Portfolio Variance: Definition, Formula, Calculation, Example

Portfolio variance is a key concept in risk management and investment analysis. It measures the dispersion of returns for a portfolio of assets, taking into account the weights and correlations of each asset in the portfolio. By calculating portfolio variance, investors can assess the level of risk associated with their investment portfolio.

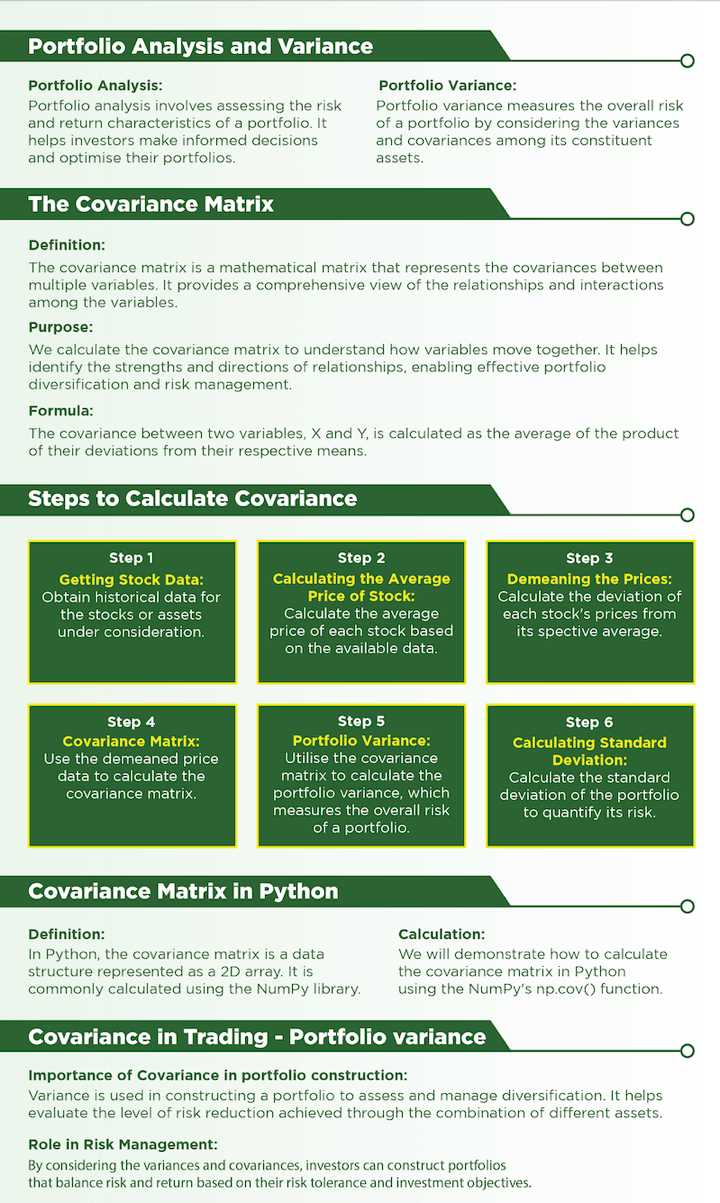

Definition

Portfolio variance is a statistical measure that quantifies the volatility or risk of a portfolio. It considers the individual asset returns, their weights in the portfolio, and the correlations between them. The variance of each asset is multiplied by its weight squared, and the covariance between each pair of assets is multiplied by their respective weights. The sum of these products gives the portfolio variance.

Formula for Calculating Portfolio Variance

The formula for calculating portfolio variance is as follows:

Portfolio Variance = ∑(wi * wj * σi * σj * ρij)

Where:

- wi, wj are the weights of assets i and j in the portfolio

- σi, σj are the standard deviations of assets i and j

- ρij is the correlation coefficient between assets i and j

Calculation Example

Let’s consider a portfolio consisting of two assets: stocks and bonds. The weights of stocks and bonds in the portfolio are 0.6 and 0.4, respectively. The standard deviation of stocks is 0.12, the standard deviation of bonds is 0.08, and the correlation coefficient between stocks and bonds is 0.5.

