What is Commercial Insurance?

Commercial insurance is a type of insurance that provides coverage for businesses and organizations against potential financial losses and liabilities. It is designed to protect businesses from various risks and uncertainties that can arise in the course of their operations.

Commercial insurance policies typically cover a wide range of risks, including property damage, liability claims, theft, employee injuries, and business interruption. The specific coverage and terms of a commercial insurance policy may vary depending on the type of business and the industry it operates in.

Importance of Commercial Insurance

Commercial insurance is essential for businesses of all sizes as it helps them manage and mitigate the financial risks associated with their operations. Here are some key reasons why commercial insurance is important:

- Protection against property damage: Commercial insurance provides coverage for damage to property owned or leased by a business, including buildings, equipment, and inventory.

- Liability coverage: Commercial insurance protects businesses from legal claims and lawsuits that may arise due to bodily injury, property damage, or advertising injury caused by the business or its products/services.

- Business continuity: In the event of a covered loss or damage, commercial insurance can help businesses recover and resume their operations by providing financial support for repairs, replacement of assets, and temporary relocation.

- Employee protection: Commercial insurance often includes coverage for employee injuries and illnesses, providing medical benefits, disability income, and compensation for work-related injuries.

- Compliance with legal requirements: Many industries and jurisdictions require businesses to have certain types of commercial insurance coverage, such as workers’ compensation insurance or professional liability insurance.

Overall, commercial insurance plays a crucial role in safeguarding businesses from unexpected events and ensuring their long-term stability and success.

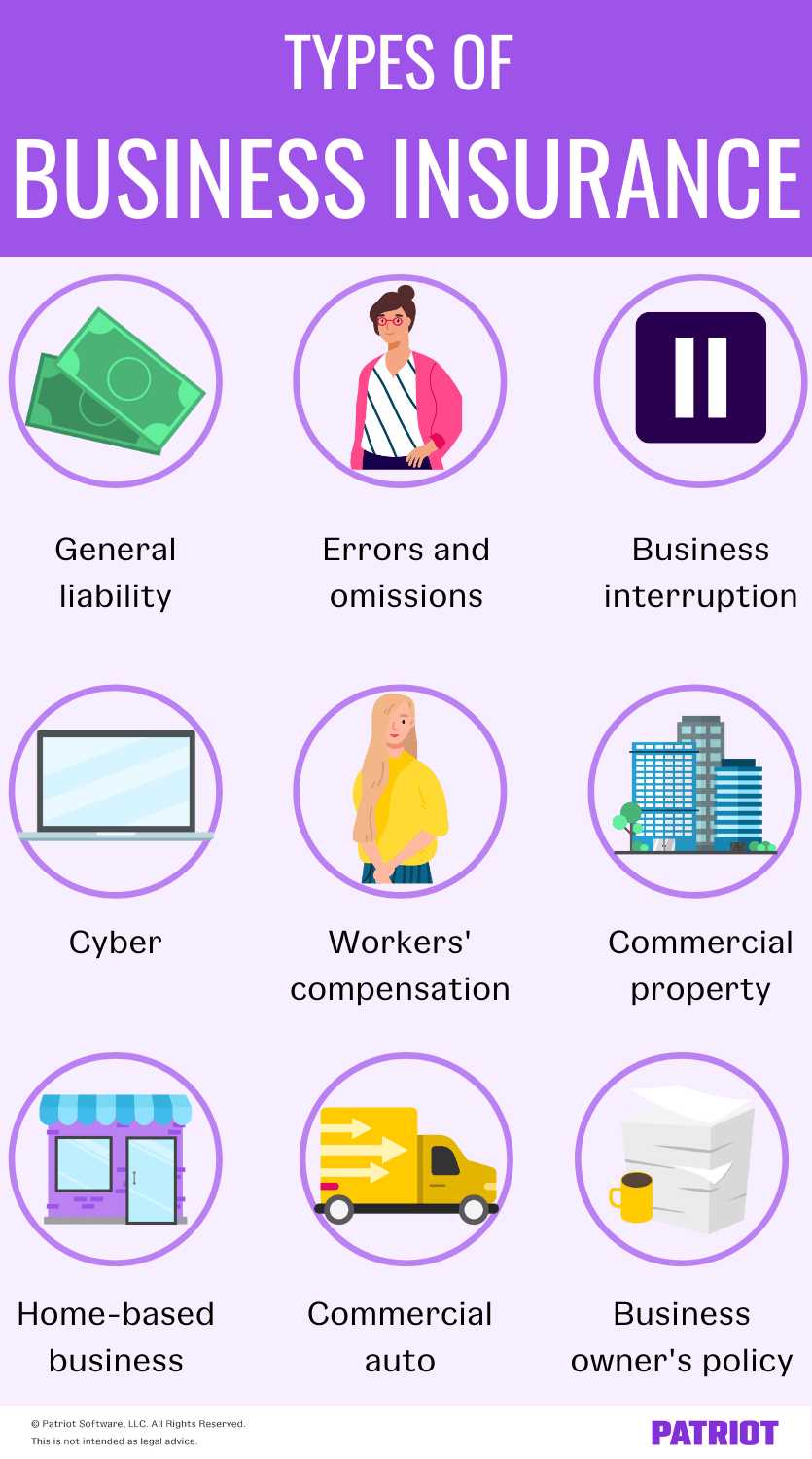

Types of Commercial Insurance

| Type of Insurance | Description |

|---|---|

| General Liability Insurance | This type of insurance provides coverage for third-party bodily injury, property damage, and personal injury claims that may arise during the course of your business operations. |

