Sector Breakdown: Definition and Stock Market Use

What is Sector Breakdown?

Sector breakdown involves dividing the stock market into different sectors, such as technology, healthcare, finance, consumer goods, and more. Each sector represents a specific industry or group of related industries. For example, the technology sector includes companies involved in software development, hardware manufacturing, and telecommunications.

The purpose of sector breakdown is to provide a clear overview of the market and enable investors to identify trends and opportunities within specific industries. By analyzing the performance of different sectors, investors can gain insights into the overall health of the economy and make strategic investment decisions.

How is Sector Breakdown Used in the Stock Market?

Sector breakdown is a valuable tool for investors as it allows them to assess the performance of individual sectors and compare them to the broader market. By tracking the performance of sectors over time, investors can identify which industries are thriving and which are lagging behind.

Investors can use sector breakdown to:

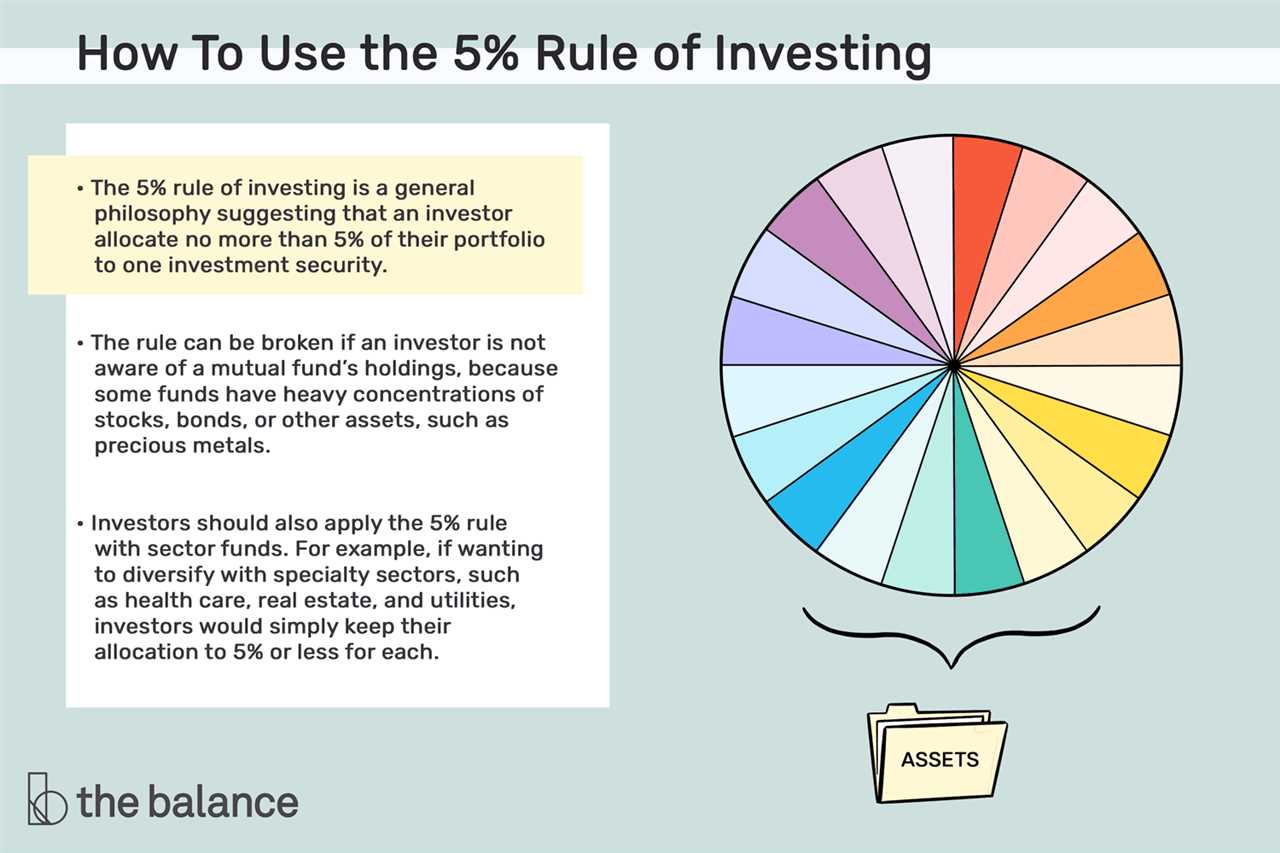

- Diversify their portfolio: By investing in different sectors, investors can spread their risk and reduce the impact of any single sector’s performance on their overall portfolio.

- Identify investment opportunities: Sector breakdown helps investors identify sectors that are experiencing growth or have the potential for future growth. This information can guide investment decisions and help investors capitalize on emerging trends.

- Monitor market trends: By analyzing sector breakdown, investors can stay updated on market trends and adjust their investment strategies accordingly. For example, if the technology sector is performing well, an investor may choose to allocate more funds to technology stocks.

- Diversification: Sector breakdown allows investors to diversify their portfolios by investing in stocks from different sectors. This helps spread the risk and reduces the impact of any single sector’s performance on the overall portfolio.

- Identifying Opportunities: By analyzing sector breakdown, investors can identify sectors that are poised for growth or have untapped potential. This allows them to capitalize on investment opportunities and potentially earn higher returns.

