Different Types of Endowments

1. Restricted Endowments

Restricted endowments are funds that are designated for a specific purpose or use. The donor specifies how the funds should be used, and the organization or institution must adhere to these restrictions. For example, a donor may establish a restricted endowment to provide scholarships for students studying a particular field or to support a specific research project. The funds in a restricted endowment cannot be used for any other purpose without the donor’s permission.

2. Unrestricted Endowments

Unrestricted endowments, on the other hand, provide more flexibility to the organization or institution. These funds can be used for any purpose that supports the organization’s mission or goals. While the donor may have specific preferences for how the funds should be used, they do not impose strict restrictions. This allows the organization to allocate the funds where they are most needed at any given time.

3. Quasi-Endowments

Quasi-endowments are funds that are treated like endowments but do not meet the traditional definition. These funds are typically created from surplus operating funds or other sources within the organization. While they are not true endowments, they are managed and invested in a similar manner. The income generated from quasi-endowments can be used to support the organization’s activities, but the principal remains intact.

Policies Governing Endowments

Endowments are governed by a set of policies that outline how the funds can be used and managed. These policies are put in place to ensure the long-term sustainability and effectiveness of the endowment. Here are some common policies that govern endowments:

1. Spending Policy:

The spending policy determines how much of the endowment’s funds can be spent each year. This policy is typically based on a percentage of the endowment’s total value, such as 4% or 5%. The goal is to strike a balance between providing a steady stream of income for the designated purpose and preserving the principal amount for future generations.

The investment policy outlines how the endowment’s funds should be invested to generate returns. It sets guidelines for asset allocation, risk tolerance, and diversification. The goal is to maximize returns while managing risk to ensure the long-term growth of the endowment.

3. Governance Policy:

The governance policy establishes the structure and responsibilities of the individuals or entities involved in managing the endowment. This may include a board of trustees or an investment committee. The policy outlines their roles, decision-making processes, and accountability measures.

4. Distribution Policy:

The distribution policy determines how the funds generated from the endowment’s investments are distributed. It specifies the beneficiaries or programs that will receive the funds and the criteria for eligibility. The policy ensures that the funds are used in accordance with the endowment’s purpose and goals.

5. Reporting Policy:

The reporting policy requires regular reporting on the performance and financial status of the endowment. This includes providing updates on investment returns, spending, and any changes to the endowment’s policies. The policy promotes transparency and accountability to the stakeholders and donors.

These policies play a crucial role in ensuring that endowments are managed responsibly and in alignment with their intended purpose. They provide a framework for decision-making, accountability, and long-term sustainability. By adhering to these policies, endowments can continue to make a positive impact for generations to come.

Benefits of Endowments

Endowments offer numerous benefits to both individuals and organizations. Here are some key advantages:

1. Long-Term Financial Stability

One of the main benefits of endowments is that they provide long-term financial stability. By establishing an endowment, individuals or organizations can ensure a steady stream of income for years to come. This stability can be especially beneficial for non-profit organizations or educational institutions that rely on consistent funding to support their operations.

2. Perpetual Giving

Endowments are designed to be perpetual, meaning that the principal amount is preserved and only a portion of the investment earnings is used for spending. This allows the endowment to continue supporting its designated cause indefinitely. By setting up an endowment, individuals can leave a lasting legacy and make a significant impact on the causes they care about.

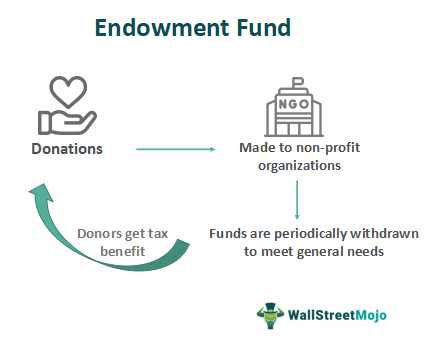

3. Tax Benefits

Contributions made to endowments often come with tax benefits. In many countries, donations to registered non-profit organizations or charitable foundations are tax-deductible. By making a contribution to an endowment, individuals can reduce their taxable income and potentially lower their overall tax liability.

4. Donor Control

Endowments provide donors with a high level of control over how their funds are used. Donors can specify the purpose of their endowment, such as supporting scholarships, funding research, or preserving a particular cultural institution. This level of control allows donors to align their philanthropic goals with the mission and values of the organization receiving the endowment.

5. Investment Growth

Endowments are typically invested in a diversified portfolio, aiming for long-term growth. This investment strategy can lead to significant growth over time, increasing the value of the endowment and allowing for larger contributions to the designated cause. The potential for investment growth can further enhance the impact of the endowment and ensure its sustainability.

Considerations for Establishing an Endowment

Establishing an endowment is a significant decision that requires careful consideration. Here are some key factors to keep in mind:

1. Purpose and Mission

Before establishing an endowment, it is crucial to define the purpose and mission of the organization or institution that will benefit from it. The endowment should align with the long-term goals and values of the organization.

2. Financial Stability

3. Investment Strategy

Developing an investment strategy is a critical aspect of establishing an endowment. Determine the level of risk tolerance, desired returns, and asset allocation that align with the organization’s financial goals. It may be beneficial to seek advice from financial professionals or investment advisors.

4. Fundraising Efforts

Consider the organization’s ability to raise funds to support the endowment. Developing a comprehensive fundraising plan and engaging with potential donors is crucial for the success of the endowment. It is essential to have a clear strategy for attracting and retaining donors over the long term.

5. Governance and Policies

Establishing clear governance and policies for the endowment is essential to ensure its proper management and use. Define how the endowment will be governed, who will have decision-making authority, and how funds will be allocated. Consider creating an endowment committee or working with existing governance structures.

6. Legal and Tax Considerations

Consult with legal and tax professionals to understand the legal and tax implications of establishing an endowment. Different jurisdictions may have specific regulations and requirements that need to be followed. Ensure compliance with all applicable laws and regulations to avoid any legal or financial complications.

By carefully considering these factors, organizations can establish an endowment that aligns with their goals and values, ensuring long-term financial stability and support for their mission.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.