The Phillips Curve Economic Theory Explained

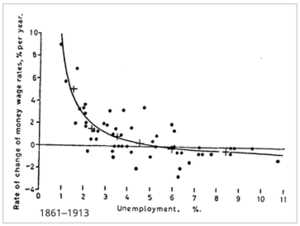

The Phillips Curve is an economic theory that describes the relationship between inflation and unemployment. It was first introduced by economist A.W. Phillips in 1958 and has since become a fundamental concept in macroeconomics. The theory suggests that there is an inverse relationship between the rate of inflation and the rate of unemployment in an economy.

On the other hand, when there is high unemployment, firms have excess capacity, and there is less pressure on wages and prices to increase. This leads to lower inflation. The Phillips Curve suggests that policymakers can choose a combination of inflation and unemployment that is most desirable for the economy.

Key Concepts of the Phillips Curve

There are several key concepts associated with the Phillips Curve:

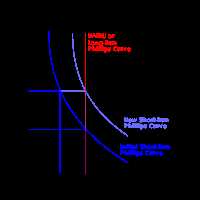

- The short-run Phillips Curve suggests that there is a trade-off between inflation and unemployment in the short term. This means that policymakers can use monetary or fiscal policy to stimulate the economy and reduce unemployment, but this will lead to higher inflation.

- The long-run Phillips Curve suggests that there is no trade-off between inflation and unemployment in the long term. This is because in the long run, wages and prices adjust to changes in aggregate demand, and the economy returns to its natural rate of unemployment.

- The natural rate of unemployment is the rate of unemployment that exists when the economy is operating at its full potential. It is determined by structural factors such as demographics, technology, and labor market institutions.

Implications of the Phillips Curve

The Phillips Curve has several implications for policymakers:

- Monetary policy can be used to influence the trade-off between inflation and unemployment in the short run. By adjusting interest rates, central banks can stimulate or slow down the economy, affecting both inflation and unemployment.

- Fiscal policy, such as government spending and taxation, can also affect the trade-off between inflation and unemployment. Expansionary fiscal policy, such as increasing government spending, can stimulate the economy and reduce unemployment, but it may also lead to higher inflation.

- The Phillips Curve suggests that policymakers face a trade-off between inflation and unemployment. They must decide on the optimal combination of inflation and unemployment that is most desirable for the economy.

On the other hand, when unemployment is high, there is less pressure on wages, and employers can hire workers at lower wages. This reduces production costs and keeps prices low, resulting in lower inflation. Therefore, the Phillips Curve suggests that policymakers can use monetary and fiscal policies to manipulate the level of inflation and unemployment in the economy.

However, it is important to note that the Phillips Curve is not a fixed relationship and can shift over time. Factors such as changes in productivity, expectations of inflation, and supply shocks can affect the trade-off between inflation and unemployment. For example, if workers expect higher inflation in the future, they may demand higher wages, leading to higher inflation even at higher levels of unemployment.

Key Concepts of the Phillips Curve

The Phillips Curve is an economic theory that describes the relationship between inflation and unemployment. It suggests that there is an inverse relationship between these two variables, meaning that as unemployment decreases, inflation increases, and vice versa.

Inflation

Inflation refers to the rate at which the general level of prices for goods and services is rising and, consequently, the purchasing power of currency is falling. It is measured by calculating the percentage change in the Consumer Price Index (CPI) over a period of time. Inflation can have both positive and negative effects on the economy, and it is an important factor to consider when analyzing the Phillips Curve.

Unemployment

Unemployment refers to the number of people who are actively seeking employment but are unable to find a job. It is an important economic indicator that reflects the health of the labor market. High levels of unemployment can lead to social and economic problems, while low levels of unemployment can indicate a strong economy. The Phillips Curve suggests that there is a trade-off between inflation and unemployment.

Trade-off

The Phillips Curve suggests that there is a trade-off between inflation and unemployment. This means that policymakers can manipulate the level of inflation by adjusting the level of unemployment, and vice versa. For example, if the government wants to reduce inflation, it can implement contractionary monetary or fiscal policies, which would increase unemployment in the short term. On the other hand, if the government wants to reduce unemployment, it can implement expansionary policies, which would increase inflation in the short term.

Expectations

Expectations play a crucial role in the Phillips Curve theory. It suggests that individuals and businesses form expectations about future inflation based on their past experiences and current economic conditions. These expectations can influence their behavior and decision-making, which in turn can affect the relationship between inflation and unemployment. If people expect higher inflation in the future, they may demand higher wages, leading to an increase in inflation. Conversely, if people expect lower inflation, they may accept lower wages, leading to a decrease in inflation.

Long-Run Phillips Curve

| Key Concepts | Description |

|---|---|

| Inflation | The rate at which the general level of prices for goods and services is rising. |

| Unemployment | The number of people who are actively seeking employment but are unable to find a job. |

| Trade-off | The inverse relationship between inflation and unemployment. |

| Expectations | The role of individuals and businesses forming expectations about future inflation. |

| Long-Run Phillips Curve | The recognition that there is no trade-off between inflation and unemployment in the long run. |

Implications of the Phillips Curve

1. Policy Implications

The Phillips Curve has important policy implications for governments and central banks. It suggests that policymakers can use monetary and fiscal policies to manipulate the trade-off between inflation and unemployment. For example, during periods of high unemployment, policymakers can implement expansionary monetary and fiscal policies to stimulate economic growth and reduce unemployment. However, this may lead to higher inflation in the long run.

On the other hand, during periods of low unemployment, policymakers can implement contractionary monetary and fiscal policies to control inflation. These policies may lead to higher unemployment in the short term but can help maintain price stability in the long run.

2. Expectations and Adaptive Behavior

The Phillips Curve also highlights the role of expectations and adaptive behavior in shaping the relationship between inflation and unemployment. According to the theory, if individuals and firms expect higher inflation, they will demand higher wages and prices, leading to an increase in inflation. Similarly, if they expect lower inflation, they will accept lower wages and prices, leading to a decrease in inflation.

3. Long-Run Phillips Curve

The Phillips Curve also suggests that the trade-off between inflation and unemployment is only temporary in the short run. In the long run, there is no trade-off, and the Phillips Curve becomes vertical at the natural rate of unemployment. This implies that policymakers cannot permanently reduce unemployment through expansionary policies without causing inflation.

Therefore, the long-run Phillips Curve suggests that the best way to achieve sustainable economic growth and low inflation is by maintaining a stable macroeconomic environment and promoting supply-side policies that improve productivity and reduce structural unemployment.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.