The Rise and Fall of WorldCom: Uncovering the Scandal

WorldCom, once hailed as one of the leading telecommunications companies in the world, experienced a dramatic rise and an even more dramatic fall. The uncovering of the scandal that ultimately led to its downfall sent shockwaves through the business world and raised questions about corporate ethics and accountability.

Background of WorldCom

WorldCom was founded in 1983 as Long Distance Discount Services (LDDS) by businessman Bernie Ebbers. The company initially focused on providing long-distance telephone services to small businesses in Mississippi. Over the years, WorldCom expanded its operations through a series of mergers and acquisitions, becoming one of the largest telecommunications companies in the United States.

WorldCom’s Rapid Expansion and Success

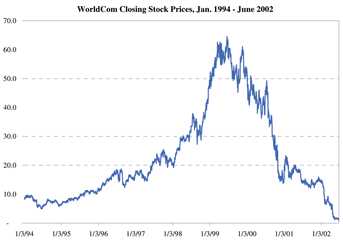

During the 1990s, WorldCom experienced rapid expansion and success. The company aggressively pursued acquisitions, including the purchase of MCI Communications in 1998, which solidified WorldCom’s position in the telecommunications industry. WorldCom’s stock price soared, and it became a Wall Street darling.

However, behind the scenes, WorldCom was engaging in fraudulent accounting practices to artificially inflate its earnings and hide its mounting debt. The company’s senior executives, including CEO Bernie Ebbers, orchestrated a scheme that involved capitalizing expenses, inflating revenues, and manipulating financial statements.

The Unveiling of the Scandal and its Aftermath

In 2002, the scandal at WorldCom came to light when an internal auditor discovered irregularities in the company’s books. An investigation by the Securities and Exchange Commission (SEC) revealed that WorldCom had overstated its earnings by nearly $11 billion, making it one of the largest accounting scandals in history.

The revelation of the scandal sent shockwaves through the financial markets, leading to a sharp decline in WorldCom’s stock price and the eventual bankruptcy of the company. Bernie Ebbers was convicted of fraud, conspiracy, and filing false documents with regulators, and he was sentenced to 25 years in prison.

The WorldCom scandal served as a wake-up call for the business world, highlighting the need for stricter regulations and improved corporate governance. It also led to increased scrutiny of other large corporations, as investors and regulators sought to prevent similar scandals from occurring in the future.

Background of WorldCom

Under the leadership of Ebbers, WorldCom quickly grew through a series of acquisitions, expanding its services and becoming one of the largest telecommunications companies in the United States. By the late 1990s, WorldCom had become a major player in the industry, offering a wide range of services including data transmission, internet access, and voice services.

WorldCom’s rapid expansion was fueled by a strategy of aggressive acquisitions, including the purchase of MCI Communications in 1998, which was one of the largest mergers in U.S. history at that time. This acquisition further solidified WorldCom’s position as a dominant player in the telecommunications market.

Despite its success and rapid growth, WorldCom was facing increasing competition and financial pressures. In the early 2000s, the telecommunications industry experienced a downturn, and WorldCom’s stock price began to decline.

However, the true extent of WorldCom’s financial troubles was not revealed until 2002, when the company announced that it had improperly accounted for $3.8 billion in expenses. This revelation led to further investigations, which uncovered a massive accounting fraud orchestrated by top executives at WorldCom.

The accounting fraud involved inflating the company’s revenues and assets, while hiding expenses and liabilities. This allowed WorldCom to present a false image of financial health and stability, deceiving investors and analysts.

The WorldCom scandal served as a wake-up call for the corporate world, highlighting the need for stronger financial regulations and oversight. It also led to increased scrutiny of other companies and ultimately contributed to the passage of the Sarbanes-Oxley Act in 2002, which aimed to improve corporate governance and accountability.

WorldCom’s Rapid Expansion and Success

WorldCom was founded in 1983 as a long-distance telephone company. However, it quickly expanded its operations and became one of the largest telecommunications companies in the United States. Under the leadership of CEO Bernard Ebbers, WorldCom pursued an aggressive growth strategy through a series of mergers and acquisitions.

WorldCom’s success was also fueled by its innovative approach to pricing. The company introduced a flat-rate pricing model for long-distance calls, which was a departure from the traditional per-minute billing. This pricing strategy appealed to customers and helped WorldCom gain a competitive edge in the market.

In addition to its aggressive expansion and innovative pricing, WorldCom also invested heavily in its network infrastructure. The company built a vast network of fiber-optic cables, which allowed for faster and more reliable communication. This investment in infrastructure further solidified WorldCom’s position as a leading telecommunications provider.

WorldCom’s rapid expansion and success were reflected in its financial performance. The company experienced significant revenue growth and its stock price soared during the late 1990s and early 2000s. At its peak, WorldCom was valued at over $180 billion, making it one of the most valuable companies in the world.

However, behind the scenes, WorldCom was engaging in fraudulent accounting practices to inflate its financial results. The company was artificially inflating its revenue and hiding its expenses, leading to a massive accounting scandal that would ultimately bring down the company.

The rise and fall of WorldCom serves as a cautionary tale of corporate greed and the consequences of unethical business practices. It highlights the importance of transparency and accountability in corporate governance, and the need for effective oversight to prevent such scandals from occurring in the future.

The Unveiling of the Scandal and its Aftermath

In 2002, the telecommunications industry was rocked by one of the biggest accounting scandals in history. WorldCom, once hailed as a major player in the industry, was exposed for engaging in fraudulent accounting practices that ultimately led to its downfall.

The scandal came to light when an internal auditor at WorldCom discovered irregularities in the company’s financial statements. It was revealed that WorldCom had been inflating its earnings by over $11 billion through various accounting tricks and fraudulent practices.

As news of the scandal broke, WorldCom’s stock price plummeted, and the company was forced to file for bankruptcy protection. Thousands of employees lost their jobs, and investors saw their investments wiped out. The scandal also had a ripple effect on the telecommunications industry as a whole, causing a loss of trust and resulting in increased scrutiny of other companies in the sector.

The aftermath of the WorldCom scandal led to significant changes in corporate governance and accounting practices. The Sarbanes-Oxley Act was passed in response to the scandal, imposing stricter regulations on public companies and holding executives more accountable for their actions. The act also established the Public Company Accounting Oversight Board (PCAOB) to oversee the auditing profession and ensure the integrity of financial reporting.

Overall, the WorldCom scandal served as a wake-up call for the business world, highlighting the importance of transparency, ethics, and accountability in corporate practices. It remains a cautionary tale of the devastating consequences that can result from unchecked greed and fraudulent behavior.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.