Long Straddle: Definition and Explanation

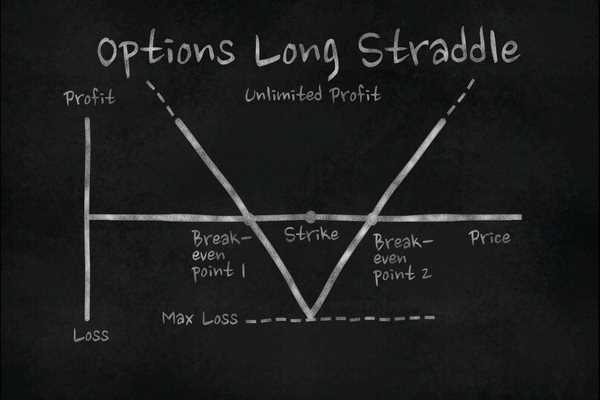

A long straddle is an options trading strategy that involves purchasing both a call option and a put option with the same strike price and expiration date. This strategy is used when the trader believes that the underlying asset will experience significant volatility in price, but is unsure about the direction of the price movement.

The main advantage of a long straddle is that it allows the trader to profit from volatility without having to predict the direction of the price movement. This strategy can be particularly useful in situations where there is an upcoming event or announcement that is expected to cause significant price fluctuations.

However, it is important to note that a long straddle can be a high-risk strategy, as it requires the underlying asset to experience substantial price movements in order to be profitable. If the price remains relatively stable, both the call and put options may expire worthless, resulting in a loss for the trader.

In summary, a long straddle is an options trading strategy that involves buying both a call option and a put option with the same strike price and expiration date. It allows traders to profit from volatility without having to predict the direction of the price movement. However, it is a high-risk strategy that requires significant price movements to be profitable.

What is a Long Straddle?

A long straddle is an options trading strategy that involves buying both a call option and a put option with the same strike price and expiration date. This strategy is used when the trader believes that the underlying asset will experience significant volatility in the near future, but is uncertain about the direction of the price movement.

How does a Long Straddle work?

When implementing a long straddle strategy, the trader pays a premium for both the call option and the put option. This premium represents the cost of the options and is the maximum potential loss for the trader. If the price of the underlying asset remains relatively stable, both options may expire worthless, resulting in a loss equal to the premium paid.

However, if the price of the underlying asset experiences a significant increase or decrease, one of the options will become profitable, potentially offsetting the loss on the other option. The trader can choose to exercise the profitable option and sell the other option to lock in the gains.

Advantages of a Long Straddle:

- Potential for unlimited profit if the price of the underlying asset moves significantly in either direction

- Allows the trader to benefit from volatility without predicting the direction of the price movement

Disadvantages of a Long Straddle:

- Requires a significant price movement to be profitable

- Time decay can erode the value of the options if the price remains relatively stable

- High upfront cost due to the premium paid for both options

How is a Long Straddle Used in Trading?

A long straddle is a trading strategy that involves buying both a call option and a put option with the same strike price and expiration date. This strategy is used when the trader believes that the underlying asset will experience significant volatility in the near future, but is unsure of the direction in which the price will move.

The main advantage of a long straddle is that it allows the trader to profit from volatility in the market, regardless of the direction of the price movement. This makes it a popular strategy for traders who expect a significant market event or announcement that could cause a large price swing.

Managing Risk

To manage this risk, traders often set a predetermined stop-loss level to limit their potential losses. This means that if the price of the underlying asset reaches a certain point, the trader will exit the position to minimize their losses.

Example

Let’s say a trader believes that a company is about to release its quarterly earnings report, and expects the report to have a significant impact on the stock price. The trader decides to use a long straddle strategy to profit from the expected volatility.

The trader purchases a call option and a put option on the company’s stock, both with a strike price of $100 and an expiration date of one month. The call option costs $5 and the put option costs $4, resulting in a total investment of $9.

However, if the stock price remains relatively stable and does not experience a significant price movement, both the call option and the put option may expire worthless, resulting in a loss of the initial investment of $9.

| Scenario | Stock Price | Call Option Value | Put Option Value | Total Profit/Loss |

|---|---|---|---|---|

| Positive Earnings Report | $120 | $20 | $0 | $11 |

| Negative Earnings Report | $80 | $0 | $20 | $11 |

| Stable Stock Price | $100 | $0 | $0 | -$9 |

Example of a Long Straddle

Let’s take a look at an example to better understand how a long straddle works in trading.

Suppose you are an options trader and you believe that a particular stock, XYZ, is going to experience a significant price movement in the near future, but you are unsure of the direction. You decide to employ a long straddle strategy to take advantage of this anticipated volatility.

You first purchase a call option for XYZ with a strike price of $100 and an expiration date of one month. This gives you the right to buy XYZ at $100 per share. At the same time, you also purchase a put option for XYZ with the same strike price and expiration date. This gives you the right to sell XYZ at $100 per share.

Now, let’s consider two scenarios:

Scenario 1: XYZ’s price increases

If XYZ’s price increases to $120 per share before the expiration date, the call option will be in the money, meaning it has value. You can exercise your right to buy XYZ at $100 per share and then sell it at the market price of $120 per share. This results in a profit of $20 per share.

On the other hand, the put option will expire worthless since there is no benefit in selling XYZ at $100 per share when it is trading at $120 per share. You would only lose the premium paid for the put option.

Scenario 2: XYZ’s price decreases

If XYZ’s price decreases to $80 per share before the expiration date, the put option will be in the money. You can exercise your right to sell XYZ at $100 per share and then buy it at the market price of $80 per share. This results in a profit of $20 per share.

Similarly, the call option will expire worthless since there is no benefit in buying XYZ at $100 per share when it is trading at $80 per share. Again, you would only lose the premium paid for the call option.

In both scenarios, you would make a profit regardless of whether the stock price goes up or down. This is the advantage of a long straddle strategy. However, it is important to note that the stock price needs to move significantly in order to cover the cost of both options and generate a profit.

Advanced Concepts in Long Straddle Trading

1. Implied Volatility: Implied volatility is a measure of the expected future price movement of an underlying asset. In long straddle trading, it is important to consider the implied volatility of the options being traded. Higher implied volatility generally leads to higher option prices, which can be beneficial for long straddle traders.

4. Risk Management: Long straddle trading carries inherent risks, including the potential for unlimited losses if the underlying asset moves in the opposite direction than expected. Traders should implement risk management strategies, such as setting stop-loss orders or using options spreads, to limit their potential losses and protect their capital.

5. Event Risk: Long straddle trading can be particularly effective during periods of high event risk, such as earnings announcements or major economic releases. These events often lead to increased volatility, which can benefit long straddle traders. However, it is important to carefully consider the timing of these events and their potential impact on the underlying asset.

6. Adjustments and Exit Strategies: Long straddle traders should have a plan in place for adjusting their positions or exiting trades if the market conditions change. This may involve rolling the options to a different expiration date or strike price, or closing the position early to lock in profits or limit losses. Having a clear plan for adjustments and exit strategies can help traders navigate changing market conditions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.