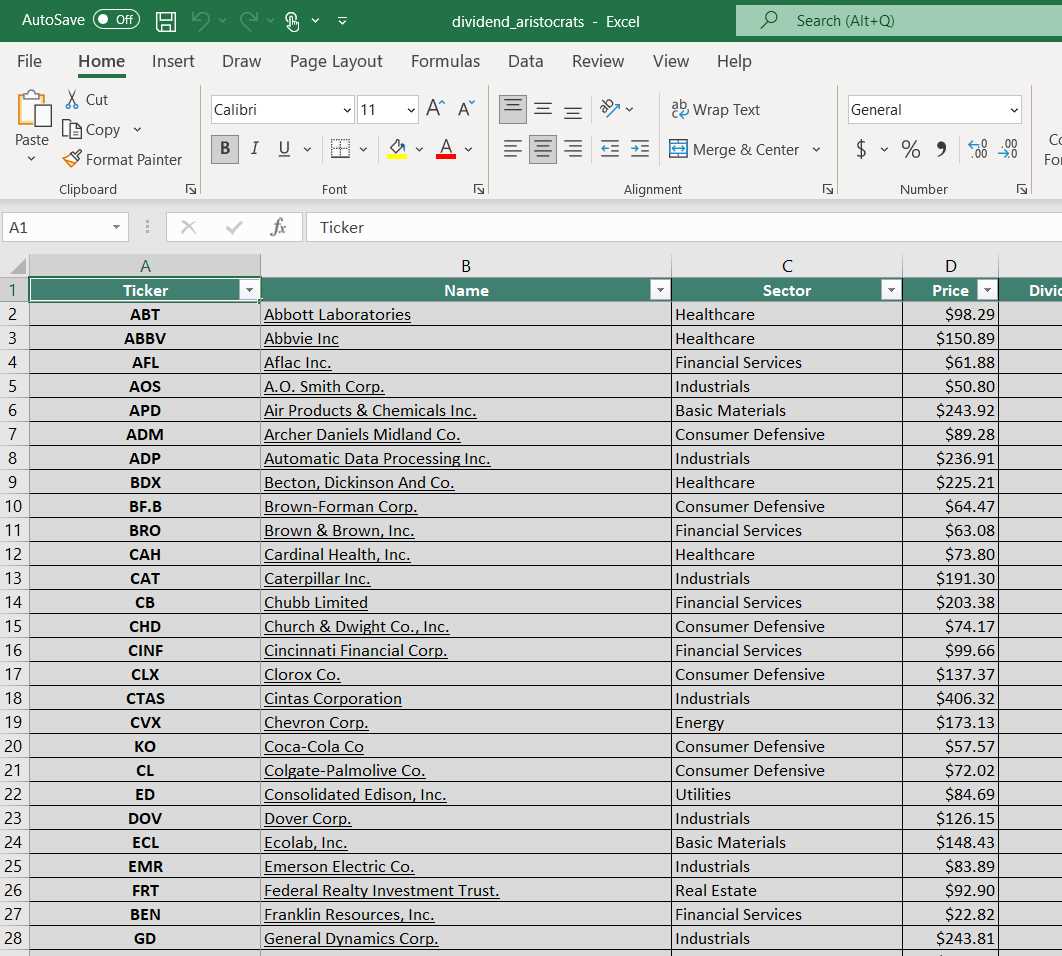

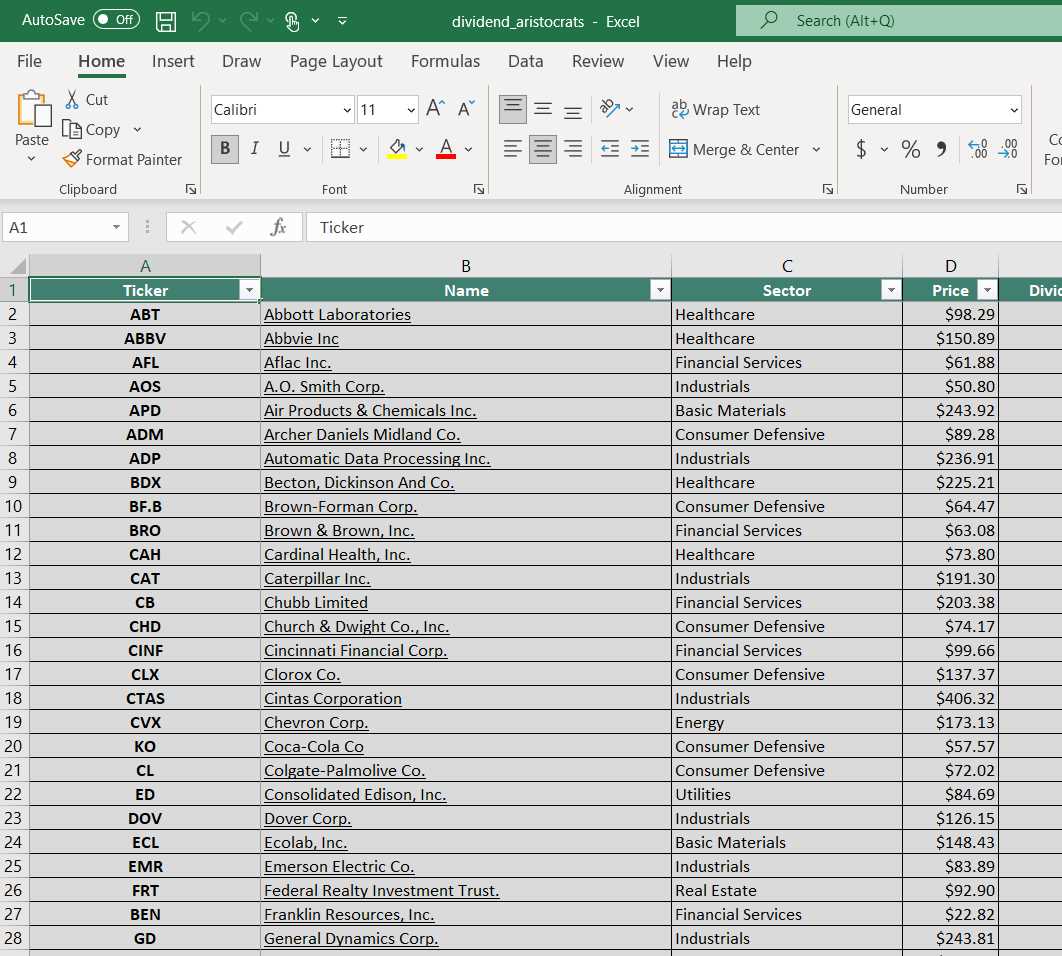

S&P 500 Dividend Aristocrat Index: Top Companies

The S&P 500 Dividend Aristocrat Index is a list of companies that have consistently increased their dividends for at least 25 consecutive years. These companies are considered to be some of the most reliable and stable dividend payers in the market.

Here are some of the top companies included in the S&P 500 Dividend Aristocrat Index:

| Company | Ticker Symbol | Industry |

|---|---|---|

| Johnson & Johnson | JNJ | Healthcare |

| The Coca-Cola Company | KO | Beverages |

| Procter & Gamble | PG | Consumer Goods |

| 3M Company | MMM | Industrial Conglomerates |

| Walgreens Boots Alliance | WBA | Retail |

Investing in companies included in the S&P 500 Dividend Aristocrat Index can be a way to potentially generate income and participate in the long-term growth of these reliable companies.

Definition of Dividend Stocks

Dividend stocks are a type of investment that provide regular income to investors in the form of dividends. Dividends are payments made by a company to its shareholders, typically on a quarterly basis, as a portion of the company’s profits.

When you invest in dividend stocks, you become a partial owner of the company and are entitled to a share of its profits. These profits are distributed to shareholders in the form of dividends, which can be paid in cash or additional shares of stock.

Benefits of Investing in Dividend Stocks

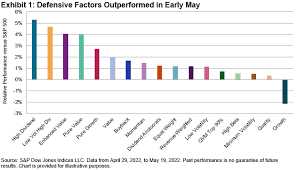

2. Stability: Dividend stocks are generally considered less volatile than growth stocks, making them a more stable investment option. This stability can help protect your portfolio during market downturns.

3. Long-Term Growth: While dividend stocks provide regular income, they can also offer long-term growth potential. Many dividend-paying companies have a track record of increasing their dividends over time, which can result in higher income and capital appreciation.

4. Dividend Reinvestment: Some companies offer dividend reinvestment programs (DRIPs), which allow you to automatically reinvest your dividends to purchase additional shares of stock. This can help accelerate the growth of your investment over time.

5. Tax Advantages: In some countries, dividends may be taxed at a lower rate than other forms of income, such as interest or capital gains. This can provide additional tax advantages for investors in dividend stocks.

