What is a Qualified Trust?

A qualified trust is a type of trust that meets certain requirements set forth by the Internal Revenue Service (IRS) in order to receive specific tax benefits. These trusts are commonly used in estate planning to help individuals and families minimize their tax liabilities and protect their assets.

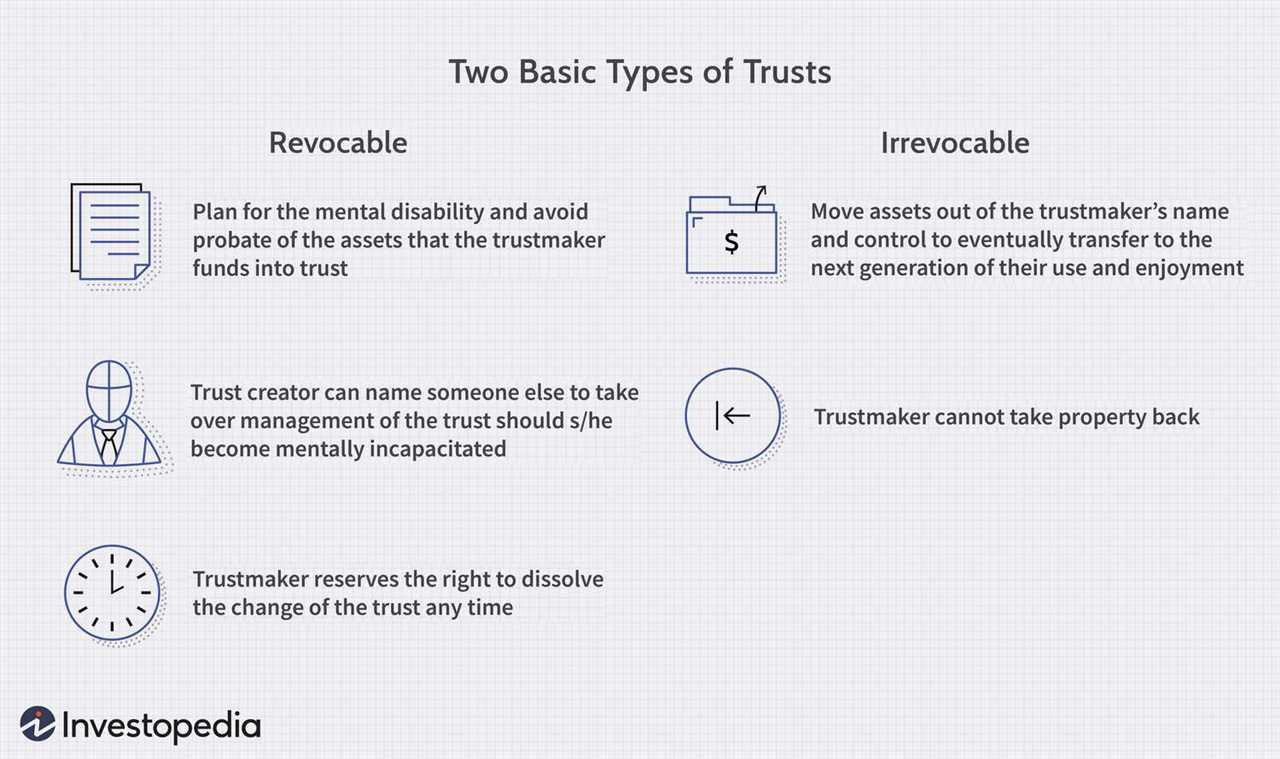

In order for a trust to be considered qualified, it must meet several criteria. First, it must be irrevocable, meaning that the grantor cannot change or revoke the terms of the trust once it has been established. Second, it must have a specific purpose, such as providing for the education or medical expenses of a beneficiary. Third, it must have a trustee who is responsible for managing the trust and distributing its assets according to the terms outlined in the trust document.

One of the main benefits of a qualified trust is its ability to provide tax advantages. For example, assets placed in a qualified trust may be excluded from the grantor’s taxable estate, which can help reduce estate taxes. Additionally, income generated by the trust may be taxed at a lower rate than if it were held in the grantor’s name.

Qualified trusts can also provide asset protection for beneficiaries. Since the trust is irrevocable, the assets held within it are typically shielded from creditors and legal claims. This can be especially beneficial for individuals who are concerned about protecting their wealth for future generations.

Benefits of a Qualified Trust

A qualified trust offers several benefits to individuals and families who are considering estate planning. These benefits include:

1. Tax Advantages

One of the main advantages of a qualified trust is its ability to provide tax advantages. By placing assets into a qualified trust, individuals can potentially reduce their estate tax liability. This is especially beneficial for individuals with large estates that may be subject to high estate taxes.

2. Asset Protection

A qualified trust can also provide asset protection for beneficiaries. By placing assets into a trust, individuals can ensure that those assets are protected from creditors and other potential threats. This can be particularly important for individuals who have concerns about their beneficiaries’ financial stability or who want to protect assets from potential lawsuits.

3. Control and Flexibility

With a qualified trust, individuals can maintain a level of control and flexibility over their assets. They can specify how and when the assets are distributed to beneficiaries, ensuring that their wishes are carried out even after their passing. This can be particularly important for individuals who have specific goals or intentions for their assets, such as providing for the education of their children or supporting a charitable cause.

4. Privacy

Unlike a will, which becomes a public document after the individual’s passing, a qualified trust offers privacy. The details of the trust, including the assets and beneficiaries, are not made public, providing individuals with a greater level of privacy and confidentiality.

