Promissory Note Types: Pros and Cons Explained

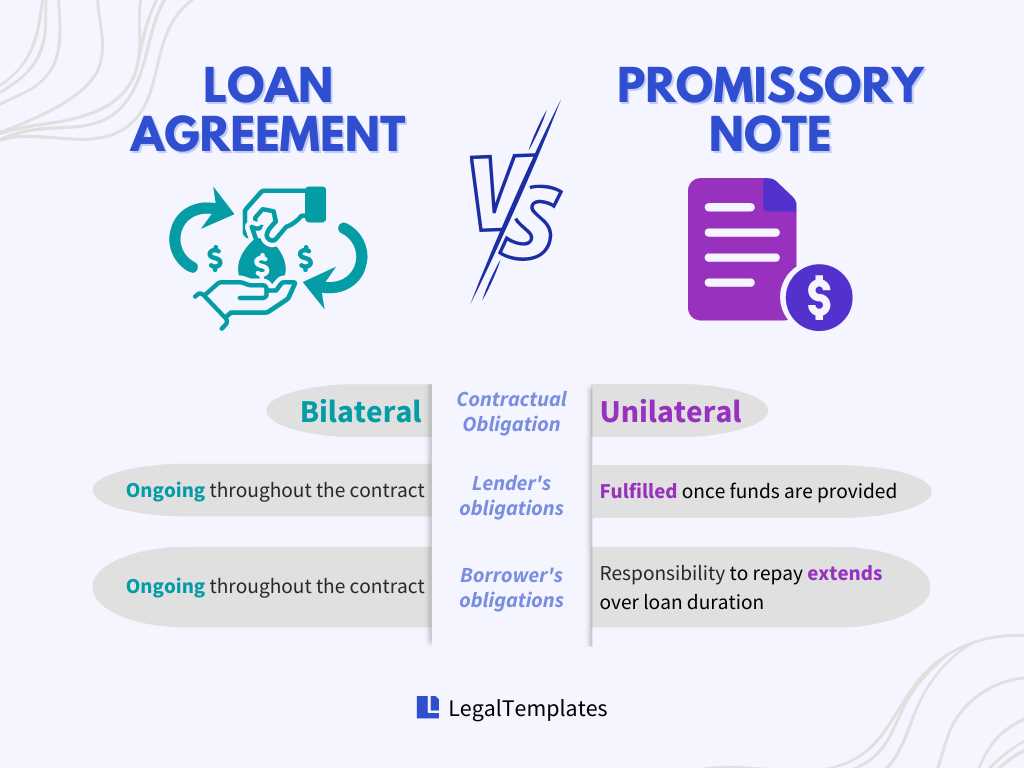

A promissory note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. It serves as a written promise by the borrower to repay the loan amount to the lender within a specified period of time. There are different types of promissory notes, each with its own set of pros and cons.

Another type of promissory note is a convertible promissory note. This type of note allows the lender to convert the outstanding loan amount into equity in the borrower’s company. This can be advantageous for both parties, as it provides the lender with the potential for a higher return on investment, and it allows the borrower to secure funding without having to give up ownership or control of their company. However, this type of note can be complex and may require legal and financial expertise to properly structure and execute.

Unsecured Promissory Notes

An unsecured promissory note is a type of loan agreement that does not require any collateral or security from the borrower. It is based solely on the borrower’s promise to repay the loan amount within a specified period of time, along with any interest or fees that may be applicable.

Unsecured promissory notes are commonly used in situations where the borrower does not have any assets or property to offer as collateral. This type of loan agreement is often used for personal loans, small business loans, or loans between friends or family members.

While unsecured promissory notes offer flexibility and convenience for borrowers, they also carry a higher risk for lenders. Since there is no collateral to secure the loan, lenders may charge higher interest rates to compensate for the increased risk. Additionally, if the borrower defaults on the loan, the lender may have limited options for recovering the loan amount.

When entering into an unsecured promissory note agreement, it is important for both parties to carefully consider the terms and conditions. The agreement should clearly outline the loan amount, repayment terms, interest rate, and any other applicable fees or penalties. It is also recommended to include provisions for late payments or default, as well as a dispute resolution process.

| Pros | Cons |

|---|---|

| Flexibility for borrowers | Higher risk for lenders |

| Convenience for personal loans | Limited options for loan recovery |

| Useful for small business loans | Potential for higher interest rates |

| Can be used for loans between friends or family members | Requires careful consideration of terms and conditions |

Secured Promissory Notes

Pros of Secured Promissory Notes

- Easier approval: Secured loans are generally easier to obtain than unsecured loans, especially for borrowers with less-than-perfect credit. The collateral provides reassurance to the lender.

Cons of Secured Promissory Notes

- Potential loss of collateral: If the borrower is unable to repay the loan, they risk losing the pledged asset. This can have significant financial consequences, especially if the collateral is valuable.

- Time-consuming process: Secured loans often require more paperwork and documentation compared to unsecured loans. The lender needs to verify the value and ownership of the collateral, which can delay the loan approval process.

- Limited options for collateral: Not all assets can be used as collateral for a secured promissory note. The lender may have specific requirements regarding the type and value of the collateral.

Overall, secured promissory notes can be a beneficial option for borrowers who are willing to provide collateral in exchange for lower interest rates and higher borrowing limits. However, it is important for borrowers to carefully consider the potential risks and consequences before entering into a secured loan agreement.

Convertible Promissory Notes

Pros of Convertible Promissory Notes

There are several advantages to using convertible promissory notes:

- Lower Interest Rates: Convertible promissory notes often have lower interest rates compared to traditional loans or bonds. This can make them an attractive option for both the issuer and the investor.

- Potential for Higher Returns: If the company performs well and the investor decides to convert their debt into equity, they have the potential to earn higher returns compared to traditional debt investments.

Cons of Convertible Promissory Notes

Despite their advantages, convertible promissory notes also have some drawbacks:

- Risk of Equity Dilution: If the investor decides to convert their debt into equity, it can lead to dilution of ownership for existing shareholders. This means that their percentage of ownership in the company will decrease.

- Dependent on Company Performance: The potential returns from a convertible promissory note are dependent on the future performance of the issuing company. If the company does not perform well, the investor may not receive the expected returns.

Conclusion: Convertible promissory notes can be a useful financing tool for both companies and investors. They offer flexibility and potential for higher returns, but also come with risks such as equity dilution and dependence on company performance. It is important for both parties to carefully consider the terms and implications before entering into a convertible promissory note agreement.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.