Transferable Letter of Credit: Definition and Advantages

A transferable letter of credit is a financial instrument that allows a beneficiary to transfer all or part of the credit they receive to another party. This type of letter of credit is commonly used in international trade transactions, where multiple parties are involved in the supply chain.

It is important to note that a transferable letter of credit is different from a non-transferable letter of credit. In a non-transferable letter of credit, the beneficiary cannot transfer the credit to another party. Instead, they can only use the credit for their own benefit.

What is a Transferable Letter of Credit?

A transferable letter of credit is a financial instrument that allows a beneficiary (the seller) to transfer all or part of the proceeds of a letter of credit to another party (the second beneficiary). This type of letter of credit is commonly used in international trade transactions where the original beneficiary is acting as an intermediary or middleman.

How Does a Transferable Letter of Credit Work?

When a transferable letter of credit is issued, the original beneficiary (the seller) will negotiate the terms of the sales contract with the buyer. Once the terms are agreed upon, the buyer will arrange for a letter of credit to be issued in favor of the seller.

The letter of credit will specify the amount of money that will be paid to the seller upon presentation of the required documents. The seller can then use this letter of credit as collateral to obtain financing from a bank or other financial institution.

If the seller wants to transfer their rights to the proceeds of the letter of credit to another party, they will need to obtain the consent of the issuing bank. The issuing bank will review the request and determine whether or not to allow the transfer.

Once the transfer is approved, the original beneficiary will provide the second beneficiary with the necessary documents and instructions to present to the issuing bank in order to receive payment. The second beneficiary will then present these documents to the issuing bank and receive the proceeds of the letter of credit.

Advantages of Using a Transferable Letter of Credit

There are several advantages to using a transferable letter of credit in international trade transactions:

- Flexibility: A transferable letter of credit allows the original beneficiary to involve another party in the transaction, providing flexibility in fulfilling the terms of the sales contract.

- Access to Financing: The original beneficiary can use the letter of credit as collateral to obtain financing from a bank or other financial institution, which can help facilitate the transaction.

- Reduced Risk: By involving another party in the transaction, the original beneficiary can reduce their risk and ensure that the terms of the sales contract are fulfilled.

How Does a Transferable Letter of Credit Work?

A transferable letter of credit is a financial instrument that allows a beneficiary (the seller) to transfer all or part of the credit to another party (the second beneficiary). This type of letter of credit is commonly used in international trade transactions where the original beneficiary is acting as an intermediary or middleman.

Here is a step-by-step explanation of how a transferable letter of credit works:

Step 1: Issuance of the Letter of Credit

The buyer (importer) requests their bank (issuing bank) to issue a letter of credit in favor of the seller (original beneficiary). The letter of credit specifies the terms and conditions of the transaction, including the amount, expiry date, and documents required for payment.

Step 2: Transfer of the Letter of Credit

The original beneficiary (seller) approaches their bank (advising bank) and requests the transfer of the letter of credit to the second beneficiary. The original beneficiary provides the advising bank with the necessary documents, such as a transfer request and a letter of indemnity.

Step 3: Confirmation by the Advising Bank

The advising bank reviews the transfer request and the supporting documents provided by the original beneficiary. If everything is in order, the advising bank confirms the transfer of the letter of credit to the second beneficiary.

Step 4: Presentation of Documents by the Second Beneficiary

The second beneficiary (intermediary or middleman) prepares the goods or services as per the terms of the letter of credit. They then present the required documents to the advising bank for examination and verification.

Step 5: Payment to the Second Beneficiary

If the documents presented by the second beneficiary comply with the terms and conditions of the letter of credit, the advising bank makes payment to the second beneficiary. The payment is usually made through the issuing bank, which has an obligation to honor the letter of credit.

In summary, a transferable letter of credit allows the original beneficiary to transfer their rights to another party, who can then receive payment upon fulfilling the terms of the letter of credit. This mechanism provides flexibility and convenience in international trade transactions, especially when an intermediary is involved.

Advantages of Using a Transferable Letter of Credit

A transferable letter of credit offers several advantages for both the buyer and the seller. Here are some of the key benefits:

1. Facilitates International Trade:

A transferable letter of credit simplifies international trade transactions by providing a secure and reliable method of payment. It allows the seller to receive payment from an intermediary bank, which reduces the risk of non-payment and ensures that the seller gets paid for their goods or services.

2. Increases Market Opportunities:

By using a transferable letter of credit, the seller can expand their market opportunities by selling to buyers who may not have the necessary creditworthiness or financial resources to make direct payments. This opens up new markets and allows the seller to reach a wider customer base.

3. Enhances Cash Flow:

With a transferable letter of credit, the seller can receive payment from the intermediary bank before the buyer makes payment. This improves the seller’s cash flow and provides them with immediate access to funds, which can be used for various business purposes such as purchasing raw materials or paying suppliers.

4. Mitigates Risk:

5. Increases Trust and Credibility:

Using a transferable letter of credit demonstrates trust and credibility between the buyer, seller, and the intermediary bank. It shows that all parties are committed to fulfilling their obligations and ensures a smooth and efficient transaction process. This can help build long-term relationships and encourage repeat business.

6. Flexibility in Financing Options:

A transferable letter of credit offers flexibility in financing options for the seller. They can use the letter of credit as collateral to obtain financing from banks or other financial institutions. This can help the seller secure additional funds for their business operations or invest in growth opportunities.

