Transfer on Death (TOD): What It Is and How the Process Works

Transfer on Death (TOD) is a legal arrangement that allows individuals to designate beneficiaries for their assets, such as bank accounts, investments, and real estate, to transfer automatically upon their death. This process is commonly used in estate planning to ensure a smooth transfer of assets to the intended beneficiaries without the need for probate.

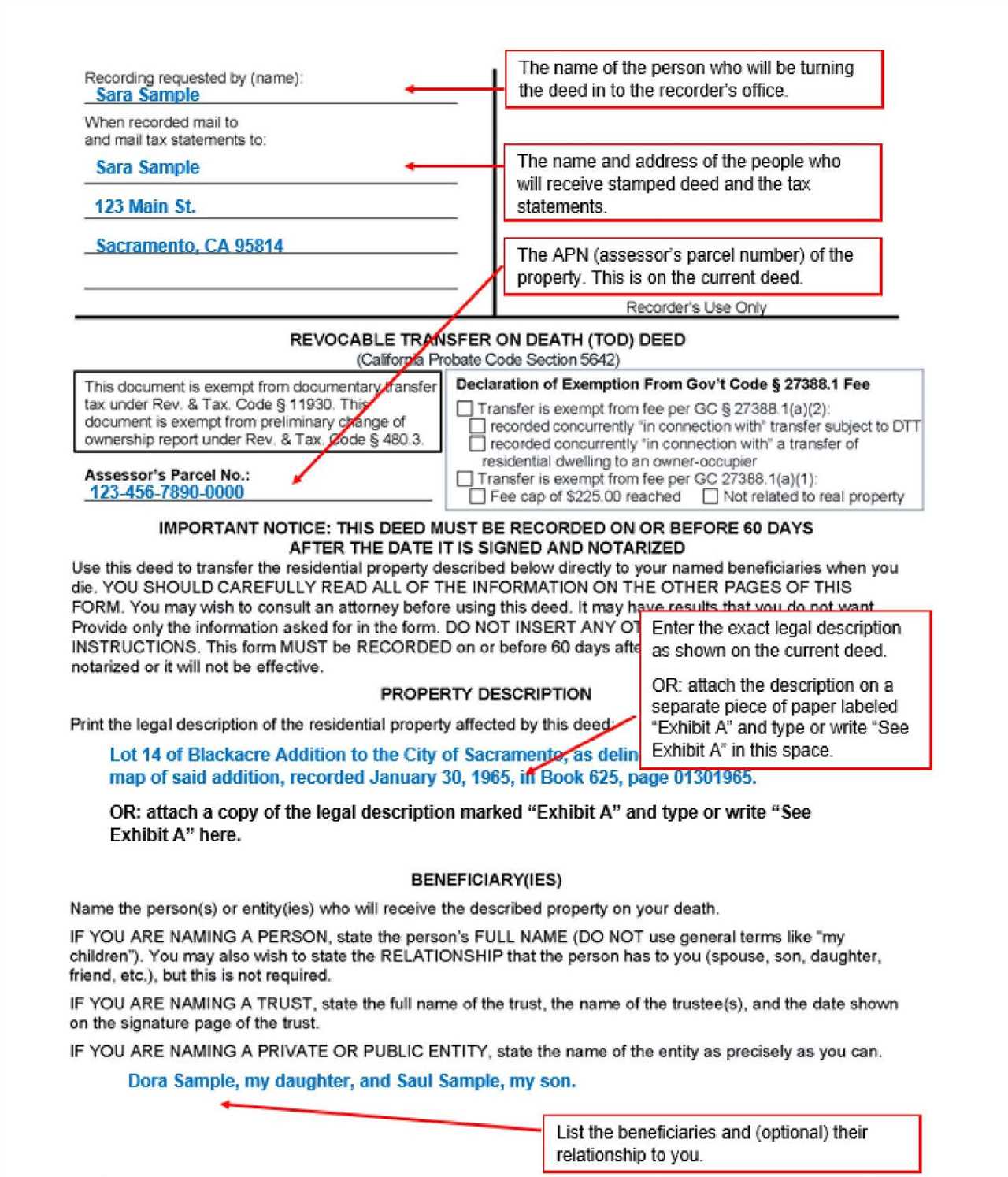

The TOD process involves the owner of the assets completing a beneficiary designation form provided by the financial institution or the relevant authority. The form requires the owner to specify the beneficiaries who will receive the assets upon their death. The beneficiaries can be individuals, organizations, or even trusts.

