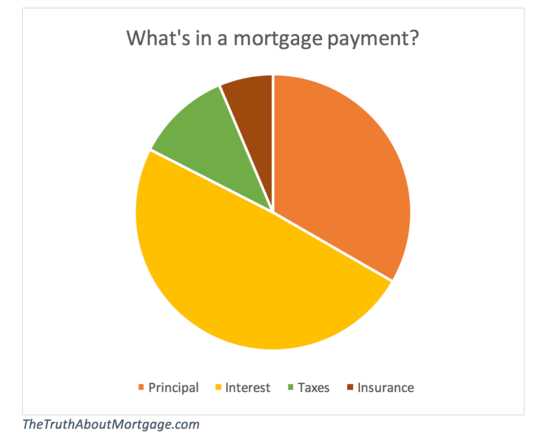

What is PITI?

Principal: The principal is the amount of money borrowed to purchase the home. It is the initial loan amount that needs to be repaid over time.

Interest: Interest is the cost of borrowing money from the lender. It is calculated as a percentage of the principal and is added to the monthly mortgage payment.

Taxes: Taxes refer to property taxes that homeowners are required to pay. These taxes are typically based on the assessed value of the property and are used to fund local government services.

Insurance: Insurance includes homeowner’s insurance, which protects the property against damage and liability. It is usually required by lenders to protect their investment in case of unforeseen events.

Definition and Meaning

PITI refers to the four components that make up your monthly mortgage payment. Let’s break down each element:

Principal:

The principal is the amount of money you borrowed to purchase your home. It is the initial loan amount that you will repay over time.

Interest:

Interest is the cost of borrowing money from the lender. It is calculated based on the interest rate and the remaining balance of your loan. The interest portion of your mortgage payment decreases over time as you pay off more of the principal.

Taxes:

Taxes refer to property taxes that are assessed by local government authorities. These taxes are typically based on the assessed value of your property and are used to fund local services and infrastructure.

Insurance:

Insurance includes homeowner’s insurance, which protects your property against damage or loss, and mortgage insurance, which is required for certain types of loans. Homeowner’s insurance provides coverage for your home and belongings, while mortgage insurance protects the lender in case you default on your loan.

PITI Formula

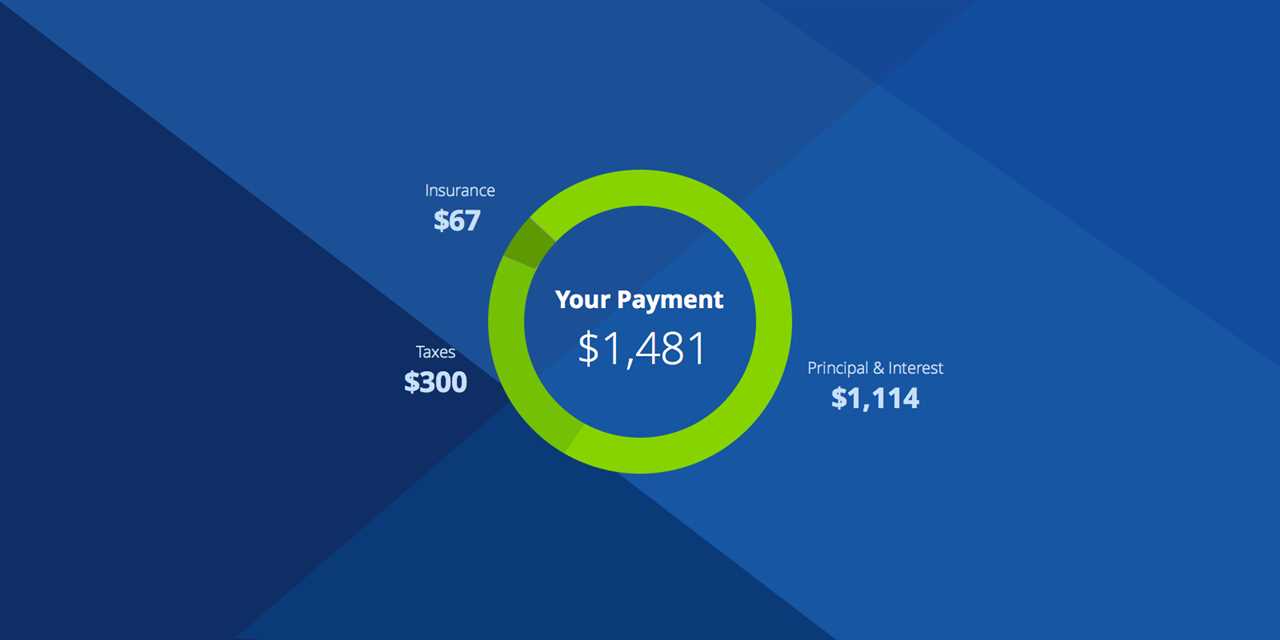

Calculating your monthly mortgage payment involves using the PITI formula. PITI stands for Principal, Interest, Taxes, and Insurance, which are the four components that make up your monthly payment.

Principal

The principal is the amount of money you borrowed to purchase your home. It is the initial loan amount that you will repay over time.

Interest

Interest is the cost of borrowing money from the lender. It is calculated as a percentage of the principal and is added to your monthly payment.

Taxes

Taxes refer to property taxes that you are required to pay as a homeowner. These taxes are typically assessed by your local government and are based on the value of your property.

Insurance

Insurance refers to homeowners insurance, which protects your home and its contents from damage or loss. It is an additional cost that is included in your monthly payment.

The PITI formula is:

PITI = Principal + Interest + Taxes + Insurance

By using this formula, you can calculate your monthly mortgage payment and ensure that you are budgeting appropriately for your home ownership expenses.

Calculating Principal, Interest, Taxes, and Insurance

Step 1: Determine your loan amount and interest rate

The first step in calculating PITI is to determine your loan amount and interest rate. The loan amount is the total amount you borrowed to purchase your home, while the interest rate is the percentage charged by the lender for borrowing the money.

Step 2: Calculate the principal and interest

Step 3: Determine your property taxes

Property taxes are levied by the local government and are based on the assessed value of your property. To find out the annual property tax amount, you can check your property tax bill or contact your local tax assessor’s office. Divide the annual amount by 12 to get the monthly property tax amount.

Step 4: Calculate the insurance cost

Step 5: Add up all the components

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.