Seller Financing: What It Is and How It’s Used in Real Estate

How Does Seller Financing Work?

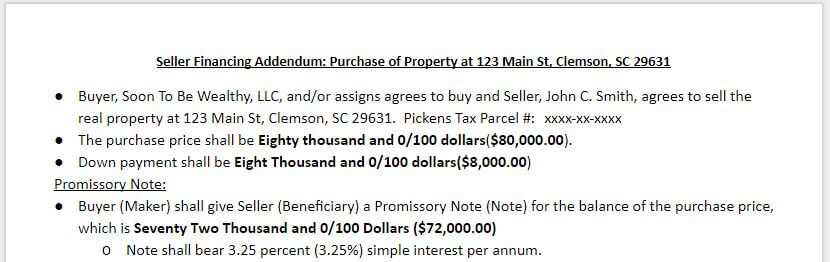

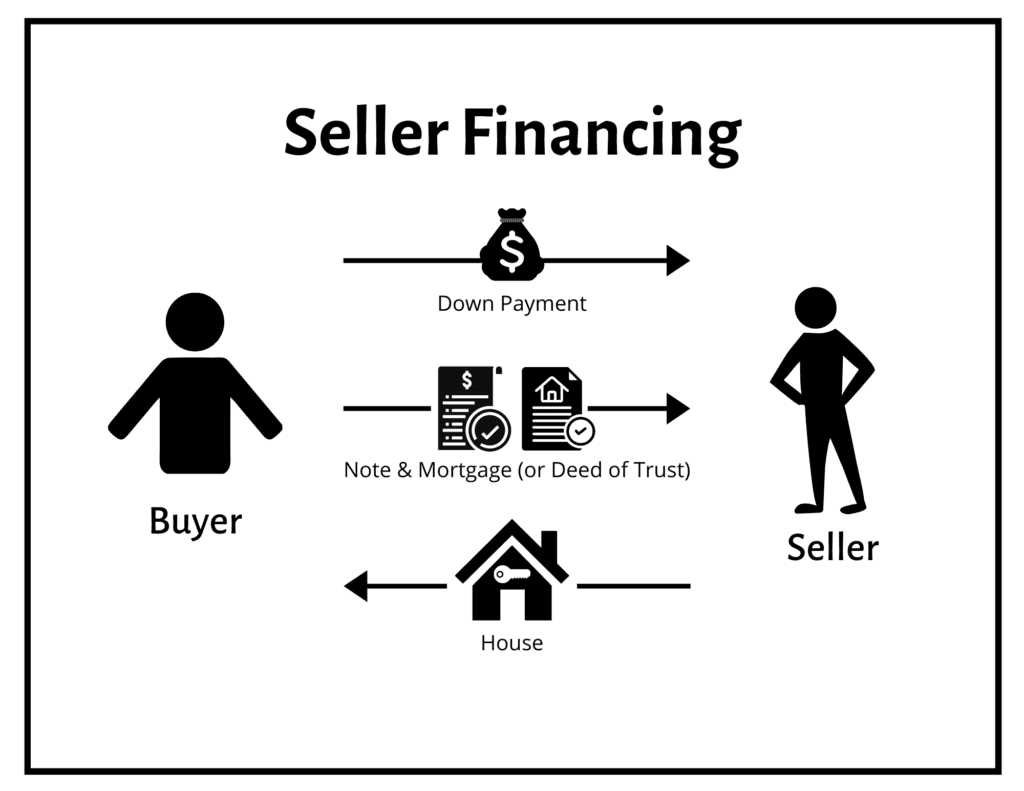

When seller financing is used, the buyer and seller negotiate the terms of the loan, including the interest rate, repayment schedule, and any other relevant terms. The buyer then makes regular payments to the seller, typically on a monthly basis, until the loan is fully repaid.

This type of financing can be beneficial for both buyers and sellers. For buyers, it provides an alternative to traditional financing options, especially if they have difficulty obtaining a mortgage from a bank. Seller financing can also offer more flexible terms and a quicker approval process.