Once the beneficiary designation form is completed and submitted, the assets will be transferred directly to the designated beneficiaries upon the owner’s death. It is important to note that the assets will not pass through the probate process, which can be time-consuming and costly.

One of the key advantages of using the TOD process is the avoidance of probate. Probate is a legal process that validates a deceased person’s will and ensures the proper distribution of assets. By using TOD, individuals can bypass this process, saving time and money for their beneficiaries.

Another benefit of the TOD process is privacy. Unlike probate, which is a public process, the transfer of assets through TOD is private and confidential. This means that the details of the assets and the beneficiaries remain confidential, which can be important for individuals who value their privacy.

However, it is important to consider some factors before opting for the TOD process. For example, if the designated beneficiaries pass away before the owner, the assets may end up in the owner’s estate and go through probate. Additionally, if there are multiple beneficiaries, conflicts may arise regarding the distribution of assets.

The transfer on death (TOD) process is a legal mechanism that allows individuals to designate beneficiaries for their assets, such as real estate, bank accounts, and investments, to ensure a smooth transfer of ownership upon their death. This process can be an effective estate planning tool, as it helps avoid probate and simplifies the transfer of assets to the intended beneficiaries.

When setting up a transfer on death designation, individuals must specify the beneficiaries who will receive their assets upon their death. These beneficiaries can be individuals, organizations, or even trusts. It is important to clearly identify the beneficiaries and their respective shares to avoid any confusion or disputes in the future.

Once the transfer on death designation is established, the assets will automatically transfer to the designated beneficiaries upon the individual’s death, without the need for probate court involvement. This can save time and money, as probate can be a lengthy and costly process.

It is important to regularly review and update the transfer on death designations as circumstances change. For example, if a beneficiary passes away or if the individual wishes to change the beneficiaries, it is crucial to update the designation accordingly. Failure to update the designation can result in unintended consequences and disputes among family members or other interested parties.

While the transfer on death process can be a convenient and efficient way to transfer assets, there are some considerations to keep in mind. For example, the transfer on death designation takes precedence over any conflicting provisions in a will or trust. Therefore, it is important to ensure that the transfer on death designation aligns with the individual’s overall estate planning goals.

Benefits and Considerations of Transfer on Death (TOD) Planning

Transfer on Death (TOD) planning is a valuable tool that allows individuals to transfer their assets to designated beneficiaries without the need for probate. This process offers several benefits and considerations that individuals should be aware of when considering TOD planning.

Benefits of TOD Planning

- Avoidance of Probate: One of the primary benefits of TOD planning is the ability to bypass the probate process. Probate can be a lengthy and costly process, and by utilizing TOD planning, individuals can ensure a smooth transfer of assets to their beneficiaries.

- Privacy: Probate is a public process, meaning that the details of an individual’s estate become part of the public record. By using TOD planning, individuals can maintain privacy since the transfer of assets occurs outside of probate.

- Flexibility: TOD planning allows individuals to retain control over their assets during their lifetime. They can change or revoke the beneficiaries designated on their TOD accounts at any time, providing flexibility and the ability to adapt to changing circumstances.

- Cost Savings: Since TOD planning avoids probate, it can result in significant cost savings. Probate fees and court costs can be substantial, and by utilizing TOD planning, individuals can minimize these expenses.

Considerations for TOD Planning

- Designation of Beneficiaries: It is crucial to carefully consider and designate the beneficiaries of TOD accounts. Individuals should ensure that their chosen beneficiaries are trustworthy and capable of managing the assets they will receive.

- Coordination with Overall Estate Plan: TOD planning should be coordinated with an individual’s overall estate plan to ensure that all assets are appropriately accounted for and distributed according to their wishes.

- Tax Implications: It is essential to understand the potential tax implications of TOD planning. While TOD transfers generally avoid probate, they may still be subject to estate or inheritance taxes, depending on the jurisdiction and the value of the assets transferred.

- Professional Guidance: TOD planning can be complex, and it is advisable to seek professional guidance from an estate planning attorney or financial advisor. They can provide personalized advice and ensure that the TOD planning aligns with an individual’s overall financial goals.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.