What is a Subsidiary Company?

Subsidiary companies are separate legal entities from their parent companies, meaning they have their own assets, liabilities, and legal obligations. However, they operate under the control and direction of the parent company, which can influence their strategic decisions and financial management.

Subsidiary companies can be established through various means, such as acquiring an existing company, starting a new company, or forming a joint venture with another company. The purpose of establishing a subsidiary company is often to expand the parent company’s operations, enter new markets, or diversify its business activities.

However, there are also some disadvantages to consider. Managing multiple subsidiary companies can be complex and require significant resources. Additionally, there may be conflicts of interest between the parent company and its subsidiaries, especially if they operate in the same industry or market. Furthermore, the parent company may be held responsible for the actions and liabilities of its subsidiaries, which can have financial and reputational implications.

Definition, Examples, Pros, Cons of Subsidiary Companies

Subsidiary companies can be found in various industries and sectors, and they can take different forms, such as limited liability companies (LLCs), corporations, or partnerships. They are often established to expand the parent company’s business operations or enter new markets.

There are several examples of subsidiary companies in the business world. One well-known example is Google, which is a subsidiary of Alphabet Inc. Google operates as a separate entity under the control of Alphabet, allowing it to focus on its core business of internet search and advertising. Another example is WhatsApp, which is a subsidiary of Facebook. WhatsApp operates independently but benefits from the resources and support of its parent company.

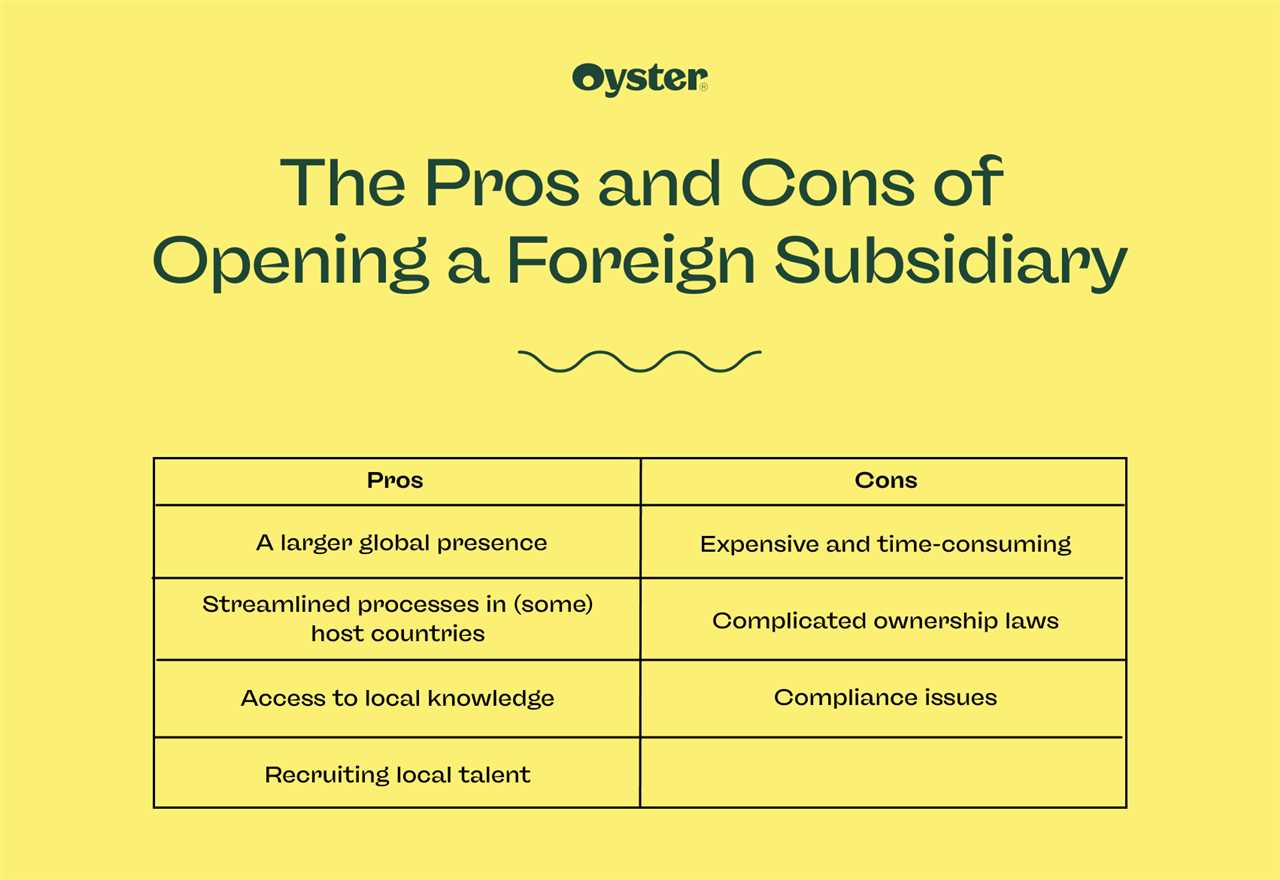

Subsidiary companies offer several advantages. First, they provide a way for the parent company to diversify its business activities and enter new markets without taking on excessive risk. By establishing a subsidiary, the parent company can separate its operations and assets, limiting the potential impact of any financial or legal issues that may arise.

