Tier 1 Capital: Definition, Components, Ratio and Usage

Tier 1 capital is a key measure of a bank’s financial strength and stability. It represents the core capital that a bank holds to support its operations and absorb losses. Tier 1 capital is considered the highest quality capital as it consists of shareholders’ equity and retained earnings, which are the most stable and permanent sources of funding for a bank.

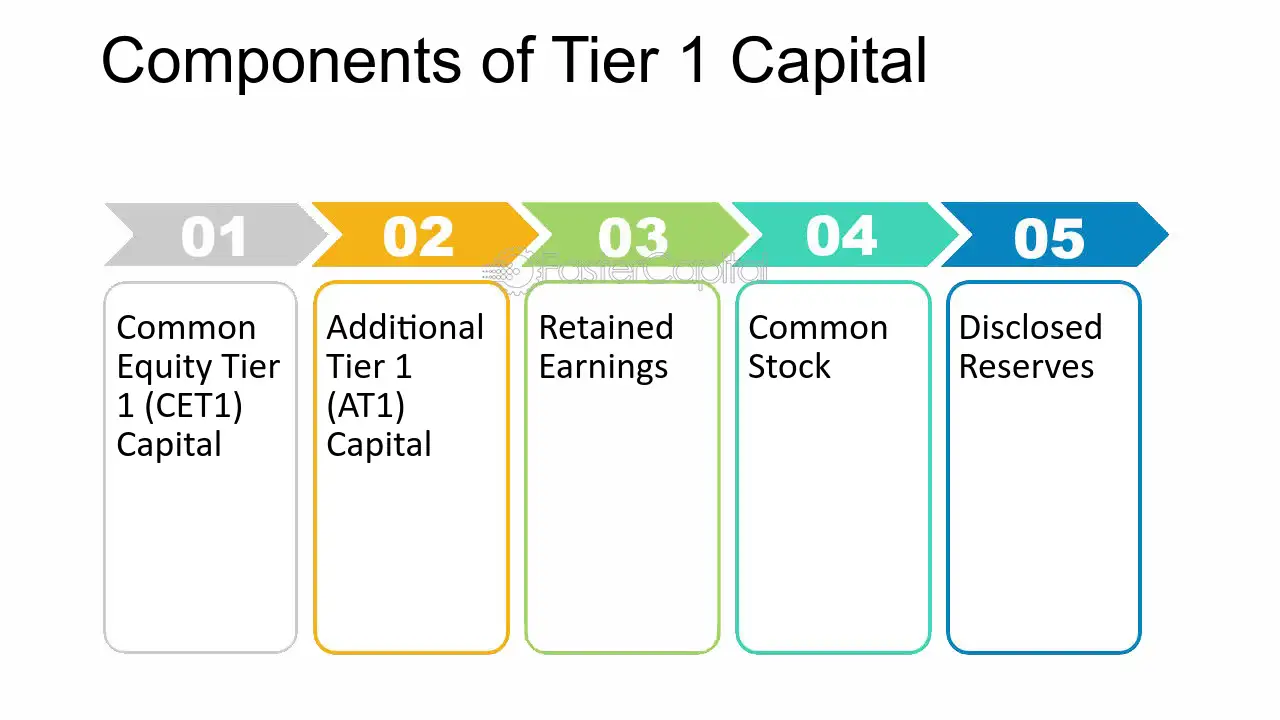

The components of Tier 1 capital include common equity tier 1 (CET1) capital, additional tier 1 (AT1) capital, and other tier 1 capital instruments. CET1 capital is the highest quality capital and includes common shares, retained earnings, and other comprehensive income. AT1 capital includes instruments such as perpetual non-cumulative preference shares and subordinated debt, which have certain loss-absorbing features.

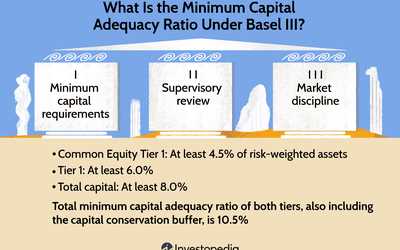

The Tier 1 capital ratio is a measure of a bank’s financial strength and is calculated by dividing Tier 1 capital by risk-weighted assets. This ratio indicates the proportion of a bank’s capital that is available to absorb losses in relation to its risk-weighted assets. A higher Tier 1 capital ratio indicates a bank’s ability to withstand financial stress and maintain solvency.