Overall, dividend stocks can be a valuable addition to a well-diversified investment portfolio, providing both income and potential for long-term growth.

Benefits of Investing in Dividend Stocks

Investing in dividend stocks can offer several advantages for investors. Here are some key benefits:

1. Regular Income: Dividend stocks provide a steady stream of income for investors. Companies that pay dividends distribute a portion of their profits to shareholders on a regular basis, usually quarterly. This can be especially attractive for income-focused investors who rely on dividends to supplement their income.

2. Potential for Growth: Dividend stocks can offer the potential for both income and capital appreciation. Companies that consistently pay dividends often have a track record of stable earnings and cash flow, which can indicate a healthy and growing business. As a result, investors may benefit from both dividend income and potential stock price appreciation.

3. Dividend Reinvestment: Many dividend stocks offer the option to reinvest dividends automatically through a Dividend Reinvestment Plan (DRIP). This allows investors to use their dividend payments to purchase additional shares of the same stock, without incurring any transaction fees. Over time, this can compound the investment and potentially increase overall returns.

4. Lower Volatility: Dividend stocks tend to be less volatile compared to non-dividend-paying stocks. This is because companies that pay dividends often have more stable earnings and cash flow, which can provide a cushion during market downturns. Dividends can also act as a signal of a company’s financial health and management’s confidence in the business.

5. Diversification: Dividend stocks can be a valuable addition to a diversified investment portfolio. By including dividend-paying stocks from different sectors and industries, investors can spread their risk and potentially benefit from different sources of income. This can help to reduce the overall volatility of the portfolio and provide a more stable return over time.

6. Tax Advantages: In some countries, dividends may be subject to lower tax rates compared to other forms of investment income, such as interest or capital gains. This can provide additional tax advantages for investors who receive dividend income.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.