Annuities: A Reliable Retirement Income Solution

What Are Immediate Payment Annuities?

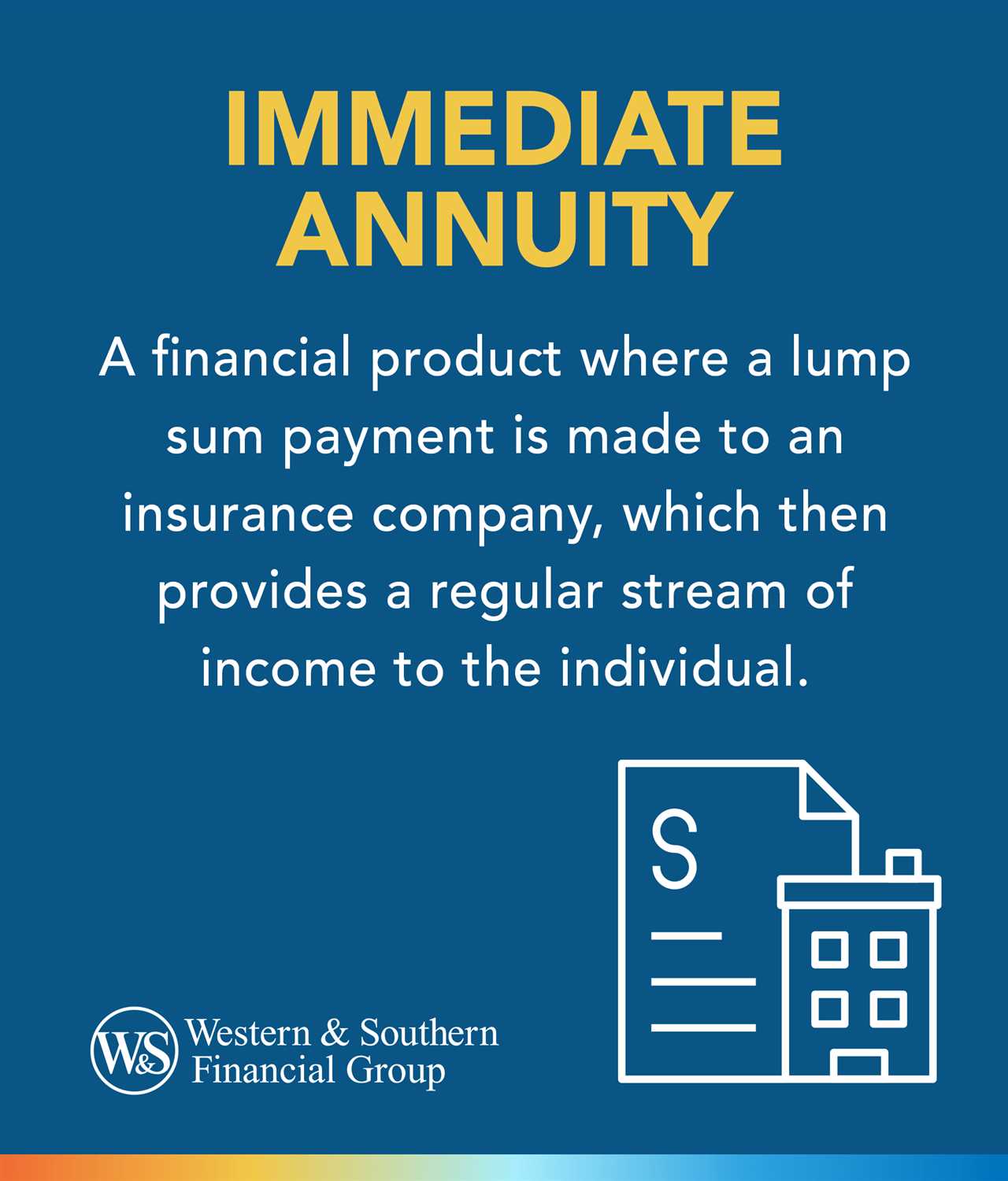

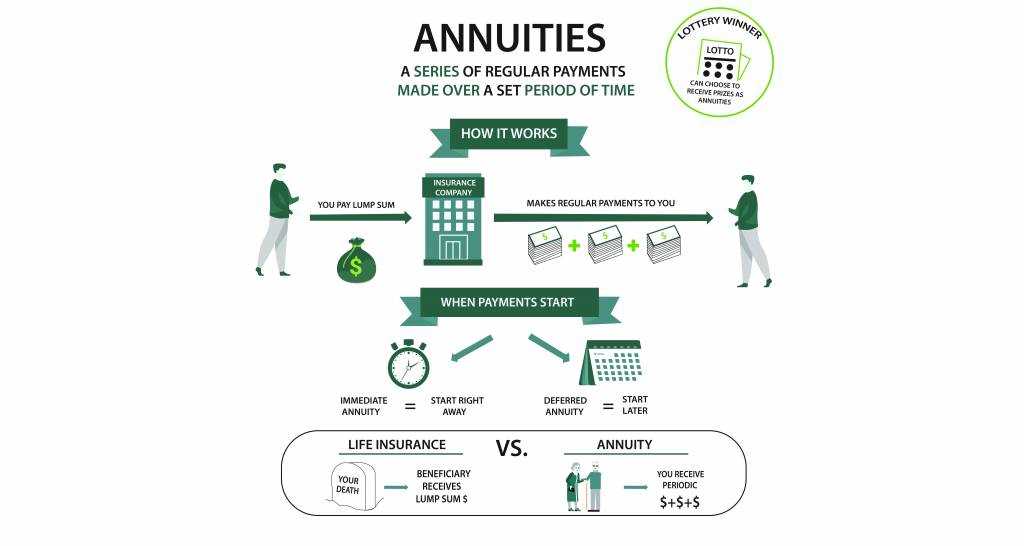

An immediate payment annuity is a type of insurance contract that is purchased with a lump sum of money. In exchange for this payment, the insurance company promises to make regular payments to the annuitant for a specified period of time, typically for the rest of their life. This makes immediate payment annuities an attractive option for retirees who want a stable income stream that they cannot outlive.