Additionally, subsidiary companies can benefit from the expertise, resources, and financial backing of the parent company. They can access the parent company’s established distribution networks, supply chains, and customer base, which can help them grow and expand more quickly than if they were operating independently.

However, there are also some drawbacks to establishing a subsidiary company. One major disadvantage is the potential loss of control for the parent company. While the parent company may have majority ownership and control over the subsidiary, it may still need to consider the interests and opinions of minority shareholders or partners.

Furthermore, there may be additional administrative and regulatory requirements associated with operating a subsidiary company. This can include compliance with local laws and regulations, tax obligations, and reporting requirements. The parent company may also be held liable for the actions or debts of its subsidiary, which can pose a financial risk.

Definition of Subsidiary Company

Subsidiary companies can be formed through various methods, such as acquiring an existing company, establishing a new company, or through mergers and acquisitions. The main purpose of creating a subsidiary is to expand the parent company’s business operations, diversify its products or services, or enter new markets.

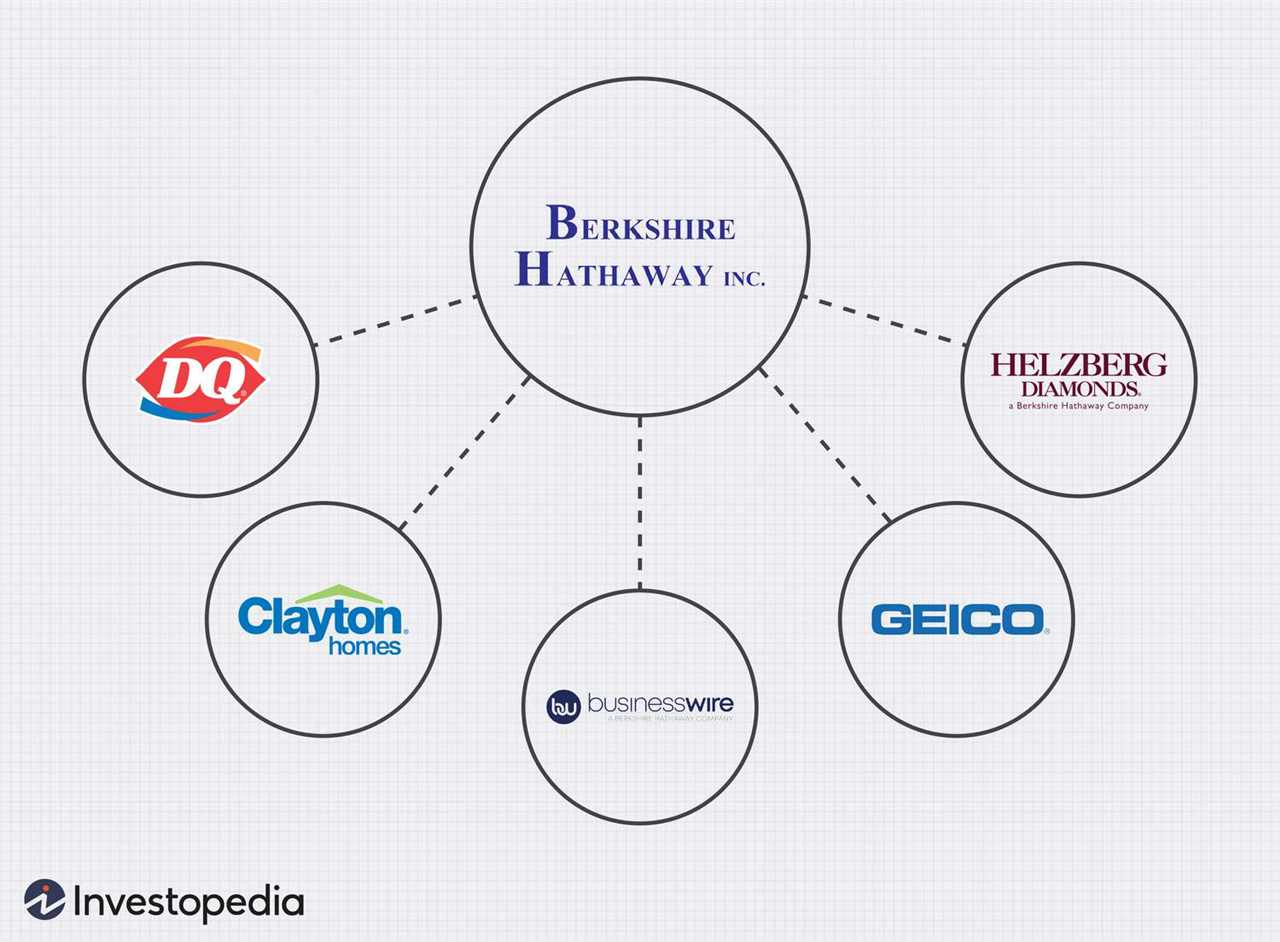

Examples of Subsidiary Companies

There are numerous examples of subsidiary companies in various industries. For instance, Alphabet Inc. is the parent company of Google LLC, which operates as a subsidiary. Google LLC handles the search engine, advertising, and other internet-related services, while Alphabet Inc. oversees the overall strategic direction and financial management of the subsidiary.

