Types of Private Companies

Private companies are a popular form of business organization that are not publicly traded on the stock market. They are owned and operated by individuals or a small group of people, and their shares are not available for purchase by the general public. There are several types of private companies, each with its own characteristics and advantages.

Sole Proprietorship

Partnership

A partnership is a private company that is owned by two or more individuals. In a partnership, the owners share the profits, losses, and responsibilities of the business. There are two main types of partnerships: general partnerships and limited partnerships. In a general partnership, all partners have unlimited liability for the company’s debts. In a limited partnership, there are both general partners, who have unlimited liability, and limited partners, who have limited liability. Partnerships are often chosen by professionals, such as lawyers or accountants, who want to share resources and expertise.

Limited Liability Company (LLC)

Sole Proprietorship

A sole proprietorship is a type of private company that is owned and operated by a single individual. It is the simplest and most common form of business ownership. In a sole proprietorship, the owner has complete control and decision-making power over the business.

Advantages of Sole Proprietorship

There are several advantages to operating as a sole proprietorship:

| Advantages | Description |

|---|---|

| Easy and inexpensive to set up | Setting up a sole proprietorship is relatively simple and inexpensive compared to other business structures. There are no formal legal requirements or paperwork to establish a sole proprietorship. |

| Complete control | |

| Flexibility | A sole proprietorship allows for flexibility in terms of business operations. You can easily change the direction or focus of the business without having to consult with others. |

| Profit retention | |

| Tax advantages | One of the main advantages of a sole proprietorship is the ability to take advantage of certain tax benefits. The business income is reported on the owner’s personal tax return, which can result in lower tax rates. |

Overall, a sole proprietorship can be a great option for individuals looking to start a small business with complete control and flexibility. However, it is important to carefully consider the potential risks and liabilities associated with this business structure.

Partnership

A partnership is a type of private company where two or more individuals come together to carry on a business for profit. In a partnership, the partners share the responsibilities, profits, and losses of the business.

There are two main types of partnerships:

| General Partnership | Limited Partnership |

|---|---|

| In a general partnership, all partners have equal rights and responsibilities. They share the profits and losses equally and have unlimited liability for the debts and obligations of the partnership. | In a limited partnership, there are two types of partners: general partners and limited partners. General partners have unlimited liability and manage the day-to-day operations of the business, while limited partners have limited liability and are not involved in the management of the business. |

Partnerships offer several advantages:

- Shared Responsibility: Partners can share the workload and responsibilities of the business, allowing for a more efficient operation.

- Pooling of Resources: Partners can contribute their individual resources, such as capital, skills, and networks, to the partnership, which can help in the growth and success of the business.

- Combined Expertise: Partners bring their unique skills and expertise to the partnership, which can lead to better decision-making and problem-solving.

- Tax Benefits: Partnerships are not subject to double taxation like corporations. Instead, the profits and losses of the partnership are passed through to the partners, who report them on their individual tax returns.

However, partnerships also have some disadvantages:

- Unlimited Liability: In a general partnership, partners have unlimited personal liability for the debts and obligations of the partnership. This means that their personal assets can be used to satisfy the partnership’s debts.

- Shared Profits: Partners must share the profits of the business with each other, which can sometimes lead to conflicts or disagreements.

- Limited Life: A partnership may dissolve upon the death, retirement, or withdrawal of a partner, which can disrupt the continuity of the business.

Overall, partnerships can be a flexible and effective way for individuals to come together and run a business. However, it is important to carefully consider the advantages and disadvantages before entering into a partnership agreement.

Limited Liability Company (LLC)

One of the key benefits of forming an LLC is the limited liability protection it offers. This means that the personal assets of the members are generally protected from the company’s debts and liabilities. In the event of a lawsuit or bankruptcy, the members’ personal assets are not at risk.

Another advantage of an LLC is the flexibility it provides in terms of management. Unlike corporations, which have a more rigid management structure with a board of directors and officers, an LLC can be managed by its members or by appointed managers. This allows for greater control and decision-making power for the owners.

LLCs also offer flexibility in terms of taxation. By default, an LLC is treated as a pass-through entity for tax purposes, meaning that the profits and losses of the company are passed through to the members and reported on their individual tax returns. However, an LLC can also choose to be taxed as a corporation if it is more advantageous for the business.

Additionally, an LLC offers a level of privacy and confidentiality. Unlike publicly traded companies, which are required to disclose certain information to the public, an LLC can keep its financial and operational details private. This can be beneficial for businesses that prefer to operate discreetly.

However, there are also some potential drawbacks to forming an LLC. One of the main disadvantages is the complexity and cost associated with setting up and maintaining an LLC. There are often legal and administrative requirements that must be met, such as filing articles of organization and creating an operating agreement.

Furthermore, the taxation of an LLC can be more complex than that of a sole proprietorship or partnership. Depending on the state and the specific circumstances of the business, an LLC may be subject to additional taxes or fees.

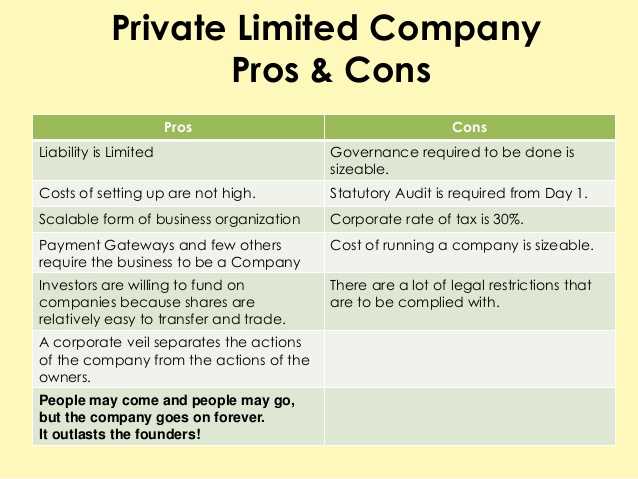

Pros of Private Companies

Private companies offer several advantages over their public counterparts. Here are some of the key benefits:

| 1. Flexibility and Control | Private companies have more flexibility and control over their operations and decision-making processes. They are not bound by the same regulatory requirements and reporting obligations as public companies, allowing them to respond quickly to market changes and make strategic decisions without the need for shareholder approval. |

| 2. Privacy | Private companies are not required to disclose their financial information to the public, which provides a level of privacy and confidentiality. This can be especially beneficial for companies that want to keep their financial performance, business strategies, and trade secrets confidential. |

| 3. Long-Term Focus | Private companies can take a long-term approach to their business strategies and investments without the pressure of meeting short-term financial targets or appeasing shareholders. This allows them to focus on sustainable growth, innovation, and building lasting relationships with customers and suppliers. |

| 4. Lower Costs | |

| 5. Greater Agility | Private companies can react quickly to market opportunities and adapt their strategies without the need for extensive bureaucratic processes or shareholder approval. This agility allows them to seize opportunities, innovate, and stay ahead of competitors in a rapidly changing business environment. |

| 6. Lower Risk of Hostile Takeovers | Private companies are less susceptible to hostile takeovers compared to public companies. Since ownership is limited to a select group of individuals or entities, it is more difficult for external parties to acquire a controlling stake in the company without the consent of the owners. This provides stability and security for the company’s management and shareholders. |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.