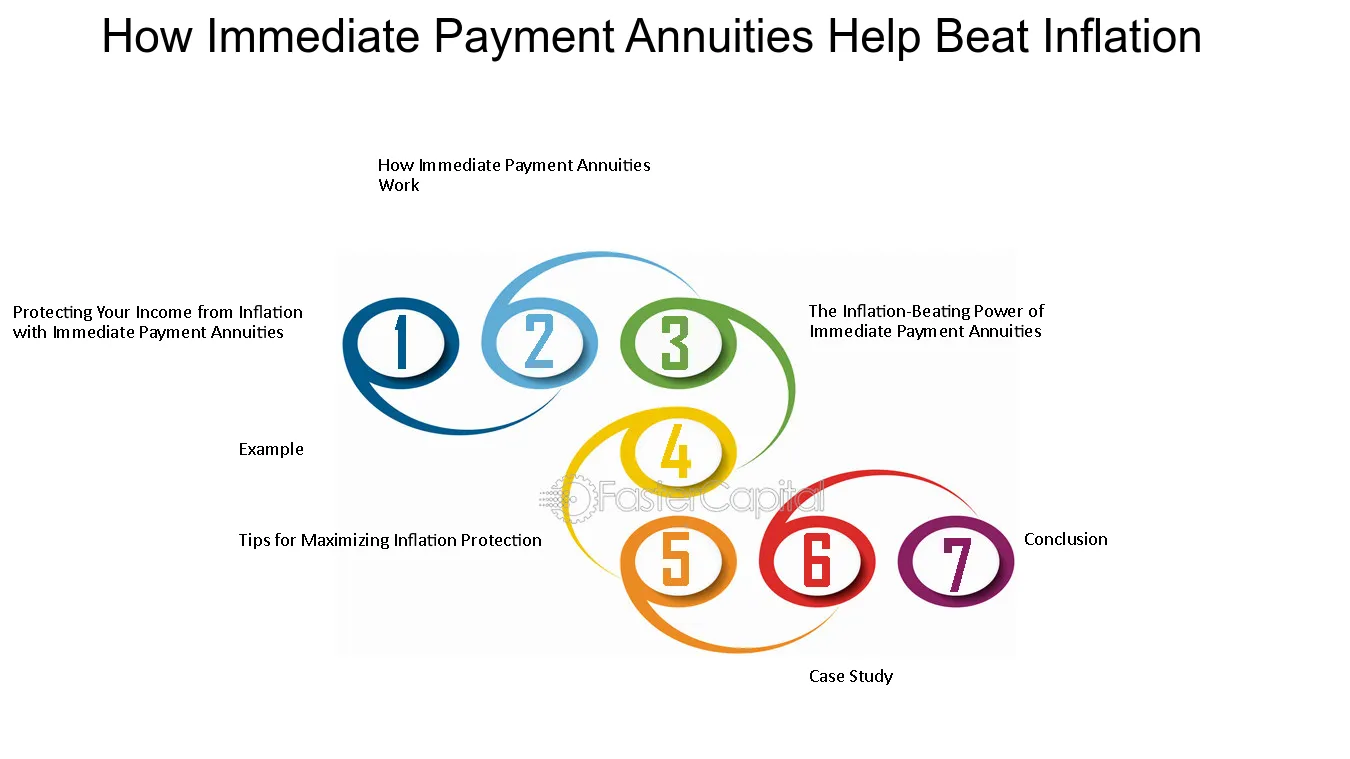

How Immediate Payment Annuities Work

When you purchase an immediate payment annuity, you essentially transfer the risk of outliving your savings to the insurance company. The amount of income you receive depends on several factors, including your age, gender, and the amount of money you invest. The insurance company calculates the payments based on actuarial tables and the expected lifespan of the annuitant.

Once the annuity is set up, the insurance company will start making regular payments to you, usually on a monthly basis. These payments are typically fixed and do not change over time, providing a predictable income stream. This can be especially beneficial for retirees who want to budget their expenses and ensure a stable standard of living.

Benefits of Immediate Payment Annuities

Immediate payment annuities offer several benefits for retirees. First and foremost, they provide a reliable and guaranteed income stream for life. This can help alleviate the fear of running out of money in retirement and provide peace of mind.

Another benefit is the potential for higher payouts compared to other retirement income options. Because immediate payment annuities pool the risk among a large group of annuitants, the insurance company can offer higher payouts than an individual could achieve on their own through other investment vehicles.

Immediate payment annuities also offer tax advantages. In many cases, only a portion of the annuity payments is subject to income tax, while the rest is considered a return of principal and is tax-free. This can help retirees minimize their tax liability and maximize their retirement income.

Considerations Before Purchasing Immediate Payment Annuities

While immediate payment annuities can be a valuable retirement income solution, there are some considerations to keep in mind. One important factor is the loss of control over your lump sum investment. Once you purchase an immediate payment annuity, you cannot access the principal amount or make changes to the contract.

It’s also important to carefully consider the financial strength and reputation of the insurance company before purchasing an immediate payment annuity. You want to ensure that the company will be able to fulfill its payment obligations for the duration of your lifetime.

What Are Immediate Payment Annuities?

An immediate payment annuity is a financial product that provides a guaranteed stream of income for a specified period of time or for the rest of your life. It is a type of annuity that starts paying out immediately after the initial investment is made.