Another example is Nestle S.A., a multinational food and beverage company. Nestle has numerous subsidiary companies, such as Nespresso, Purina, and Gerber. Each subsidiary focuses on a specific product line or market segment, allowing Nestle to cater to a wide range of consumer needs.

Pros and Cons of Subsidiary Companies

Subsidiary companies offer several advantages to the parent company. They provide opportunities for diversification, allowing the parent company to enter new markets or industries. Subsidiaries also enable the parent company to allocate resources efficiently and streamline operations. Additionally, subsidiaries can provide tax benefits and help mitigate risks by separating the parent company’s liabilities.

However, there are also potential drawbacks to establishing subsidiary companies. The parent company may face challenges in maintaining control and coordination across multiple subsidiaries. Cultural and operational differences can arise, especially in multinational subsidiaries. Furthermore, the parent company may be held liable for the actions and debts of its subsidiaries, which can impact its overall financial stability.

Subsidiary Company: Explained with Examples

There are various examples of subsidiary companies in different industries. One common example is in the automotive industry, where major car manufacturers often have subsidiary companies that specialize in specific aspects of the business, such as manufacturing parts or providing financial services. For instance, General Motors owns various subsidiary companies, including Chevrolet, GMC, and Cadillac.

Another example is in the technology industry, where large tech companies often acquire smaller companies to expand their product offerings or gain access to new markets. Facebook, for example, acquired Instagram and WhatsApp, which now operate as subsidiary companies under the Facebook umbrella.

Subsidiary companies can have several advantages. First, they allow the parent company to diversify its operations and enter new markets without starting from scratch. By acquiring an existing company in a specific industry or market, the parent company can benefit from the subsidiary’s established customer base, brand recognition, and expertise.

Additionally, subsidiary companies provide a level of legal protection for the parent company. Since the subsidiary is a separate legal entity, it can be held liable for its own debts and legal obligations, reducing the risk for the parent company. This separation also allows the parent company to limit its financial exposure to the subsidiary’s operations.

However, there are also some disadvantages to subsidiary companies. One potential drawback is the complexity of managing multiple entities. The parent company must ensure effective communication and coordination between the different subsidiaries, which can be challenging, especially if they operate in different countries or have different cultures.

Furthermore, subsidiary companies may face conflicts of interest with the parent company. The subsidiary’s management may prioritize the interests of the subsidiary over those of the parent company, leading to potential conflicts and disagreements. This can be mitigated through clear communication and alignment of goals between the parent company and its subsidiaries.

Pros and Cons of Subsidiary Companies

Pros of Subsidiary Companies:

1. Limited Liability: One of the main advantages of a subsidiary company is that it has its own legal identity and is separate from its parent company. This means that the parent company’s liability is limited to the amount of investment it has made in the subsidiary. If the subsidiary faces financial difficulties or legal issues, the parent company’s assets are generally protected.

2. Risk Diversification: By establishing or acquiring subsidiary companies in different industries or geographic locations, a parent company can diversify its risks. If one subsidiary is facing challenges, the parent company can rely on the performance of its other subsidiaries to mitigate potential losses.

3. Tax Benefits: Subsidiary companies can also provide tax advantages. Depending on the jurisdiction, a parent company may be able to take advantage of tax incentives, deductions, or lower tax rates by structuring its operations through subsidiary companies.

4. Access to New Markets: Establishing subsidiary companies in different countries can provide access to new markets. By having a local presence, the parent company can better understand the local market dynamics, establish relationships with customers and suppliers, and tailor its products or services to meet local preferences.

Cons of Subsidiary Companies:

1. Complex Legal and Regulatory Requirements: Setting up and operating subsidiary companies can be complex and time-consuming. Each jurisdiction has its own legal and regulatory requirements that must be complied with, including company registration, tax filings, and reporting obligations. Failure to comply with these requirements can result in penalties or legal consequences.

2. Loss of Control: While subsidiary companies provide a level of autonomy, the parent company may have less control over the day-to-day operations and decision-making of its subsidiaries. This can be a disadvantage if the parent company wants to maintain a high level of control or if there are conflicts of interest between the parent and subsidiary.

3. Costly and Resource-Intensive: Establishing and operating subsidiary companies can be expensive. There are costs associated with setting up the legal structure, hiring employees, establishing infrastructure, and complying with regulatory requirements. Additionally, the parent company must allocate resources and management attention to oversee and support the subsidiaries.

4. Reputation Risk: The actions and performance of subsidiary companies can impact the reputation of the parent company. If a subsidiary engages in unethical or illegal activities, it can tarnish the reputation of the entire corporate group. The parent company must carefully monitor and manage the activities of its subsidiaries to mitigate reputation risks.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.