5. Avoiding Probate

Another benefit of a qualified trust is the ability to avoid probate. Probate is the legal process of validating a will and distributing assets according to its instructions. This process can be time-consuming, expensive, and subject to public scrutiny. By placing assets into a trust, individuals can bypass the probate process, allowing for a faster and more efficient distribution of assets to beneficiaries.

How Does a Qualified Trust Work?

A qualified trust is a type of trust that meets certain requirements set forth by the Internal Revenue Service (IRS). These requirements are primarily related to the tax treatment of the trust and its beneficiaries. By meeting these requirements, a qualified trust can provide significant tax benefits.

Requirements for a Qualified Trust

In order for a trust to be considered qualified, it must meet several key requirements:

- The trust must be irrevocable, meaning that once it is established, it cannot be changed or revoked by the grantor.

- The trust must have a valid purpose, such as providing for the financial security of the grantor’s beneficiaries.

- The trust must have a named trustee who is responsible for managing the trust assets and making distributions to the beneficiaries.

- The trust must comply with all applicable state and federal laws.

- The trust must provide for the distribution of income and principal to the beneficiaries in a manner that meets the IRS’s requirements.

Tax Benefits of a Qualified Trust

One of the main benefits of a qualified trust is its favorable tax treatment. Qualified trusts are typically exempt from federal estate tax, which can result in significant tax savings for the grantor and their beneficiaries. Additionally, qualified trusts may also be eligible for certain income tax deductions and exemptions.

Another benefit of a qualified trust is that it can provide asset protection for the grantor’s beneficiaries. By placing assets in a qualified trust, the grantor can ensure that those assets are protected from creditors and other potential threats.

How a Qualified Trust Works

Once a qualified trust is established, the grantor transfers assets into the trust. These assets are then managed by the trustee according to the terms of the trust agreement. The trustee is responsible for making distributions to the beneficiaries as outlined in the trust agreement.

The trust agreement will specify how and when distributions are to be made, as well as any conditions or restrictions that may apply. For example, the trust agreement may require that distributions be made only for specific purposes, such as education or medical expenses.

The trustee is also responsible for ensuring that the trust complies with all applicable laws and regulations. This includes filing any necessary tax returns and providing the IRS with the required information.

Conclusion

A qualified trust can be a powerful tool in estate planning, providing both tax benefits and asset protection for the grantor and their beneficiaries. By meeting the IRS’s requirements, a qualified trust can help minimize estate taxes and ensure that assets are distributed according to the grantor’s wishes.

It is important to work with an experienced estate planning attorney to establish a qualified trust and ensure that it is properly structured and administered. This will help ensure that the trust meets all necessary requirements and provides the desired benefits.

Qualified Trust vs. Other Trusts

One key difference between a qualified trust and other trusts is the specific purpose for which it is created. While other trusts may be created for general estate planning purposes, a qualified trust is specifically designed to transfer a primary residence or vacation home while minimizing estate and gift taxes.

Another difference is the limited duration of a qualified trust. Unlike other trusts that can last for an indefinite period of time, a qualified trust typically has a predetermined term, often ranging from 10 to 20 years. At the end of the term, the property held in the trust is transferred to the beneficiaries, typically family members or loved ones.

Additionally, a qualified trust may offer greater asset protection compared to other types of trusts. By transferring the property to the trust, it is shielded from potential creditors and legal claims. This can be particularly beneficial for individuals who want to protect their primary residence or vacation home from potential lawsuits or other financial risks.

It is also important to note that a qualified trust may have certain restrictions and limitations. For example, the individual creating the trust may be required to pay rent to the trust during the term of the trust. Additionally, if the individual dies before the end of the trust term, the property may be included in their taxable estate.

Qualified Trust in Estate Planning

Estate planning is a crucial aspect of financial management, ensuring that your assets are distributed according to your wishes after your passing. One of the tools commonly used in estate planning is a qualified trust.

What is a Qualified Trust?

A qualified trust is a type of trust that meets specific requirements set by the Internal Revenue Service (IRS) in the United States. It is designed to provide tax advantages and protect assets for beneficiaries. To be considered qualified, a trust must meet certain criteria, such as being irrevocable and having a designated trustee.

Benefits of a Qualified Trust

There are several benefits to using a qualified trust in estate planning. Firstly, it allows for the reduction of estate taxes. By placing assets in a qualified trust, they are removed from the taxable estate, potentially reducing the overall tax liability. Additionally, a qualified trust can provide asset protection for beneficiaries, ensuring that the assets are preserved and not subject to creditors or other potential risks.

How Does a Qualified Trust Work?

A qualified trust works by transferring assets into the trust, which is managed by a designated trustee. The trustee is responsible for overseeing the trust and distributing assets to the beneficiaries according to the terms outlined in the trust document. The trust document specifies the conditions and timing of asset distribution, ensuring that the assets are distributed in a manner that aligns with the grantor’s wishes.

Qualified Trust vs. Other Trusts

While there are various types of trusts available for estate planning, a qualified trust offers distinct advantages. Unlike a revocable trust, which can be changed or revoked by the grantor, a qualified trust is irrevocable, providing more protection for the assets. Additionally, a qualified trust offers tax benefits that may not be available with other types of trusts.

Compared to a living trust, a qualified trust provides more stringent requirements and guidelines, ensuring that the trust meets the necessary criteria for tax advantages. It is important to consult with an experienced estate planning attorney to determine the most suitable trust for your specific needs.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.