When you purchase an immediate payment annuity, you give a lump sum of money to an insurance company in exchange for regular income payments. The amount of the payments is determined by several factors, including the amount of the initial investment, the annuitant’s age, and the prevailing interest rates.

Immediate payment annuities are often used as a retirement income solution because they provide a reliable source of income that can supplement other sources of retirement savings, such as Social Security or a pension. They can help ensure a steady cash flow during retirement, which can be especially beneficial for individuals who do not have a traditional pension plan.

One key feature of immediate payment annuities is that they offer a guaranteed income stream, regardless of market fluctuations. This can provide peace of mind for retirees who are concerned about outliving their savings or who want a predictable income in retirement.

Immediate payment annuities can be structured in different ways to meet individual needs. Some annuities provide fixed payments that do not change over time, while others offer inflation-adjusted payments that increase to keep pace with rising costs of living. There are also options to include a survivor benefit, which ensures that payments continue to a spouse or other beneficiary after the annuitant’s death.

How Immediate Payment Annuities Work

When you purchase an immediate payment annuity, you enter into a contract with an insurance company. The insurance company then assumes the responsibility of managing the funds and making the payments to you. The amount of each payment is determined by several factors, including the size of the premium, your age, and the prevailing interest rates at the time of purchase.

One of the key features of immediate payment annuities is that they provide a fixed income stream. This means that the amount of each payment remains the same throughout the duration of the annuity, regardless of market fluctuations or changes in interest rates. This can provide peace of mind and financial stability, especially for retirees who rely on a consistent income to cover their living expenses.

Another important aspect of immediate payment annuities is the option to choose a specific payout period. You can opt for a fixed number of years or for the rest of your life. If you choose a specific number of years, the payments will continue until the end of the chosen period. However, if you choose the lifetime option, the payments will continue for as long as you live, even if you live longer than expected.

