What is Surety?

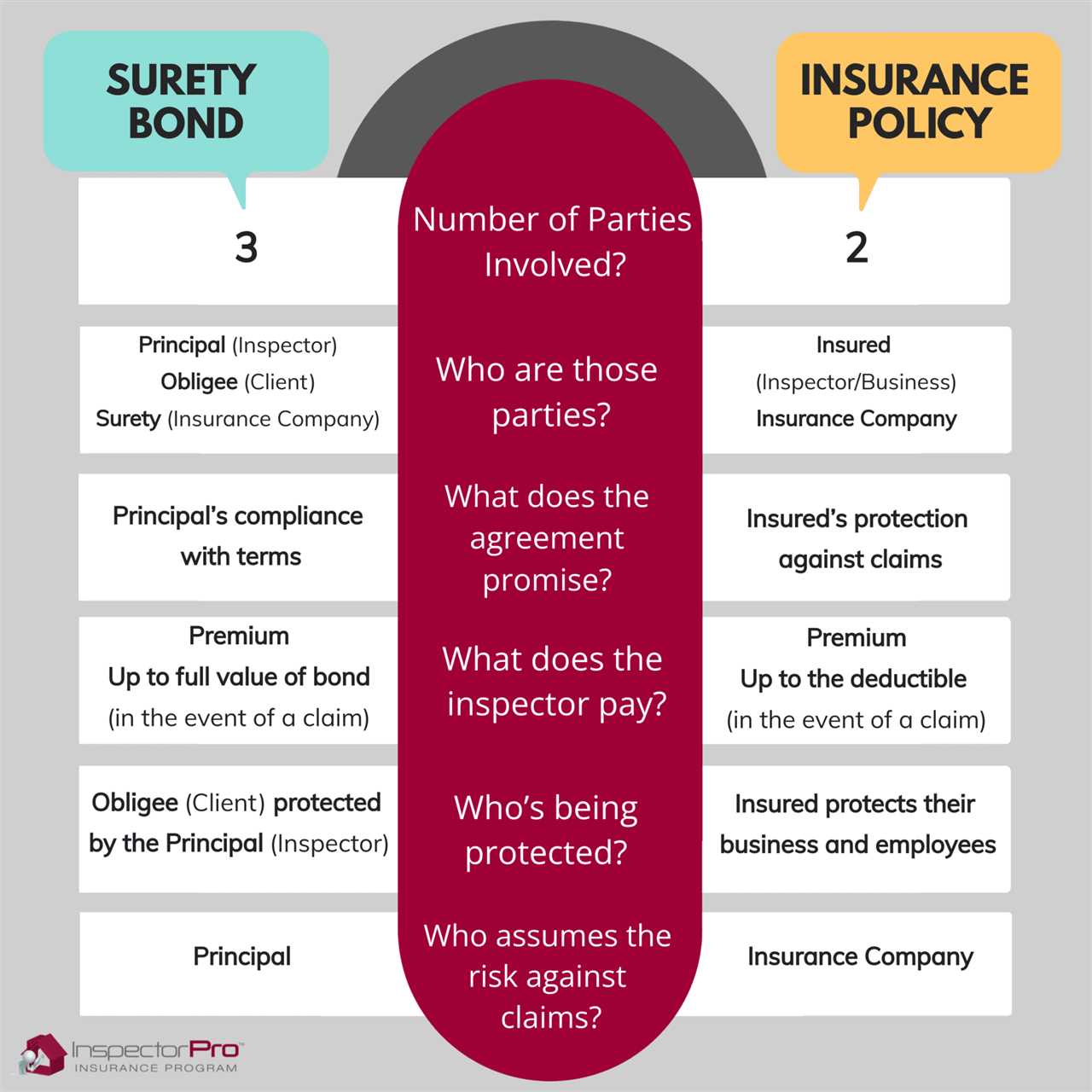

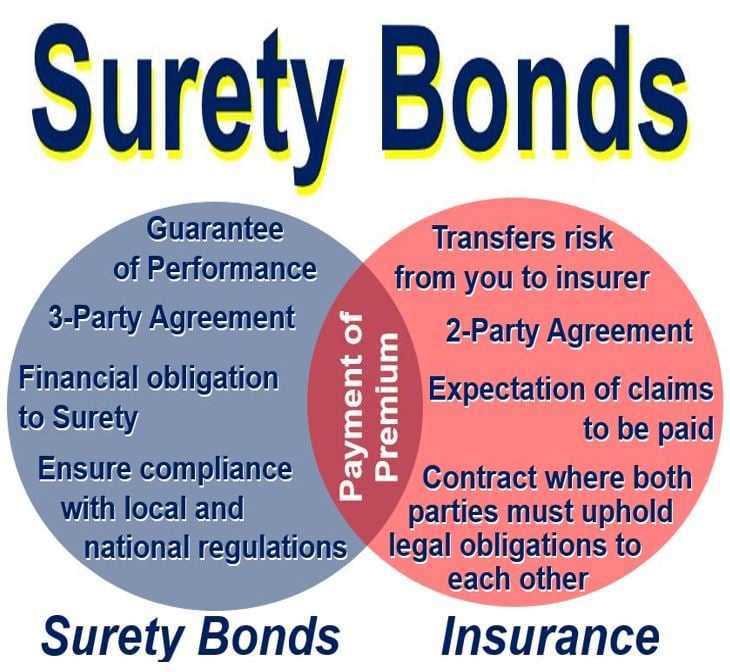

Surety is a financial arrangement that involves three parties: the principal, the obligee, and the surety company. The principal is the party that needs to provide a guarantee or assurance to the obligee that they will fulfill their obligations. The obligee is the party that requires the guarantee or assurance from the principal. The surety company is the third party that provides the guarantee on behalf of the principal.

When a surety bond is issued, the surety company agrees to pay the obligee a certain amount of money if the principal fails to fulfill their obligations. This ensures that the obligee is protected in case the principal does not meet their contractual obligations.

How does Surety work?

When a principal needs to obtain a surety bond, they approach a surety company and provide the necessary documentation and information. The surety company then assesses the principal’s financial standing, creditworthiness, and ability to fulfill their obligations. Based on this assessment, the surety company determines the premium that the principal needs to pay for the surety bond.

If the principal fails to fulfill their obligations, the obligee can make a claim on the surety bond. The surety company then investigates the claim and determines whether it is valid. If the claim is valid, the surety company pays the obligee the agreed-upon amount. The principal is then responsible for reimbursing the surety company for the amount paid out.

Why is Surety important?

Surety is important because it provides a guarantee to the obligee that the principal will fulfill their obligations. It helps protect the obligee from financial loss in case the principal fails to meet their contractual obligations. Surety bonds are commonly used in various industries, including construction, real estate, and finance, to ensure that parties fulfill their contractual obligations.

| Benefits of Surety | Drawbacks of Surety |

|---|---|

| Provides financial protection for the obligee | Requires the principal to pay a premium |

| Ensures that contractual obligations are met | May limit the principal’s financial flexibility |

| Increases the credibility of the principal | May require collateral or personal guarantees |

How Surety Bonds Work

Surety bonds are a type of financial guarantee that ensures the completion of a contract or the fulfillment of certain obligations. They are commonly used in industries such as construction, real estate, and finance to protect parties involved in a transaction.

When a surety bond is issued, there are typically three parties involved:

- The principal: This is the party that needs the bond, such as a contractor or a business owner.

- The obligee: This is the party that requires the bond, such as a project owner or a government agency.

- The surety: This is the party that provides the bond, typically an insurance company or a surety bond provider.

