What are Unaffiliated Investments?

Unaffiliated investments refer to investments made by a company or individual in entities that are not affiliated with them. These investments are typically made in companies or organizations that operate in different industries or sectors.

Unlike affiliated investments, where the investor has some form of control or influence over the entity, unaffiliated investments are made purely for financial gain. The investor does not have any say in the management or decision-making processes of the invested entity.

One of the key advantages of unaffiliated investments is the potential for higher returns. By investing in different companies or organizations, investors can benefit from the growth and success of multiple entities. This can help mitigate the risk of investing in a single company or industry.

However, unaffiliated investments also come with their own set of risks. The performance of the invested entities can fluctuate, and there is no guarantee of returns. Investors need to carefully analyze and assess the financial health and prospects of the entities they are investing in.

Overall, unaffiliated investments play an important role in diversifying investment portfolios and potentially generating higher returns. However, they require careful consideration and analysis to mitigate risks and maximize potential gains.

The History of Unaffiliated Investments

Early Origins

The concept of unaffiliated investments can be traced back to ancient times when traders and merchants would diversify their wealth by investing in various ventures. In ancient Greece, for example, wealthy individuals would invest in ships and trade routes to expand their fortunes.

During the Middle Ages, the rise of banking and the establishment of financial institutions provided individuals with more opportunities to invest their money. Merchants and nobles would invest in land, commodities, and even other businesses to generate additional income.

Modern Development

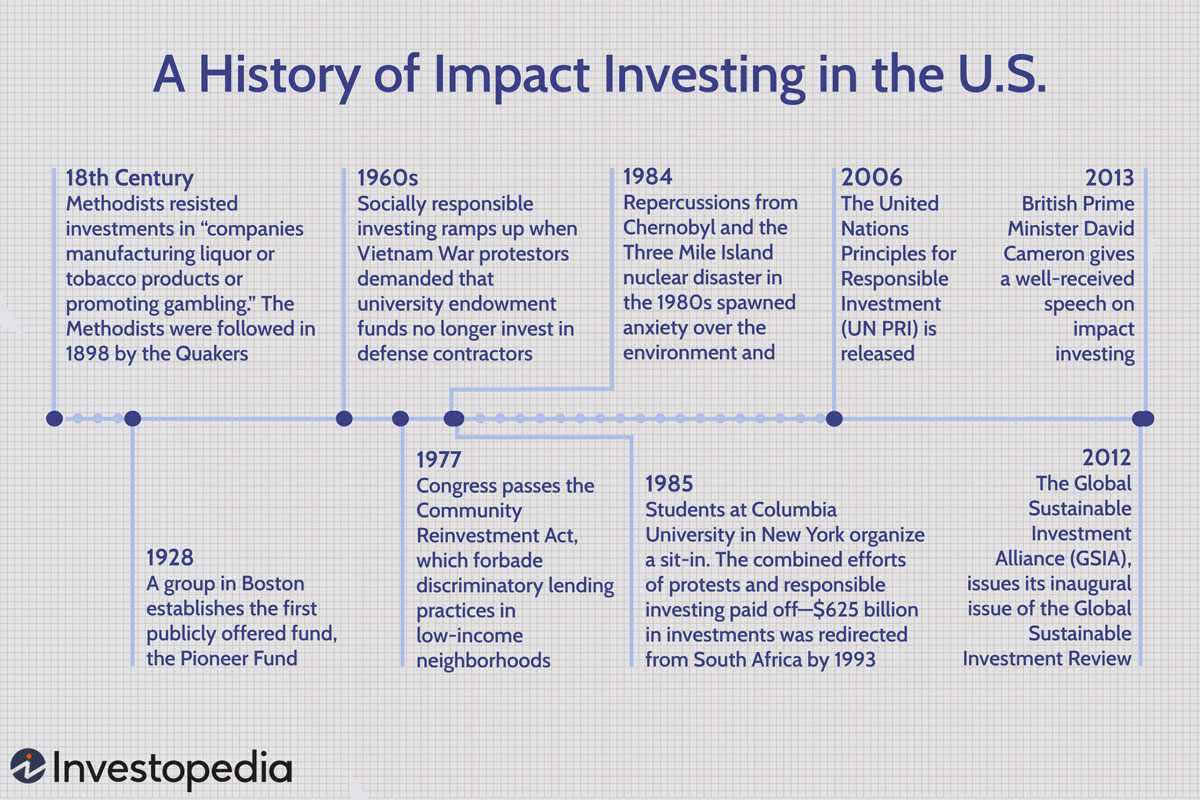

The modern concept of unaffiliated investments began to take shape in the 20th century with the growth of the stock market and the emergence of investment funds. Individuals and organizations started to invest in stocks, bonds, and mutual funds as a way to diversify their portfolios and potentially earn higher returns.

In the 21st century, the rise of technology and the internet has revolutionized the investment landscape. Online trading platforms and robo-advisors have made it easier for individuals to invest in a wide range of assets, including stocks, cryptocurrencies, and alternative investments.

Benefits and Risks

Unaffiliated investments offer several benefits to investors. They provide diversification, which can help reduce risk and potentially increase returns. They also offer the opportunity to invest in different industries and sectors, allowing investors to take advantage of emerging trends and opportunities.

However, unaffiliated investments also come with risks. The value of financial assets can fluctuate, and investors may experience losses. Additionally, investing in unfamiliar industries or markets can be challenging and requires thorough research and analysis.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.