Using the formula for portfolio variance, we can calculate:

Portfolio Variance = (0.6^2 * 0.12^2) + (0.4^2 * 0.08^2) + (2 * 0.6 * 0.4 * 0.12 * 0.08 * 0.5)

Simplifying the calculation:

Portfolio Variance = 0.0144 + 0.0128 + 0.0192 = 0.0464

Therefore, the portfolio variance is 0.0464.

By calculating the portfolio variance, investors can gain insights into the risk level of their investment portfolio. A higher portfolio variance indicates higher risk, while a lower portfolio variance indicates lower risk. It is important for investors to consider portfolio variance when making investment decisions and managing their risk exposure.

What is Portfolio Variance?

When constructing an investment portfolio, it is important to consider not only the expected returns of the individual assets but also the potential risks. Portfolio variance provides a quantitative measure of the overall risk of the portfolio, taking into account the potential interactions between the assets.

The concept of portfolio variance is based on the idea that by diversifying investments across different assets, investors can reduce the overall risk of their portfolio. By including assets with low or negative correlations, the fluctuations in the returns of one asset can be offset by the movements in the returns of other assets.

To calculate portfolio variance, the individual variances of the assets in the portfolio are weighted according to their respective weights in the portfolio. The covariance between each pair of assets is also taken into account. The formula for portfolio variance is as follows:

Portfolio Variance = ∑(wi * wj * Cov(i,j)), where wi and wj are the weights of assets i and j in the portfolio, and Cov(i,j) is the covariance between assets i and j.

By calculating the portfolio variance, investors can assess the potential risk associated with their investment portfolio and make informed decisions about asset allocation and diversification. It allows them to balance the desired level of risk with the expected returns of the portfolio.