Tier 1 capital is important for several reasons. Firstly, it helps banks meet regulatory capital requirements set by banking authorities. Banks are required to maintain a minimum Tier 1 capital ratio to ensure their financial stability and protect depositors’ funds. Secondly, Tier 1 capital is a key indicator of a bank’s ability to absorb losses and remain solvent during economic downturns or financial crises. Lastly, Tier 1 capital is also important for investors and stakeholders as it reflects the financial health and stability of a bank.

Definition of Tier 1 Capital

Tier 1 capital is a key measure of a bank’s financial strength and stability. It represents the highest quality capital that a bank holds and serves as a cushion against potential losses. Tier 1 capital is the core capital of a bank, consisting of shareholders’ equity and retained earnings.

Shareholders’ equity is the residual interest in the assets of a bank after deducting liabilities. It represents the amount of capital that shareholders have invested in the bank. Retained earnings, on the other hand, are the profits that a bank has accumulated over time and has chosen to retain rather than distribute to shareholders as dividends.

Tier 1 capital is considered the most reliable form of capital because it is fully available to absorb losses without the bank becoming insolvent. It provides a strong foundation for a bank’s operations and allows it to withstand financial shocks and economic downturns. Regulators require banks to maintain a minimum level of Tier 1 capital to ensure their solvency and protect depositors.

Furthermore, Tier 1 capital is an important indicator of a bank’s ability to support lending and other financial activities. Banks with higher levels of Tier 1 capital are generally seen as more stable and less risky, making them more attractive to investors and counterparties. It also allows banks to meet regulatory requirements and continue operating even during periods of financial stress.

In summary, Tier 1 capital is the highest quality capital that a bank holds, consisting of shareholders’ equity and retained earnings. It provides a measure of a bank’s financial strength and stability, serving as a cushion against potential losses. Maintaining an adequate level of Tier 1 capital is crucial for a bank’s solvency and ability to support lending and other financial activities.

Components of Tier 1 Capital

Tier 1 capital is an important measure of a bank’s financial strength and stability. It consists of several components that are considered the highest quality capital, providing the most protection to depositors and other creditors in the event of a bank’s failure.

Common Equity Tier 1 (CET1) Capital

The first component of Tier 1 capital is Common Equity Tier 1 (CET1) capital. This includes the bank’s common shares, retained earnings, and other comprehensive income. CET1 capital is considered the purest form of capital because it does not include any preferred shares or other instruments that may have obligations to pay dividends or interest.

Common shares represent ownership in the bank and provide the highest level of loss absorption capacity. Retained earnings are the accumulated profits that have not been distributed to shareholders as dividends. Other comprehensive income includes unrealized gains or losses on certain financial instruments that are not yet recognized in the bank’s income statement.

Additional Tier 1 (AT1) Capital

The second component of Tier 1 capital is Additional Tier 1 (AT1) capital. This includes instruments that have characteristics of both debt and equity. These instruments have the ability to absorb losses and convert into common equity in times of financial distress.

Retained Earnings and Accumulated Other Comprehensive Income (AOCI)

Retained earnings and accumulated other comprehensive income (AOCI) are also considered components of Tier 1 capital. Retained earnings represent the profits that have been retained by the bank instead of being distributed as dividends. AOCI includes unrealized gains or losses on certain financial instruments that are not yet recognized in the bank’s income statement.

Both retained earnings and AOCI contribute to a bank’s Tier 1 capital by increasing its equity base and providing a cushion against potential losses.

Tier 1 Capital Ratio and Its Importance

The Tier 1 Capital Ratio is a key measure of a bank’s financial strength and stability. It is calculated by dividing a bank’s Tier 1 capital by its total risk-weighted assets. This ratio is used by regulators and investors to assess a bank’s ability to absorb losses and maintain solvency.

Tier 1 capital consists of the bank’s core capital, which includes common equity tier 1 capital and additional tier 1 capital. Common equity tier 1 capital is the highest quality capital, as it consists of the bank’s common shares and retained earnings. Additional tier 1 capital includes instruments such as perpetual preferred shares and hybrid securities.

The Tier 1 Capital Ratio is important because it indicates the bank’s ability to withstand financial stress and economic downturns. A higher Tier 1 Capital Ratio suggests that the bank has a strong capital base and is better equipped to handle potential losses. This provides confidence to depositors and investors, as it reduces the risk of insolvency and the need for government bailouts.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.