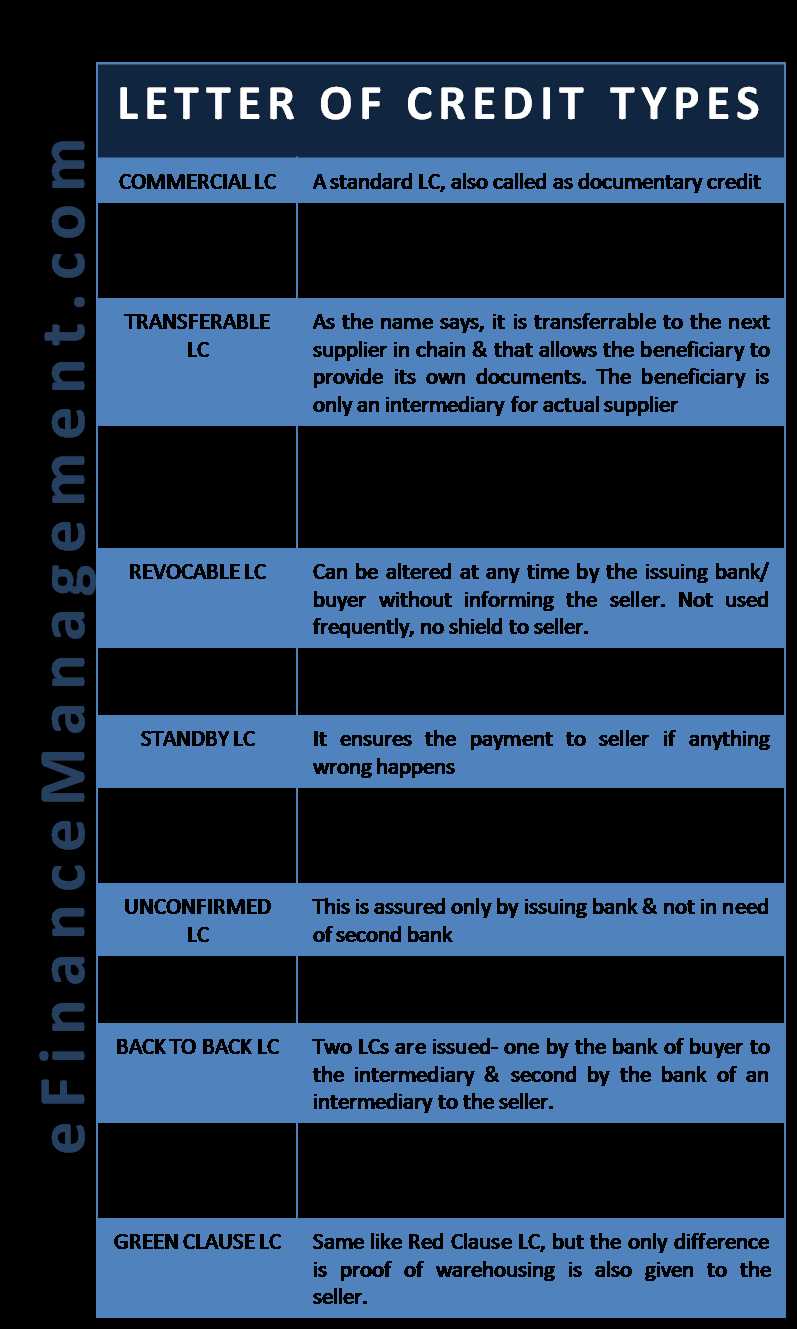

Differences Between Transferable and Non-Transferable Letters of Credit

Definition of Transferable Letter of Credit

A transferable letter of credit is a financial instrument that allows the original beneficiary (the seller) to transfer all or part of the credit to another party (the second beneficiary). This means that the seller can use the letter of credit to secure payment for goods or services from a third party.

Definition of Non-Transferable Letter of Credit

In contrast, a non-transferable letter of credit is issued only in favor of the original beneficiary and cannot be transferred to any other party. The original beneficiary is the only party entitled to receive payment under a non-transferable letter of credit.

Differences in Flexibility

One of the key differences between transferable and non-transferable letters of credit is the level of flexibility they offer. A transferable letter of credit provides greater flexibility as it allows the seller to transfer the credit to another party. This can be beneficial in situations where the seller is acting as a middleman or when multiple suppliers are involved in fulfilling an order.

On the other hand, a non-transferable letter of credit is less flexible as it restricts payment to the original beneficiary only. This can be a disadvantage in situations where the seller wants to involve other parties in the transaction or needs to subcontract part of the order.

Differences in Risk Allocation

Another important difference between transferable and non-transferable letters of credit is the allocation of risk. In a transferable letter of credit, the risk is shared between the original beneficiary and the second beneficiary. If the second beneficiary fails to fulfill their obligations, the original beneficiary is still responsible for payment to the issuing bank.

On the other hand, in a non-transferable letter of credit, the risk is solely on the original beneficiary. If the buyer fails to make payment, the original beneficiary bears the loss and cannot transfer the risk to another party.

Differences in Cost

Transferable letters of credit are generally more expensive than non-transferable letters of credit. This is because the issuing bank incurs additional administrative costs and assumes a higher level of risk when allowing the transfer of credit to another party.

Conclusion

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.