| Property Insurance | Property insurance protects your business property, including buildings, equipment, inventory, and furniture, against damage or loss caused by fire, theft, vandalism, or other covered perils. |

| Business Interruption Insurance | This insurance provides coverage for lost income and expenses if your business operations are interrupted or temporarily shut down due to a covered event, such as a fire or natural disaster. |

| Professional Liability Insurance | |

| Workers’ Compensation Insurance | Workers’ compensation insurance provides coverage for medical expenses and lost wages for employees who are injured or become ill while performing their job duties. |

| Commercial Auto Insurance | This insurance covers vehicles used for business purposes, such as company cars or trucks, against damage or liability in case of an accident. |

| Cyber Liability Insurance | Cyber liability insurance protects businesses against the financial losses and liabilities associated with data breaches, cyberattacks, and other cyber incidents. |

Benefits of Commercial Insurance

1. Asset Protection

One of the main benefits of commercial insurance is asset protection. Commercial insurance policies can cover a wide range of assets, including buildings, equipment, inventory, and vehicles. In the event of a covered loss, such as a fire or theft, the insurance company will provide compensation to help repair or replace the damaged or stolen assets. This can help businesses avoid significant financial losses and continue their operations smoothly.

2. Liability Coverage

Commercial insurance also provides liability coverage, which protects businesses from legal claims and lawsuits. If a customer or third party is injured on the business premises or as a result of the business’s products or services, the insurance company will cover the costs of legal defense and any settlements or judgments awarded against the business. This can help businesses avoid bankruptcy or financial ruin due to legal expenses.

3. Business Interruption Coverage

In the event of a covered loss, such as a natural disaster or a fire, commercial insurance can provide business interruption coverage. This coverage compensates businesses for lost income and ongoing expenses during the period of interruption. It can help businesses stay afloat and recover more quickly after a significant loss.

4. Peace of Mind

Having commercial insurance can provide business owners with peace of mind. Knowing that their assets are protected, their liability risks are covered, and their business can recover from unexpected events can alleviate stress and allow business owners to focus on running their businesses. Commercial insurance provides a safety net that can give business owners the confidence to take risks and pursue growth opportunities.

Choosing the Right Commercial Insurance

Assess Your Business Risks

Research Different Insurance Providers

Next, research different insurance providers to find one that offers the coverage you require at a competitive price. Look for providers that specialize in commercial insurance and have a strong reputation for customer service. Read reviews and compare quotes to ensure you are getting the best value for your money.

Review Policy Coverage and Exclusions

Once you have narrowed down your options, carefully review the coverage and exclusions of each policy. Make sure the policy covers all the essential areas of your business and provides adequate protection. Pay attention to any exclusions or limitations that may affect your coverage.

Consider Additional Coverage Options

In addition to the basic coverage, consider any additional coverage options that may be beneficial for your business. This could include coverage for specific risks or endorsements that enhance your policy. Discuss these options with your insurance provider to determine if they are necessary for your business.

Seek Professional Advice

If you are unsure about which commercial insurance policy is right for your business, consider seeking professional advice. An insurance broker or agent can help you navigate the complexities of commercial insurance and provide personalized recommendations based on your unique needs.

By following these steps and taking the time to choose the right commercial insurance, you can protect your business from potential risks and ensure its long-term success.

1. General Liability Insurance: This type of policy provides coverage for third-party bodily injury, property damage, and personal injury claims that may arise from your business operations. It protects your business from lawsuits and helps cover legal expenses.

2. Property Insurance: Property insurance covers the physical assets of your business, including buildings, equipment, inventory, and furniture, against damage or loss caused by fire, theft, vandalism, or other covered perils. It helps you recover financially and resume operations after a covered event.

4. Workers’ Compensation Insurance: Workers’ compensation insurance provides coverage for medical expenses and lost wages for employees who are injured or become ill on the job. It is required by law in most states and helps protect both employees and employers.

5. Cyber Liability Insurance: With the increasing reliance on technology, cyber liability insurance is becoming more important for businesses. It provides coverage for data breaches, cyberattacks, and other cyber-related risks that can result in financial loss, reputational damage, and legal liabilities.

It is important to carefully review and understand the terms and conditions of each policy before purchasing commercial insurance. Consider working with an experienced insurance agent or broker who can help you navigate the complexities of insurance policies and ensure that you have adequate coverage for your business.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.