If the principal fails to fulfill their obligations, the obligee can make a claim against the bond. The surety will then investigate the claim and, if it is found to be valid, will compensate the obligee up to the bond amount. The principal is then responsible for reimbursing the surety for the amount paid out.

There are various types of surety bonds, including performance bonds, payment bonds, and bid bonds. Each type serves a specific purpose and provides different forms of protection.

Distinctions between Surety and Corporate Debt

While both surety and corporate debt involve financial obligations, there are several key distinctions between the two.

1. Nature of the Obligation:

2. Parties Involved:

In a surety bond, there are typically three parties involved: the principal (the party who needs the bond), the obligee (the party who requires the bond), and the surety (the party providing the bond). On the other hand, corporate debt involves two parties: the borrowing company and the investors or lenders who provide the funds.

3. Purpose:

Surety bonds are primarily used to guarantee the performance or completion of a specific project or contract. They protect the obligee from financial loss in case the principal fails to fulfill their obligations. Corporate debt, on the other hand, is used by companies to raise capital for various purposes, such as expanding operations, acquiring assets, or funding research and development.

4. Risk and Return:

5. Legal Framework:

Types of Surety Bonds

1. Contract Surety Bonds

Contract surety bonds are used in the construction industry to ensure that contractors fulfill their obligations. These bonds protect the project owner by guaranteeing that the contractor will complete the project according to the terms of the contract. If the contractor fails to meet their obligations, the bond provides financial compensation to the project owner.

2. Commercial Surety Bonds

Commercial surety bonds are required by government agencies and regulatory bodies to ensure compliance with laws and regulations. These bonds are often needed for businesses that require licenses or permits to operate legally. Examples of commercial surety bonds include license and permit bonds, customs bonds, and tax bonds.

3. Court Surety Bonds

Court surety bonds are used in legal proceedings to guarantee the performance of certain obligations. These bonds are typically required when a party is seeking an injunction, appealing a court decision, or acting as a fiduciary. Examples of court surety bonds include appeal bonds, injunction bonds, and probate bonds.

4. Fidelity Surety Bonds

5. Miscellaneous Surety Bonds

There are also miscellaneous surety bonds that don’t fit into the other categories. These bonds cover a wide range of situations and can be tailored to meet specific needs. Examples of miscellaneous surety bonds include lost instrument bonds, lottery bonds, and immigration bonds.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.