax rate. This means that any investment income earned by your child could potentially be taxed at a higher rate than if it were earned by you.

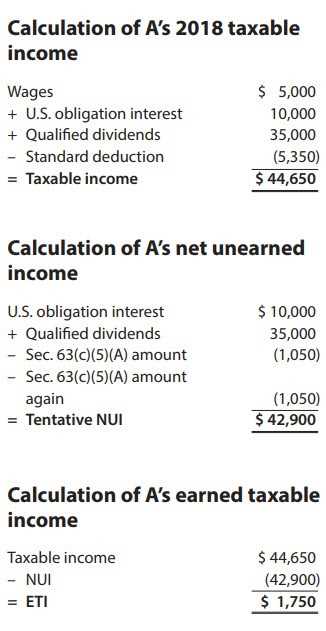

Calculating the Kiddie Tax

The Kiddie Tax is calculated using a specific formula. The child’s investment income is added to the parent’s income, and the total is subject to the parents’ marginal tax rate. However, there is an exemption amount that is not subject to the Kiddie Tax. For the tax year 2021, the exemption amount is $2,200.

If your child’s investment income exceeds the exemption amount, the excess income will be subject to the Kiddie Tax. This means that the excess income will be taxed at your marginal tax rate, which could be significantly higher than your child’s tax rate.

Strategies to Minimize Kiddie Tax Liability

If you want to minimize your child’s Kiddie Tax liability, there are a few strategies you can consider. One option is to invest in tax-efficient investments, such as tax-exempt municipal bonds or index funds with low turnover. These types of investments generate less taxable income, which can help reduce your child’s overall tax liability.

Strategies to Minimize Kiddie Tax Liability

1. Utilize Tax-Advantaged Accounts

One effective strategy is to invest your child’s funds in tax-advantaged accounts such as a 529 college savings plan or a custodial Roth IRA. These accounts offer tax benefits, such as tax-free growth and tax-free withdrawals for qualified education expenses or retirement, respectively. By utilizing these accounts, you can minimize the tax liability on your child’s investment income.

2. Gift Assets to Your Child

3. Consider Tax-Efficient Investments

Choosing tax-efficient investments can also help minimize the impact of the Kiddie Tax. Investments that generate qualified dividends or long-term capital gains are typically taxed at lower rates. By focusing on these types of investments, you can reduce the tax liability on your child’s investment income.

4. Spread Investments Across Family Members

If you have multiple children, spreading investments across family members can help minimize the overall Kiddie Tax liability. By allocating investments to different children, you can take advantage of each child’s lower tax bracket and reduce the overall tax burden on your family.

5. Monitor and Adjust Investment Strategies

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.