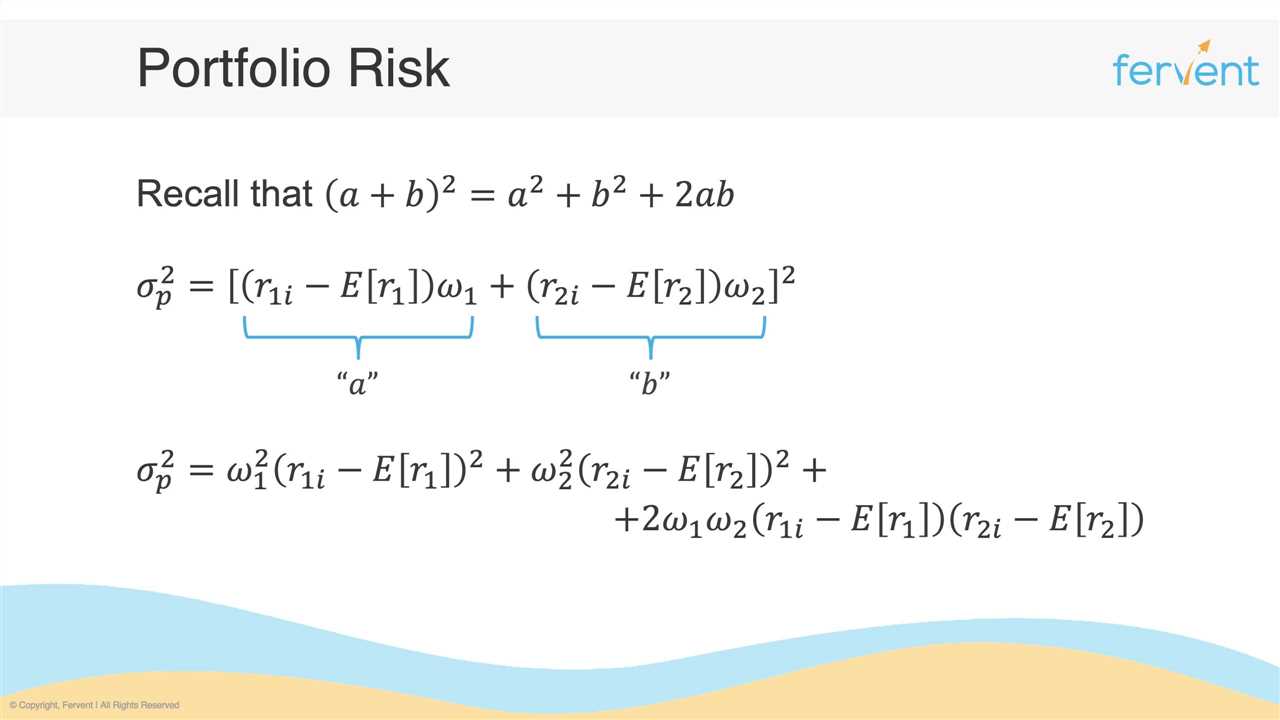

Formula for Calculating Portfolio Variance

The portfolio variance is a measure of the overall risk of a portfolio, taking into account the individual variances and covariances of the assets within the portfolio. It is an important concept in risk management and portfolio optimization.

The formula for calculating portfolio variance is:

Portfolio Variance = w1^2 * σ1^2 + w2^2 * σ2^2 + 2 * w1 * w2 * ρ12 * σ1 * σ2 + … + wn^2 * σn^2 + 2 * w1 * wn * ρ1n * σ1 * σn + … + 2 * wn-1 * wn * ρn-1,n * σn-1 * σn

Where:

- w1, w2, …, wn are the weights of the assets in the portfolio

- σ1, σ2, …, σn are the standard deviations of the returns of the assets

- ρ12, ρ1n, …, ρn-1,n are the correlations between the returns of the assets

The portfolio variance formula takes into account both the individual risk of each asset (measured by the variance) and the relationship between the assets (measured by the covariance). It allows investors to assess the overall risk of their portfolio and make informed decisions about asset allocation and diversification.

By minimizing the portfolio variance, investors can aim to achieve a balance between risk and return, maximizing their potential for gains while minimizing the potential for losses.

It is important to note that the portfolio variance formula assumes that the returns of the assets are normally distributed and that the correlations between the assets remain constant over time. In practice, these assumptions may not always hold true, and additional considerations may be necessary in portfolio analysis.

Example of Portfolio Variance Calculation

Step 1: Gather Data

Let’s assume that the historical returns for Stock A are as follows:

| Year | Return |

|---|---|

| 2016 | 0.10 |

| 2017 | 0.15 |

| 2018 | 0.08 |

And the historical returns for Stock B are as follows:

| Year | Return |

|---|---|

| 2016 | 0.05 |

| 2017 | 0.12 |

| 2018 | 0.09 |

Finally, let’s assume that the covariance between Stock A and Stock B is 0.0012.

Step 2: Calculate the Expected Return for Each Stock

To calculate the expected return for each stock, we will take the average of the historical returns.

The expected return for Stock A is calculated as:

(0.10 + 0.15 + 0.08) / 3 = 0.11

The expected return for Stock B is calculated as:

(0.05 + 0.12 + 0.09) / 3 = 0.08

Step 3: Calculate the Portfolio Variance

The portfolio variance is calculated using the following formula:

Portfolio Variance = (wA^2 * σA^2) + (wB^2 * σB^2) + (2 * wA * wB * Cov(A, B))

Where:

wA and wB are the portfolio weights for Stock A and Stock B, respectively.

σA^2 and σB^2 are the variances of Stock A and Stock B, respectively.

Cov(A, B) is the covariance between Stock A and Stock B.

Using the given data, we can substitute the values into the formula:

Portfolio Variance = (0.6^2 * σA^2) + (0.4^2 * σB^2) + (2 * 0.6 * 0.4 * 0.0012)

Step 4: Calculate the Portfolio Variance

Finally, we can calculate the portfolio variance:

Portfolio Variance = (0.6^2 * σA^2) + (0.4^2 * σB^2) + (2 * 0.6 * 0.4 * 0.0012)

= (0.36 * σA^2) + (0.16 * σB^2) + (0.0048)

Assuming that the variances of Stock A and Stock B are 0.02 and 0.03, respectively, we can substitute the values into the equation:

Portfolio Variance = (0.36 * 0.02) + (0.16 * 0.03) + (0.0048)

= 0.0072 + 0.0048 + 0.0048

= 0.0168

Therefore, the portfolio variance for this hypothetical investment portfolio is 0.0168.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.