What is Reverse Morris Trust?

Reverse Morris Trust (RMT) is a financial transaction that allows a company to sell or spin off a subsidiary while avoiding capital gains taxes. It is a tax-efficient method used in mergers and acquisitions, particularly in cases where a larger company wants to divest a subsidiary or business unit.

The Reverse Morris Trust structure is named after a court case involving the Morris Trust, which established the legality of tax-free transactions under certain conditions. The reverse aspect refers to the fact that, in an RMT, the subsidiary is being divested rather than acquired.

RMT transactions offer several benefits, including tax savings, increased shareholder value, and strategic flexibility. By utilizing an RMT, companies can efficiently restructure their operations, focus on core businesses, and unlock shareholder value.

Overall, Reverse Morris Trust is a valuable tool for companies looking to divest subsidiaries or business units while minimizing tax liabilities and maximizing shareholder value.

Benefits of Reverse Morris Trust

Reverse Morris Trust (RMT) transactions offer several benefits to companies looking to restructure or divest a subsidiary. Here are some of the key advantages:

1. Tax Efficiency: One of the primary benefits of an RMT is the potential for significant tax savings. By structuring the transaction as a tax-free exchange, companies can avoid capital gains taxes that would typically be incurred in a traditional sale. This can result in substantial cost savings and increased cash flow for the company.

2. Simplified Process: Compared to other methods of divestiture, such as an outright sale or initial public offering (IPO), an RMT can be a simpler and more streamlined process. This is because the transaction involves a merger between the subsidiary and the acquiring company, rather than a separate sale or IPO process. This can save time and resources for both parties involved.

3. Flexibility in Deal Structure: RMT transactions offer flexibility in structuring the deal to meet the specific needs of the companies involved. For example, the acquiring company can choose to pay for the subsidiary with cash, stock, or a combination of both. This flexibility can help facilitate a smoother transaction and increase the likelihood of a successful outcome.

4. Preservation of Shareholder Value: In many cases, an RMT can help preserve shareholder value by allowing the divesting company’s shareholders to maintain an ongoing interest in the subsidiary. This can be particularly beneficial if the subsidiary is expected to experience future growth or if there are strategic reasons for the divesting company to retain an interest in the subsidiary.

5. Strategic Focus: By divesting a subsidiary through an RMT, companies can refocus their resources and attention on their core business operations. This can help improve overall operational efficiency and allow the company to allocate resources to areas that offer the greatest potential for growth and profitability.

Overall, the benefits of a Reverse Morris Trust transaction make it an attractive option for companies seeking to restructure or divest a subsidiary. The tax savings, simplified process, flexibility in deal structure, preservation of shareholder value, and strategic focus are all factors that contribute to the appeal of this transaction structure.

Tax Savings with Reverse Morris Trust

When considering trust and estate planning, one of the key benefits of a Reverse Morris Trust is the potential for significant tax savings. This structure allows for a tax-efficient transfer of assets between two companies, resulting in potential tax advantages for both parties involved.

One of the main tax benefits of a Reverse Morris Trust is the ability to defer capital gains taxes. In a typical merger or acquisition, the selling company may be subject to capital gains taxes on the sale of its assets. However, with a Reverse Morris Trust, the transaction is structured in a way that allows the selling company to defer these taxes.

Additionally, the acquiring company can benefit from a tax-free exchange of its stock for the assets of the selling company. This can result in significant tax savings for the acquiring company, as it can avoid paying taxes on the appreciation of its stock.

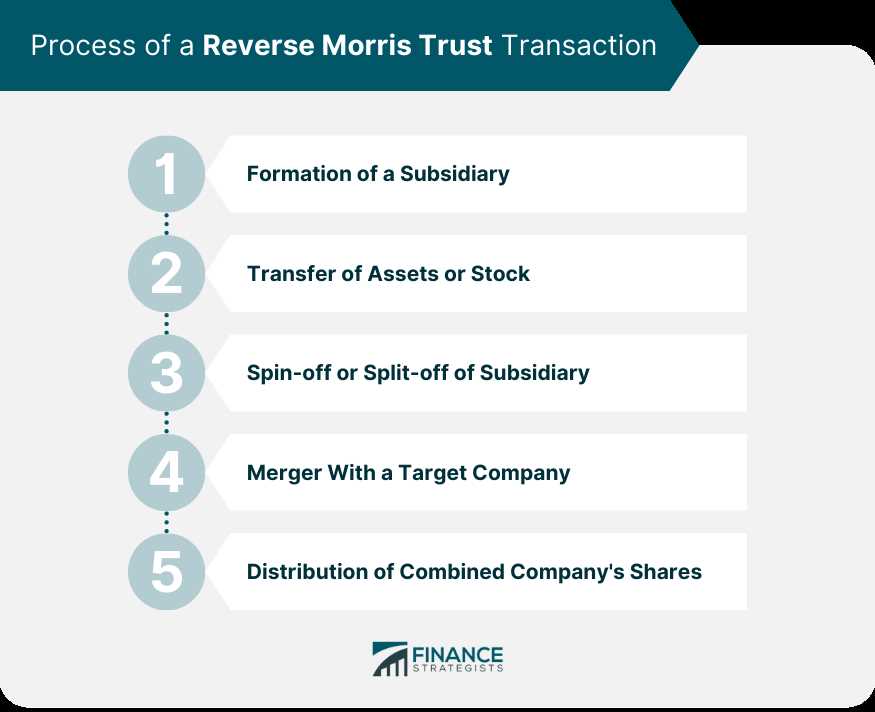

How does it work?

In a Reverse Morris Trust transaction, the selling company transfers its assets to a newly created subsidiary. This subsidiary is then merged with the acquiring company, with the selling company’s shareholders receiving stock in the acquiring company in exchange for their shares in the subsidiary.

This structure allows the selling company to defer capital gains taxes because the transaction is treated as a tax-free exchange under the Internal Revenue Code. The acquiring company can also benefit from tax savings by avoiding taxes on the appreciation of its stock.

Overall, the tax savings with a Reverse Morris Trust can be substantial, making it an attractive option for companies looking to optimize their tax planning strategies.

Trust and Estate Planning with Reverse Morris Trust

One of the main benefits of using a Reverse Morris Trust in trust and estate planning is the ability to defer capital gains taxes. By transferring assets to a new company in exchange for shares, individuals can delay the recognition of capital gains until they decide to sell those shares. This can be particularly advantageous for those with highly appreciated assets, as it allows for tax savings and increased flexibility in managing their estate.

Additionally, the Reverse Morris Trust can be a useful tool for estate planning purposes. By transferring assets to a new company, individuals can effectively separate those assets from their personal estate, potentially reducing estate taxes. This can be especially beneficial for individuals with large estates who are concerned about the impact of estate taxes on their heirs.

Furthermore, the Reverse Morris Trust can provide a streamlined and efficient way to transfer assets to the next generation. By utilizing this transaction structure, individuals can ensure a smooth transition of ownership while minimizing tax consequences. This can be particularly important for those who want to pass down their business or other assets to their children or other family members.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.