Example of an Immediate Payment Annuity

Let’s say you are 65 years old and have $200,000 that you want to invest in an immediate payment annuity. You choose the lifetime option, which means you want to receive payments for the rest of your life. Based on your age and the prevailing interest rates, the insurance company determines that your monthly payment will be $1,000.

Once you purchase the annuity, the insurance company will start making monthly payments of $1,000 to you for as long as you live. This provides you with a steady income stream that you can rely on to cover your living expenses throughout retirement.

Conclusion

Immediate payment annuities offer a reliable and predictable source of income during retirement. They work by exchanging a lump sum of money for regular payments that start immediately. These payments can be made for a fixed number of years or for the rest of your life. While immediate payment annuities may not be suitable for everyone, they can provide financial stability and peace of mind for those who prioritize a consistent income stream.

Benefits of Immediate Payment Annuities

| 1. Guaranteed Income: | Immediate payment annuities provide a guaranteed income stream for life or a specified period, ensuring that you will receive regular payments regardless of market conditions or investment performance. This can provide peace of mind and financial security during retirement. |

| 2. Stable and Predictable Payments: | Unlike other investment options that may fluctuate in value, immediate payment annuities offer stable and predictable payments. This can help you plan your budget and expenses effectively, knowing exactly how much income you will receive each month. |

| 3. Protection Against Longevity Risk: | One of the biggest concerns for retirees is running out of money during their lifetime. Immediate payment annuities provide protection against longevity risk by ensuring that you will continue to receive income as long as you live, no matter how long that may be. |

| 4. Tax Advantages: | In some countries, immediate payment annuities offer tax advantages. The income received from annuities may be taxed at a lower rate compared to other sources of income, providing potential tax savings for retirees. |

| 5. Flexibility in Payment Options: | Immediate payment annuities offer flexibility in payment options. You can choose to receive payments for a fixed period, such as 10 or 20 years, or for your entire lifetime. You can also opt for joint annuities that provide income for both you and your spouse. |

| 6. Protection Against Inflation: | Some immediate payment annuities offer inflation protection, where the income payments increase over time to keep pace with inflation. This can help maintain your purchasing power and ensure that your income does not erode over the years. |

Overall, immediate payment annuities can provide a reliable and stable source of income during retirement, offering financial security and peace of mind. However, it is important to carefully consider your individual financial goals and circumstances before purchasing an immediate payment annuity.

Considerations Before Purchasing Immediate Payment Annuities

Before purchasing an immediate payment annuity, there are several important considerations to keep in mind. While these annuities can provide a reliable source of retirement income, it is essential to thoroughly evaluate your financial situation and goals.

1. Financial Stability: Assess your current financial stability and determine if you have enough savings to cover any unexpected expenses or emergencies. An immediate payment annuity will provide a fixed income stream, so it’s crucial to ensure you have enough funds for other financial needs.

2. Retirement Goals: Consider your retirement goals and how an immediate payment annuity fits into your overall financial plan. Evaluate if the annuity’s income stream aligns with your desired lifestyle and retirement objectives.

3. Inflation Protection: Immediate payment annuities do not typically provide inflation protection. This means that the fixed income you receive may not keep up with the rising cost of living over time. Consider if you need to supplement your annuity income with other investments or strategies to account for inflation.

4. Longevity Risk: An immediate payment annuity guarantees income for life, regardless of how long you live. While this provides security, it also means that if you pass away early, you may not receive the full value of your initial investment. Evaluate your health and family history to determine if this risk is acceptable to you.

5. Liquidity Needs: Immediate payment annuities are generally illiquid, meaning that once you purchase the annuity, it can be challenging to access the funds. Consider if you have any immediate or future liquidity needs that may require a more flexible investment option.

6. Shop Around: Before purchasing an immediate payment annuity, it is essential to shop around and compare different annuity providers. Compare the rates, fees, and terms offered by various companies to ensure you are getting the best possible deal.

7. Seek Professional Advice: Consider consulting with a financial advisor or retirement specialist who can provide personalized guidance based on your unique financial situation. They can help you evaluate the pros and cons of immediate payment annuities and determine if it is the right choice for your retirement plan.

| Considerations Before Purchasing Immediate Payment Annuities |

|---|

| 1. Financial Stability |

| 2. Retirement Goals |

| 3. Inflation Protection |

| 4. Longevity Risk |

| 5. Liquidity Needs |

| 6. Shop Around |

| 7. Seek Professional Advice |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.