Sole Proprietorship vs LLC: Pros, Cons, and Key Differences

Sole Proprietorship:

A sole proprietorship is the simplest and most common form of business ownership. It is owned and operated by a single individual, who is personally responsible for all aspects of the business. Here are some key points to consider:

- Pros: One of the main advantages of a sole proprietorship is that it is easy and inexpensive to set up. You have complete control over the business and all profits belong to you. Additionally, there is no separate business tax return, as your business income is reported on your personal tax return.

- Cons: The main disadvantage of a sole proprietorship is that there is no legal separation between the business and the owner. This means that the owner is personally liable for all debts and legal obligations of the business. Additionally, it can be difficult to raise capital or obtain financing as a sole proprietor.

LLC:

- Pros: One of the main advantages of an LLC is that it offers limited liability protection. This means that the members are not personally liable for the debts and legal obligations of the business. Additionally, an LLC can choose to be taxed as a sole proprietorship, partnership, or corporation, providing flexibility in tax planning.

- Cons: The main disadvantage of an LLC is that it requires more paperwork and formalities compared to a sole proprietorship. You will need to file articles of organization with the state, create an operating agreement, and comply with ongoing reporting requirements. Additionally, an LLC may be subject to higher taxes and fees compared to a sole proprietorship.

Key Features of Sole Proprietorship

There are several key features that distinguish a sole proprietorship:

- Ownership: In a sole proprietorship, the business is owned and controlled by a single individual. This means that the owner has full decision-making authority and retains all profits.

- Liability: The owner of a sole proprietorship is personally liable for all debts and obligations of the business. This means that if the business cannot meet its financial obligations, the owner’s personal assets may be at risk.

- Taxation: Sole proprietorships are not separate legal entities, so the owner reports business income and expenses on their personal tax return. This simplifies the tax filing process, but the owner is responsible for paying self-employment taxes.

- Flexibility: Sole proprietorships offer a high level of flexibility. The owner has complete control over all aspects of the business, including decision-making, operations, and management.

- Ease of Formation: Forming a sole proprietorship is relatively simple and inexpensive. There are no formal legal requirements or paperwork to establish the business, although certain licenses or permits may be required depending on the industry and location.

Advantages of Sole Proprietorship

There are several advantages to choosing a sole proprietorship as a business structure:

- Ease of Setup: As mentioned earlier, forming a sole proprietorship is quick and straightforward. There are no complex legal requirements or formalities to comply with.

- Complete Control: The owner has full control over all business decisions and operations. This allows for quick decision-making and the ability to adapt to changing market conditions.

- Tax Benefits: Sole proprietors can take advantage of certain tax deductions and credits that are not available to other business entities. This can help reduce the overall tax liability.

Disadvantages of Sole Proprietorship

Despite its advantages, there are also some disadvantages to consider when choosing a sole proprietorship:

- Unlimited Liability: The owner is personally liable for all business debts and obligations. This means that if the business fails or faces legal issues, the owner’s personal assets may be at risk.

- Limited Growth Potential: Sole proprietorships may face limitations in terms of growth and expansion. It can be challenging to raise capital or attract investors without the legal structure and credibility of a separate entity.

- Lack of Continuity: A sole proprietorship is closely tied to the owner’s personal identity. If the owner decides to retire, sell the business, or pass away, the business may cease to exist or face difficulties in transitioning to new ownership.

Conclusion

Sole proprietorships offer simplicity, flexibility, and ease of setup, making them an attractive option for many small businesses. However, the unlimited liability and limited growth potential should also be carefully considered. Before choosing a business structure, it is essential to evaluate the specific needs and goals of the business to make an informed decision.

Formation and Ownership

Forming an LLC involves filing the necessary documents with the state in which the business will operate. The owners of an LLC are referred to as members, and there can be one or multiple members. Unlike a sole proprietorship, an LLC can have both individuals and other businesses as members.

LLCs offer flexibility in ownership structure, allowing for different classes of membership interests and the ability to allocate profits and losses in a way that suits the needs of the members. This can be especially beneficial for businesses with multiple owners who have different levels of involvement or financial contributions.

Liability Protection

One of the main advantages of an LLC is the limited liability protection it provides to its members. This means that the personal assets of the members are generally protected from the debts and liabilities of the business. In the event that the LLC faces legal action or financial difficulties, the members’ personal assets are not at risk.

Management and Taxation

Conclusion

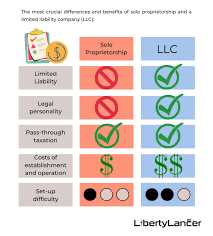

Comparing Sole Proprietorship and LLC

2. Taxes: Another important factor to consider is the tax implications of each structure. In a sole proprietorship, the business income is typically reported on the owner’s personal tax return. This means that the owner is responsible for paying self-employment taxes, which include both the employer and employee portions of Social Security and Medicare taxes. In contrast, an LLC can choose how it wants to be taxed. By default, an LLC is treated as a pass-through entity, meaning that the business income and expenses are reported on the owner’s personal tax return. However, an LLC can also elect to be taxed as a corporation, which may have different tax advantages depending on the specific situation.

3. Formalities: Sole proprietorships are generally easier and less expensive to set up and maintain compared to LLCs. A sole proprietorship does not require any formal registration or ongoing filing requirements, making it a simple and straightforward option for small businesses. On the other hand, an LLC requires filing formation documents with the state, creating an operating agreement, and complying with annual reporting and record-keeping requirements. While these additional formalities may require more time and effort, they can provide a more structured and professional image for the business.

4. Transferability and Continuity: In terms of transferability and continuity, an LLC generally offers more flexibility compared to a sole proprietorship. In a sole proprietorship, the business is tied to the owner, and it can be difficult to transfer ownership or continue the business after the owner’s death or retirement. On the other hand, an LLC can have multiple owners, and ownership interests can be easily transferred or sold. Additionally, an LLC can have perpetual existence, meaning that the business can continue to operate even if one of the owners leaves or passes away.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.