Exploring the Meaning and Implications of “Too Big to Fail”

When we talk about “Too Big to Fail,” we are referring to the concept that certain financial institutions are so large and interconnected that their failure would have severe consequences for the entire economy. These institutions are considered too big to be allowed to fail because their collapse could trigger a domino effect, leading to a widespread financial crisis.

The implications of “Too Big to Fail” are far-reaching and have been a topic of intense debate in the financial industry and among policymakers. On one hand, proponents argue that these institutions play a crucial role in the economy, providing essential financial services and supporting economic growth. They argue that allowing such institutions to fail would lead to a loss of confidence in the financial system, causing a credit crunch and deepening any ongoing economic downturn.

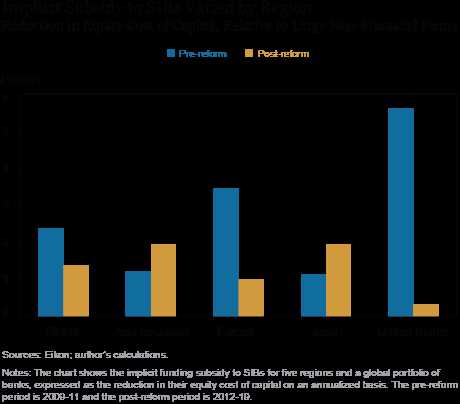

The debate surrounding “Too Big to Fail” has led to various regulatory reforms aimed at addressing the issue. These reforms include increased capital requirements for large financial institutions, the implementation of stress tests to assess their resilience, and the establishment of resolution frameworks to facilitate the orderly wind-down of failing institutions. The goal of these reforms is to reduce the likelihood of future bailouts and ensure that large financial institutions can be safely resolved without causing widespread economic disruption.

Examining the History of “Too Big to Fail”

The concept of “too big to fail” has a long and complex history that dates back to the early 20th century. It emerged as a result of the increasing size and interconnectedness of financial institutions, particularly banks, and the potential risks they posed to the stability of the overall financial system.

In the United States, the term “too big to fail” gained prominence during the Great Depression of the 1930s. The collapse of numerous large banks during this period had severe consequences for the economy, leading to widespread bank runs, job losses, and a deepening economic crisis. In response, the government implemented a series of reforms aimed at preventing future bank failures and protecting depositors’ funds.

However, it was not until the 1980s and 1990s that the concept of “too big to fail” became a central issue in financial regulation. The deregulation of the banking industry during this period, coupled with the increasing complexity and globalization of financial markets, created new challenges for policymakers and regulators.

The 2008 financial crisis served as a stark reminder of the risks posed by institutions deemed “too big to fail.” The collapse of Lehman Brothers, one of the largest investment banks at the time, sent shockwaves through the global financial system and triggered a severe recession. Governments around the world were forced to intervene and provide massive bailouts to prevent the collapse of other systemically important institutions.

Since the financial crisis, there have been ongoing debates and discussions about how to address the issue of “too big to fail.” Regulators have implemented various reforms aimed at reducing the risks posed by large financial institutions, including stricter capital requirements, stress testing, and the creation of resolution frameworks for orderly bank failures.

The Role of “Too Big to Fail” in the Modern Financial System

The concept of “too big to fail” continues to be a contentious issue in the modern financial system. Critics argue that the implicit government guarantee enjoyed by large financial institutions creates moral hazard, as it encourages excessive risk-taking and undermines market discipline. They argue that these institutions should be allowed to fail, just like any other business, to ensure a level playing field and prevent future crises.

Proponents of the “too big to fail” doctrine, on the other hand, argue that the collapse of a systemically important institution could have catastrophic consequences for the economy. They believe that the government has a responsibility to step in and prevent such failures to protect the stability of the financial system and avoid the systemic risks associated with a disorderly collapse.

The Future of “Too Big to Fail”

Ultimately, finding the right balance between promoting financial stability and ensuring market discipline is a complex and challenging task. The history of “too big to fail” serves as a reminder of the importance of robust regulation and oversight in maintaining a resilient and stable financial system.

Tracing the Origins and Evolution of the Concept

The concept of “too big to fail” has its origins in the financial industry, specifically in relation to large banks and financial institutions. It refers to the idea that some institutions are so large and interconnected that their failure would have catastrophic consequences for the overall economy. This concept gained prominence during the financial crisis of 2008, when several major banks were on the verge of collapse.

The origins of the concept can be traced back to the early 20th century, when the United States experienced a series of banking crises. These crises highlighted the risks associated with large banks and the potential for their failure to have a ripple effect throughout the economy. As a result, policymakers and regulators began to recognize the need for measures to prevent the failure of these institutions.

Despite these reforms, the concept of “too big to fail” continues to be a topic of debate and concern. Critics argue that the reforms have not gone far enough in addressing the risks posed by large institutions, and that further measures are needed to prevent future financial crises. Proponents, on the other hand, argue that the reforms have made the financial system more resilient and better equipped to handle the failure of large institutions.

| Origins | Evolution |

|---|---|

| The concept originated in the early 20th century in response to banking crises. | |

| Early recognition of the risks associated with large banks. | Globalization and interdependence of financial markets heightened concerns. |

| Policymakers and regulators recognized the need for measures to prevent failure. | Regulatory frameworks and policies were developed to mitigate risks. |

Analyzing Reforms for “Too Big to Fail”

One key reform that has been implemented is the creation of resolution regimes. These regimes aim to provide a framework for the orderly resolution of failing financial institutions, without resorting to taxpayer-funded bailouts. Under these regimes, regulators have the authority to impose losses on shareholders and creditors, and to transfer the operations of a failing institution to a new owner. This helps to ensure that the costs of failure are borne by those who have benefited from the institution’s activities, rather than by taxpayers.

Another reform that has been pursued is the implementation of stricter capital requirements for systemically important banks. By requiring these institutions to hold higher levels of capital, regulators aim to enhance their resilience and reduce the likelihood of failure. This is intended to provide a buffer against losses and ensure that banks have sufficient resources to absorb shocks without requiring government support.

In addition to resolution regimes and capital requirements, regulators have also focused on improving the supervision and oversight of systemically important financial institutions. This includes conducting regular stress tests to assess the resilience of these institutions under adverse economic conditions, as well as implementing enhanced risk management and governance standards.

Furthermore, there has been a push for greater transparency and disclosure requirements for systemically important banks. By providing more information to market participants and regulators, these requirements aim to improve market discipline and enable better assessment of the risks associated with these institutions. This can help to reduce the likelihood of excessive risk-taking and enhance market stability.

Overall, the reforms implemented to address the risks posed by “too big to fail” institutions have sought to enhance the resilience, transparency, and accountability of these institutions. By imposing stricter requirements and providing a framework for their orderly resolution, regulators aim to reduce the systemic risks associated with these institutions and mitigate the potential impact of their failure on the broader economy.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.