Importance of Sector Breakdown in Stock Market

Identifying Opportunities

By analyzing the sector breakdown, investors can identify sectors that are performing well and have the potential for growth. This information helps investors allocate their capital strategically, focusing on sectors that are likely to generate higher returns.

For example, if the technology sector is experiencing significant growth, investors may decide to allocate a larger portion of their portfolio to technology stocks. This allows them to take advantage of the upward trend and potentially earn higher profits.

Managing Risks

Another important aspect of sector breakdown is risk management. Different sectors have different levels of risk associated with them. By diversifying their portfolio across various sectors, investors can reduce the overall risk of their investments.

For instance, if an investor has a portfolio heavily weighted towards the energy sector and the sector experiences a downturn, the investor’s entire portfolio may suffer significant losses. However, by diversifying across sectors such as technology, healthcare, and consumer goods, the investor can mitigate the impact of any single sector’s poor performance.

Tracking Market Trends

The sector breakdown also helps investors track market trends and identify potential shifts in the economy. By monitoring the performance of different sectors, investors can gain insights into the overall health of the economy.

For example, if the financial sector is underperforming while the healthcare sector is thriving, it may indicate a shift in consumer behavior or market dynamics. This information can be valuable for investors in adjusting their investment strategies accordingly.

Making Informed Decisions

| Benefits of Sector Breakdown | How it Helps Investors |

|---|---|

| Identifying opportunities for growth | Allocate capital strategically |

| Managing risks through diversification | Reduce the overall risk of investments |

| Tracking market trends and shifts | Stay ahead of market changes |

| Making informed investment decisions | Increase chances of success |

Analyzing Sector Breakdown for Investment Decisions

Identifying Sector Performance

One of the key benefits of analyzing the sector breakdown is the ability to identify the performance of different sectors. Each sector has its own characteristics and tends to perform differently under various market conditions. By analyzing the sector breakdown, investors can identify which sectors are performing well and which ones are lagging behind.

Assessing Sector Risks

Identifying Investment Opportunities

For example, if an investor identifies that the healthcare sector is expected to grow due to an aging population, they may consider investing in pharmaceutical or biotech companies within that sector. By analyzing the sector breakdown, investors can uncover investment opportunities that align with their investment goals and strategies.

Sector Breakdown Strategies for Portfolio Diversification

By investing in stocks from various sectors, you can spread out your risk and potentially increase your chances of achieving better returns. Here are some sector breakdown strategies to consider:

1. Balanced Approach: This strategy involves investing in stocks from a variety of sectors in a balanced manner. By allocating your investments evenly across different sectors, you can reduce the impact of any single sector’s performance on your overall portfolio.

2. Growth vs. Value: Another sector breakdown strategy is to invest in a mix of growth and value stocks. Growth stocks are typically associated with companies that are expected to experience significant growth in the future, while value stocks are considered undervalued and have the potential for future price appreciation. By diversifying between these two types of stocks, you can capture both potential growth and value opportunities.

3. Defensive vs. Cyclical: Defensive sectors, such as healthcare and consumer staples, tend to perform well during economic downturns, while cyclical sectors, such as technology and consumer discretionary, tend to perform well during economic upturns. By investing in a combination of defensive and cyclical stocks, you can position your portfolio to perform well in different economic conditions.

4. International Exposure: Investing in stocks from different countries and regions can also provide diversification benefits. By including international stocks in your portfolio, you can gain exposure to different economies and potentially benefit from their growth prospects.

5. Risk Management: Lastly, sector breakdown strategies can also be used for risk management purposes. By monitoring the performance of different sectors and adjusting your portfolio allocation accordingly, you can mitigate the impact of any underperforming sectors and potentially improve your overall risk-adjusted returns.

Sector Breakdown and Market Performance

Why is Sector Breakdown Important?

The sector breakdown provides a detailed overview of how different industries are performing within the stock market. It allows investors to assess the relative strength or weakness of specific sectors and make strategic investment decisions accordingly.

By analyzing the market performance of various sectors, investors can identify which industries are thriving and which ones are lagging behind. This information can help them allocate their investment capital more effectively and diversify their portfolios to minimize risk.

Using Sector Breakdown for Investment Decisions

On the other hand, sectors that are underperforming or facing challenges may indicate potential risks. Investors can use this information to avoid or reduce exposure to these sectors, thereby protecting their portfolios from potential losses.

Utilizing Sector Breakdown Strategies for Portfolio Diversification

One of the key benefits of sector breakdown analysis is its ability to guide portfolio diversification strategies. By investing in a variety of sectors, investors can spread their risk and potentially enhance their returns.

For example, if one sector experiences a downturn, investments in other sectors may offset the losses, resulting in a more stable overall portfolio performance. By diversifying across sectors, investors can also take advantage of different market cycles and capitalize on opportunities for growth.

Summary

| Benefits of Sector Breakdown | Strategies for Portfolio Diversification |

|---|---|

| Identify market trends | Invest in multiple sectors |

| Make informed investment decisions | Spread risk |

| Allocate investment capital effectively | Capitalize on different market cycles |

| Diversify portfolio | Enhance returns |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.