For sellers, offering financing can attract more potential buyers and help sell the property faster. It can also generate additional income through the interest charged on the loan. Additionally, seller financing allows sellers to sell their property “as is,” without the need for repairs or renovations, since they are not relying on a bank appraisal.

Risks and Considerations

Benefits of Seller Financing

Seller financing offers several benefits for both buyers and sellers in real estate transactions. Here are some of the key advantages:

- Increased Pool of Potential Buyers: By offering seller financing, sellers can attract a larger pool of potential buyers who may not qualify for traditional bank loans. This can help sellers sell their properties faster and at potentially higher prices.

- Flexible Terms: Seller financing allows for more flexibility in terms compared to traditional bank loans. Sellers and buyers can negotiate the interest rate, repayment schedule, and other terms to meet their specific needs and circumstances.

- Lower Closing Costs: Seller financing can result in lower closing costs for both parties involved. Buyers may avoid certain fees typically associated with obtaining a mortgage, such as origination fees and appraisal costs.

- Quicker Closing Process: Seller financing can expedite the closing process since it eliminates the need for a traditional mortgage lender. This can be beneficial for buyers who need to move quickly or sellers who want to close the deal faster.

- Less Stringent Requirements: Seller financing may have less stringent requirements compared to traditional bank loans. Buyers with less-than-perfect credit or a limited credit history may have a better chance of securing financing through a seller.

Overall, seller financing provides a viable alternative to traditional bank loans, offering flexibility, increased buyer pool, and potential financial benefits for both buyers and sellers in real estate transactions.

How Seller Financing Works

One of the advantages of seller financing is that it can offer more flexibility than traditional financing options. The buyer and seller can negotiate terms that work best for both parties, such as a lower interest rate or a longer repayment period. This can make it easier for buyers to afford the property and for sellers to attract potential buyers.

Another benefit of seller financing is that it can be a faster and simpler process than obtaining a traditional mortgage. Since the buyer is working directly with the seller, there may be fewer hoops to jump through and less paperwork involved. This can save both time and money for both parties involved.

Risks and Considerations of Seller Financing

Seller financing can be an attractive option for both buyers and sellers in a real estate transaction. However, it is important to consider the risks and potential drawbacks before entering into a seller financing agreement.

1. Default Risk: One of the main risks of seller financing is the potential for the buyer to default on the loan. If the buyer fails to make the agreed-upon payments, the seller may need to pursue legal action to reclaim the property.

2. Market Conditions: Seller financing may be more common in a slow real estate market or when traditional financing options are limited. However, if market conditions improve, the buyer may be able to secure a better loan from a traditional lender, leaving the seller with a lower interest rate and potentially losing out on potential profits.

3. Interest Rate Risk: When offering seller financing, the seller takes on the role of the lender and assumes the risk associated with interest rates. If interest rates rise significantly during the term of the loan, the seller may lose out on potential income that could have been earned from a higher interest rate.

4. Property Condition: The seller may be responsible for repairs and maintenance of the property until the loan is fully repaid. This can be a significant financial burden, especially if the buyer fails to maintain the property properly.

5. Length of Loan: Seller financing typically involves shorter loan terms compared to traditional mortgages. This means that the buyer may need to make larger monthly payments to repay the loan within the agreed-upon timeframe.

6. Equity Risk: If the buyer defaults on the loan, the seller may need to foreclose on the property to reclaim it. This process can be time-consuming and expensive, and there is no guarantee that the seller will be able to recover the full amount owed.

7. Tax Implications: Seller financing can have tax implications for both the buyer and the seller. It is important to consult with a tax professional to understand the potential tax consequences before entering into a seller financing agreement.

Despite these risks, seller financing can still be a viable option for both buyers and sellers in certain situations. It is important to carefully consider the potential drawbacks and consult with professionals, such as real estate agents and attorneys, to ensure that the agreement is fair and legally binding.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.